Securing life insurance after heart attack or heart disease can be a challenging and time-consuming process, often resulting in exorbitant quotes from insurance agents.

However, there is a better way to approach this situation:

At American Term, we specialize in obtaining life insurance for individuals with a history of heart disease, including heart attack victims, without breaking the bank!

In this guide today, we will explain how life insurance for heart patients works and how to get the best life insurance approval after a heart attack or with heart disease.

What Is Heart Disease

Any condition that affects the structure or function of your heart is considered to be heart disease or cardiovascular disease.

According to WebMD, heart disease is the leading cause of death in the United States and 1 out of every 5 deaths in the U.S. can be attributed to cardiovascular or heart disease.

With this simple understanding, it should be easy to see why life insurance carriers consider people who have heart disease to be higher risk applicants.

This doesn’t prevent you from getting covered, it just means you probably want to deal with someone more experienced with heart disease life insurance cases like we are at American Term.

Types of Heart Disease

As I stated above heart disease isn’t just one condition but a list of conditions like the ones below:

Keep in mind that this isn’t every heart condition but most of the major ones that can contribute to heart disease.

How You'll Benefit From My Heart Disease

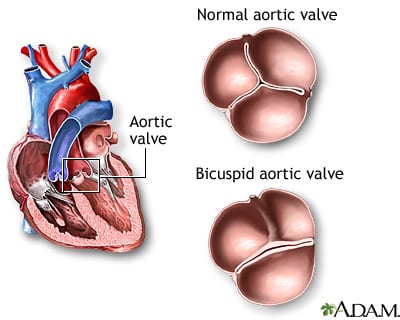

I am all too familiar with getting life insurance for people with heart conditions as I was born with a bicuspid aortic valve.

At the age of 40, I had a valve replacement and an aortic aneurysm repaired, heck I even died for 163 minutes believe it or not.

Getting life insurance for myself was never an easy task.

But I decided to search really hard and reach out to all of the best insurance companies to find the ones that best fit my situation.

Once I found the companies that would work with me I went through the process of convincing the underwriters that my case was different.

This process allowed me to get the best rate and value and I’ll do the exact same thing for you.

Qualifying For Life Insurance After Stent Surgery

Qualifying for life insurance after stent surgery depends on various factors, such as the number of stents and any prior heart attack or heart damage.

However, getting life insurance after a stent surgery doesn’t have to be a complicated process.

If you’ve had a one vessel stent with no prior heart attack at around age 50 or older, you could still qualify for term life insurance after stent at Standard or Regular rates with some insurance companies.

Once you’ve had a myocardial infarction (heart attack) and/or more than one stent or bypass, or any coronary artery disease (CAD) event before age 50, most life insurance companies will start “rating” you or charging 50%, 100% or more in addition to the Standard rate.

Make sure your agent pressures the underwriters for best offers

In addition to the “Standard” or Regular life insurance rates, some companies will even decline you if you are trying to get life insurance with stent in heart or charge you very high life insurance premiums, whereas others will not.

If you have a combination of issues and need life insurance for diabetics with heart disease, for example, then you'll pay more than you would if you only had heart disease.

It can take some work and research on our part, but we'll find an insurance company that will offer you insurance regardless of your CAD history.

Get a second opinion if you're offered higher rate than initially quoted

Don’t assume that the rate you have been given is the best rate available, this isn’t always the case.

We have had the same person declined with one insurance company and then offered a Standard rate with another company.

There have also been situations where clients get rated upwards of 150% - 200% on top of Standard rates with one insurance company and offered Standard to 50% rating with another company.

Overall, if you are looking for life insurance with a heart stent or for life insurance after bypass surgery, then be prepared for a process and don’t give up.

Getting Life Insurance After Heart Attack

Getting life insurance after heart attack is possible, but not all heart attacks are underwritten the same, and the rates for which you’ll qualify can vary greatly from carrier to carrier.

One of the most important things in determining if you’re insurable for “regular insurance” after a heart attack is how much heart damage you sustained from the heart attack.

A key indicator in determining your degree of heart damage is your left ventricular ejection fraction (LVEF) which shows how well your heart is pumping blood out to your body.

If your LVEF is 40% or less, then you’ll likely only qualify for a guaranteed issue or guaranteed acceptance life insurance.

If your LVEF is 45% or higher (the higher, the better), then you may be insurable.

But having an LVEF of 45% or higher is only one “piece of the puzzle” in determining if you’re insurable and best rates and insurance companies for you.

Applying for Insurance After Heart Attack

Most insurance companies will postpone coverage until at least 6 months after a heart attack.

Your age when you had heart attack and the severity of your coronary artery disease or atherosclerosis are also significant factors in determining the rates for which you’ll qualify.

The younger you were when you had the heart attack, the tougher it is to get life insurance.

Having a heart attack in your 30’s makes it much tougher to get a decent life insurance rate/policy compared to if you were in your 40’s, 50’s or 60’s when you had the heart attack.

