Our life insurance underwriting process is all about doing what is best for you. Applying for two policies at one time with two different carriers has helped our clients to save hundreds of thousands of dollars on their life insurance.

While insurance companies and most insurance agents don't like this strategy, we've found that by having our clients with underwriting issues (diabetes, heart disease, cancer, etc.) apply to the 2 or even 3 most probable best insurance companies is in our clients best interest.

Down the bottom of this page we've shown examples of how applying for two policies at one time will benefit you and directly below is our case of the month.

Case of the Month

Male 66, prescription meds for BP, cholesterol, allergies & asthma, anxiety/depression, severe obstrcutive sleep apnea which is well controlled now with BiPap but caused him to lose some vision in one eye also due to non-arteritic ischemia optic neuropathy, and he had essential tremor requiring deep brain stimulation. PM and PR both indicated Preferred rate possible prior to applying. PR approved at Table B rate and PM approved at the Preferred rate quoted up front. We saved this client $8,151 per year on his life insurance or $81,510 over 10 years with an excellent conversion option to extend coverage later!!

Every insurance company has different underwriting guidelines

Every life insurance company has different criteria to qualify for their different rate classifications (i.e. preferred plus, preferred, regular plus, regular, table 2, table 4, etc.)...

Even minor issues, like borderline cholesterol levels or blood pressure readings can preclude you from some insurance companies better rates, but may not preclude you from others.

Even if you don't have any known health issues, what if you cannot decide if you want 20 year term, 30 year term or a guaranteed level rate for life, and the rate for which you are ultimately approved will be a big factor in determining what you actually buy?

Every Insurance Company Underwrites Differently

There is absolutely NO WAY to know the exact rate for which you'll actually qualify until you go through the underwriting process.

By getting some basic information from you, we'll have a good sense of the rate class and insurance companies that should be best for you.

But whether or not you'll qualify for a Preferred Plus or Preferred rate, a Regular Plus or Regular rate, a Regular or a Table 2 rate, a Table 2 or a Table 4 rate, etc., can really only be determined after underwriting is complete.

Don't pay more than you have to!

There can be a big difference in cost from one rate class to the next and we are potentially talking about thousands of dollars difference over the life of the policy.

If you're like us, and cannot make a decision until you know the real price, than our dual application process is the perfect fit for you.

After you're approved, we can finalize the exact plan and amount you want to buy.

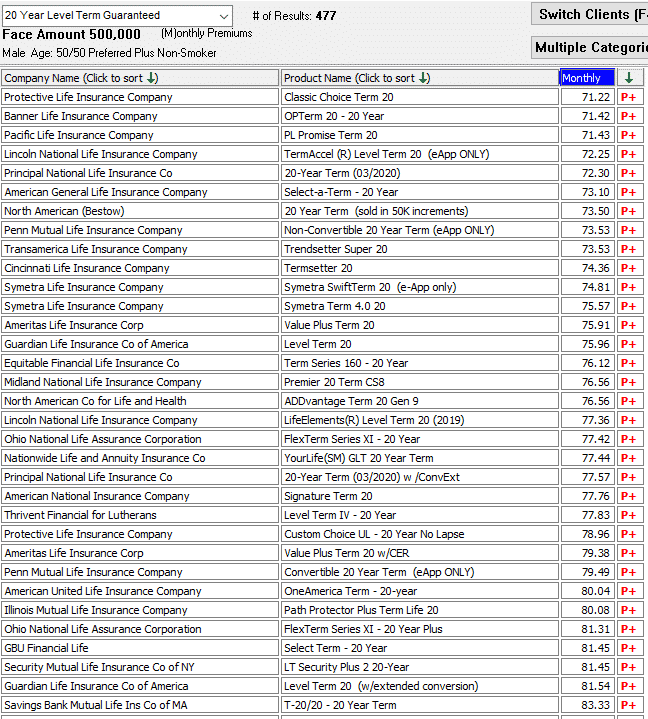

For example, check out these $500,000- 20 year term rates for a 50 year old male non-smoker in the preferred plus rate category:

What if Protective only offers you their 2nd or 3rd best rate category, but Banner Life or Pacific Life offers their best rate class, and this saves you $147 to $711 EVERY year...multiplied by 20 years...

That's a savings of $2,940 to $14,220 over 20 years, which is NO chump change!!

All term insurance is NOT the same!!

Or what if Protective does offer their best rate, but so does North American Co. for Life & Health for about $6 more per month...

And North American includes chronic and critical illness living benefits on their term policies and one of the best conversion or automatic extension options for full 20 years, but Protective offers no good living benefits and poor conversion option??

Those benefits that North American Co. offers are a much better value and a steal for $6 more per month!!

No more difficult to apply to 2 companies than 1

All you'd need to do is to complete our secure online app (takes 5 minutes) and we do the rest!

If you opt to apply for a policy that requires a free insurance exam, you'll only need to have one exam.

We can use one set of exam results for ANY carriers and the results are usually good for 12 month.

This is ideal because anything can turn up in underwriting (i.e. abnormality in blood results or urine results) and there's never any guarantee that you'll qualify for any rate you're quoted.

We can easily "flip you" to any other insurance company later without you having to do a new exam. This is a quick and simple process!

Two Application Process May Not Be Right for Everyone!

For example, if you know for a fact you have NO underwriting issues and know that you only want 20 year term at lowest rate possible and you don't care about living benefits or good conversion, then there may be no need to apply to more than one company.

But we rarely find anyone shopping for life insurance that has no underwriting issues whatsoever, even if it's just something minor like high cholesterol or blood pressure, too many moving violations, family history of heart disease or cancer, etc.

Even these minor issues can result in you only qualifying for the second or third best rate class with one company, whereas another company may offer you their best "Preferred Plus" rate.

Why aren't other agents/websites recommending I apply to multiple companies

Simple answer is because it's more work for them.

We have to track the underwriting process with both companies and deal with case managers and underwriters and then we have to negotiate for best offer.

It is more time consuming and more work for us, but we do it because we really intend to get you the best offer whereas most agents or websites just want to get you to apply and buy something quickly, then forget about you.

Life Insurance Companies Want To Charge You More!!!

And they certainly will if you let them!

The life insurance industry is a huge money maker. Because it’s so competitive and because there are thousands of life insurance companies, there are many companies that specialize in insuring people with health issues.

Even if you don't have more serious issues, every life insurance company can have drastically different guidelines for cholesterol, blood pressure, height-weight, etc.

Even Minor Issues Can Cause You To Pay More!!

It is in the life insurance company’s best interest to charge the most they can for life insurance and everyone would pay too much if this was not such a competitive market.

The rate classification for which you qualify can vary greatly from one insurance company to another.

There is also no way to know in advance the exact rate class for which you'll qualify as this will be determined during the underwriting process.

Here's why & how our dual application process works!

By applying for two policies at one time, we've found that insurance companies are more willing to negotiate the rate that they charge to some people.

Because having two different offers “on the table” gives us more leverage and negotiating room and can help us to improve the chance of you qualifying for an even better rate.

Insurance companies will NEVER reduce anyone’s rate unless the agent pressures them to do so.

What better way to do this then by having more than one offer "on the table"!!

Most agents won’t do this as it’s more work for the agent.

Gotta Put The Pressure On!

As I mentioned previously, it’s no more difficult for you to apply to 2 insurance companies instead of only 1 by using our process.

Below are just some of the great underwriting results that we have had by utilizing our 2 application process.

I'm only using the initials of each insurance companies name below to be fair and to not sway your feelings with regard to any one life insurance company. REASON: For every company that has not made a good offer on one case, they have on other cases:

Check Out These Results

Female 30, diagnosed with Hodgkin's Lymphoma Cancer 17 years ago but treated and in remission for 17 years. We received all "standard" preliminary quotes from numerous carriers except for two that indicated they may offer better rates. Had her apply to both PL and MM, one offered Preferred, we told other we needed Preferred Best to place with them and they came through and offered Preferred Best rate class...this saved client $13,680 over 30 year term had we just assumed that Standard rate class was her best option!!

Male 47, cigarette smoker with atrial fibrillation (Afib) and dormant Hepatitis B. We received several Standard Tobacco preliminary quotes for $5,000,000- 10 year term. Had him apply to the two best based on prelims, CL and UO and CL ultimately offered a rate that was $3,638 less than UO's offer. Client intends to quit smoking and apply for better rate in future. We saved client $3,638 per year or $36,380 over 10 years on his life insurance!!

Male 57, good health but currently weighs 185 pounds at 5' 7" and he lost 70 pounds over past 12 months. All life insurance companies debit for significant weight loss within last 12 months, so we got preliminary quotes for $700,000 of term insurance at standard rate class with all top carriers except 1 indicated Standard Plus possible. Had him apply to both Ag and Th with intent to negotiate for better after approvals made. Ag offered rate of $3,544 per year and would not change offer but we negotiated with Th and they were able to get their reinsurer to agree to offer "Preferred Best" rate of $2,060 per year. We saved client $1,484 per year on his life insurance!!

Female age 69 applying for $2,000,000 of permanent life insurance for estate planning. Had her apply to both PM and PL assuming she'd qualify for Preferred Plus or Preferred rates based on info she provided. Exam results showed mildly abnormal kidney functions and elevated C-reactive protein. Both carriers offered higher Standard/Regular rates. We negotiated and were able to get one carrier to bump her up to Preferred rate class which saved her $9,854 per year over the higher offer!!

Chris from Pennsylvania was declined by USAA for recently being diagnosed with atrial flutter and sick sinus syndrome. We shopped his case to numerous companies and were able to get him Standard or Regular rates with PL and AG and he accepted a portion with both carriers. All other companies wanted to rate him table 2 or 3. Our process enabled him to get the life insurance he needed to secure a SBA loan and saved him over $2,100 compared to next higher offers.

Had David age 60 from OH apply to company A and company B. David had coronary artery disease with 3 stents placed 12 year ago, but with no heart attack prior. He also had some recent shortness of breath of unknown cause in his medical records, but also had a good stress test recently. Even though both companies are usually aggressive in underwriting CAD cases, company B offered him a table 8 rate of $4,287 per year, but company A offered him a Standard rate of $2,042 per year. We saved David $2,245 per year!

We had Ron from PA apply to Company N and Company E due to his diabetes with questionable control. E offered him a rated policy with annual premium of $10,925. Diabetic life insurance company N offered him a Standard (or Regular) rate with an annual cost of $5230 for same plan/amount of insurance. Our process saved Ron $5695 per year!

Had Everett from IL apply to Company T and Company P due to what appeared to be questionable issues based on health questions he answered. T offered him their absolute best “Preferred Plus” rate of $1682 per year, whereas P offered him a higher rate of $5857 per year due to what they considered an elevated creatinine level. We saved Everett $4175 per year!

Had Richard from CA apply to Company P and Company I. He was 71 years old and had some questionable but not serious issues. Cholesterol on insurance exam was 272. The 2 companies knew they were competing for his business. P offered a Preferred rate of $3223 and I offered Standard rate of $6260 for same plan/amount of insurance. We saved Richard $3037 per year!

Susan from Virginia was offered a rate of over $5472 with Company F due to treatment for anxiety/depression and some other issues. Company J offered her a Preferred rate of $2,670 for same plan/amount. Our process saved Susan over $2802 per year!

Len from PA was offered a Standard rate of $4891 from Company O due to a heart murmur and some other minor issues. Company F offered their absolute lowest Preferred Best rate of $2,562 for same plan/amount. We saved Len $2329 per year!

William from PA was offered Standard rate plus flat extra with annual cost of $4413 due to a recent Melanoma from Company E. Company N offered him Standard rate with no flat extra and with annual cost of $2165. Our process saved William $2248 per year!

Charles from FL was approved for Preferred rate of $1633 with Company W. He was approved for Standard Plus rate of $2829 with Company F due to hypertension treatment and their interpretation of his EKG being slightly abnormal. We saved Charles $1196 per year!

Robert from FL applied to Company J and Company G. He was paying over $3600 per year for a policy he got previously from another agent. Based on our health evaluation, we believed he could save over $1000 per year. J offer their Preferred Best rate of $2519 and G only offered their Standard rate of approx $3500 due to their interpretation of his EKG. Our process saved Robert $1100 per year!

Allen from PA was approved for Preferred rate of $1947 with Company W and only approved for a Standard Plus rate of $2924 with Company F due to build, hypertension and cholesterol of 257. Allen saved $977 per year!

Gerry from PA was offered rate of $1630 with Company E due to history of alcohol abuse. Company U offered him rate of $860 for same plan/amount. We saved Gerry $770 per year!

Alex from MS was declined for insurance with Company P due to past coronary artery disease and occasional tobacco use. We shopped numerous carriers and were able to get Company E to offer him policy. Our process enabled Alex to get the life insurance his wife would need to pay off mortgage should he die prematurely.

Had Louis from SC apply to Company U and Company L since he smoked a few cigarettes per day. Company U was only company at that time that may offer limited cigarette user a non-smoker rate as long as health checks out as excellent otherwise. Company L had best smoker rate. Company U knew they were competing for clients business and offered non-smoker rate. Our process saved Louis $560 per year.

Had D. from Minnesota apply to PL and NA as she was 5' 4"- 195 pounds at time of insurance exam and she had lost 20 pounds over the previous 12 months. NA offered her their Standard rate of $198 per month due to her ht/wt, but PL offered their Preferred rate of $135 per month. Our process saved D. $63 per month or $756 per year.

Had Alfred (age 66) from Pennsylvania apply to SL and CL as both of his parents died of cancer in their 50's and he had not seen his doctor for a check up in over 2 years. CL could only offer their Standard rate of $2,938 per year, but I was able to get SL to offer their Super preferred rate of $1,788 per year. We saved Alfred $1,150!!

Terry from Alabama had been declined for life insurance 6 months ago through other insurance agency due to A1C of 9.7. He had since told me his A1C was under better control with recent A1C in 7's. We had him apply to CL and BL as we knew his case could be a tough one due to his recent uncontrolled diabetes. His A1C on new insurance exam was 10.5 so BL automatically declined. CL went out to their re-insurer and was able to make a Table F offer and Terry was able to get the life insurance his wife would need if he died prematurely.

Had James from Texas apply to BL and AG due to his diabetes diagnosed in his early 30's. His liver functions and microalbumin were elevated on insurance exam lab results so AG offered rate of $58 per month and BL offered rate of $67 per month. Our process saved James $108 per year.

"Mr. Sath" from California inquired with us because he was not happy with the life insurance offers he had been getting. He was 39 and diagnosed with type 2 diabetes in his early 30's but he had excellent control and good health otherwise. We inquired with numerous insurance companies and both PL and CL indicated they may offer Regular (Standard) or possibly better rates, whereas all other carriers wanted to rate him a table 2, 3 or 4. We had him apply to both co's and PL offered him their Regular Plus rate which saved Mr. Sath $215 per year compared to next best offer.

Had Terry age 60 from Pennsylvania apply to the 2 most likely best GUL companies, CL and AN, that also offer chronic and critical illness living benefits. Terry qualified for both companies second best Preferred rate due to his ht/wt of 6' - 228 pounds during insurance exam. After negotiating with both underwriters, we were able to get both companies to offer Terry their lowest rates. This was a 13 pound weight exception with CL. This saved Terry $518 per year. We were even surprised best rates were offered!!

Had Beth from California apply to BL and PL as she took 2 meds for which she indicated was mild and very well controlled asthma. Her Medical records indicated "moderate persistent asthma" and PL considered a previous EKG in her medical records to be abnormal. BL still offered her a Preferred Non-smoker rate of $766 per year, where as PL offered her a table 4 rate of $2,472 per year...Our process saved Beth $1,706 per year or $34,120 over the 20 year term.

Ryan from CA applied to both PL and NA due to having testicular cancer 23 years ago...we were able to get PL to offer him a Preferred Plus rate whereas NA only offered a Standard rate.

Bottom line- getting best life insurance rate

We have thousands of similar cases like the above for which our clients have saved hundreds and thousands of dollars by applying through our agency using our dual application process.

It is perfectly acceptable to apply to more one life insurance company at same time!

Our SSL secure online application can be completed in 5 minutes, at your convenience without having to answer lots of questions over the phone (which is a HUGE waste of your time).

We make it simple and easy for you to apply! You just sit back and relax and then we'll get you the best offer no matter how many companies we have to try.

Call or text us at 800-380-3533 or email us or just click on the accurate quote request button on this page and we’ll shop with 100's of the top carriers and email you quotes and information, and then you can decide to apply or not.

We won't hassle or pressure you to do anything!!