The extent of your disease based on the cardiac catheterization results showing the percentage of blockage in each of your coronary arteries and the specific arteries that had blockages will have a big determining factor in the rate for which you’ll qualify.

Lot of variables in determining what rate you're offered on life insurance after heart attack

Blockage in the left main and left anterior descending arteries, known as the “widow maker” arteries, can result in a higher rate being offered than if you only had a blockage in your circumflex or right coronary artery.

If you’ve had a 70% or higher blockage in any of your coronary arteries, this could result in a higher rate being offered than if you only had a 50% or lower % blockage.

The reason is that coronary artery disease is a progressive type of disease, so you’re never really cured even if you’ve had bypass surgery or angioplasty and stents.

According to the American Heart Association, about 335,000 people each year have a recurrent heart attack (i.e., second, third, etc.) and heart disease is the leading cause of death in the world!

I happened to have had a cardiac catheterization before having heart surgery.

I asked the doctor that performed the catheterization how long it can take perfectly clean arteries to develop blockages that are serious enough to require intervention.

He told me how it could vary significantly from person to person, but he said 10 years was a reasonable estimate.

How To Get Best Life Insurance Rate After Heart Attack

Make sure you're doing everything you can to reduce your risk of having a future cardiac event.

Quit smoking and quit using all tobacco products for that matter, and if you’re overweight, lose weight.

Get involved in an exercise program even if it’s only regular walking several times per week and change your diet to a heart-healthy diet

All life insurance underwriters like to see that you’ve had a good stress test in previous 12 to 18 months.

So even if your doctor never recommended having one, ask them to schedule one for you.

Good recent stress test has helped us to get a 2 rate classification improvement on some cases.

If your doctor has not prescribed you a blood thinning medication, then taking aspirin or a baby aspirin every day may be a right decision. Ask your cardiologist if aspirin may be good for you!

Overall excellent health otherwise will help us to get you best offer

We ideally want your current health, cholesterol levels and blood pressure to be optimal which can improve your chances of getting a great offer.

Provide as much information as you can regarding your positive lifestyle changes to any independent agent you’re applying through and ask them to relay this information to the insurance company.

We do this on every case, and it’s paid off time and time again.

Reasons you’ll be declined for life insurance after heart attack

Your ejection fraction is less than 45% or if you sustained severe heart damage, you’ll likely be declined.

You continue to smoke cigarettes after a heart attack, or use other nicotine-based products like e-cigarettes, chewing tobacco or even nicotine gum or patch, then you may be declined.

Having highly abnormal cholesterol levels or blood pressure after a heart attack can get you declined.

If you've had multiple heart attacks or ongoing Angina or chest pain or if you use nitroglycerine on a regular basis after a heart attack, then you’ll likely be declined.

Double check your most recent lab results for abnormalities

You’ve had a heart attack and other cardiac problems, like a more severe type of irregular heartbeats, then you could be declined.

You had a heart attack and other health conditions like prior stroke or diabetes that is not very well controlled, then you could be declined.

Not getting regular cardiac checkups or if you have not seen a cardiologist in more than 2 years, then you could be declined/postponed for insurance coverage until you have a more recent check up.

If you’ve had a heart attack within the last 6 months, you’ll be postponed and not able to qualify for life insurance until 6 months have passed and all follow-up check ups have been good since the heart attack.

Do You Know Your NT-proBNP

This is a relatively new test that some life insurance companies are doing on blood results. It stands for N-terminal pro-brain natriuretic peptide.

When elevated, studies have shown that you're more likely to have a cardiovascular incident like a heart attack or stroke.

A normal NT-proBNP for people under age 75 is 125 pg/mL or less. The lower, the better.

A normal NT-proBNP for people age 75 and older is 450 pg/mL or less. The lower, the better.

What You Can Expect To Pay After Heart Attack

This is not an easy question to answer since there are many variables involved in determining your approval for life insurance and the best rate and insurance company for you.

It's also going to depend on your exact heart attack history and your overall medical condition otherwise.

According to life insurance industry guidelines, the severity of your heart disease will be determined and classified by the amount of heart muscle that would be in jeopardy, if the coronary artery obstructs at the site of an atherosclerotic plaque lesion.

Without seeing your cardiac catheterization report, follow up EKG and echocardiogram, in addition to knowing nothing about your specific overall health, it is impossible for any life insurance agent or website to quote you an even semi-accurate rate.

Need medical records for cardiac details after heart attack

While we have gotten unbeatable offers on past heart attack cases, below are some monthly cost estimates of what you could expect to pay for life insurance at various ages after having a heart attack.

We’re showing 2 rates in each category below as a range of the cost.

These estimates below are for a 20 Year $250,000 guaranteed level premium insurance policy.

We are assuming a left ventricular ejection fraction of 50% or higher and that their overall health checks out as fairly good otherwise.

The actual rate for which you qualify could be lower or higher than these monthly rates below:

AGE | MALE | FEMALE |

|---|---|---|

35 Years Old | $51 – $64 | $44 – $54 |

40 Years Old | $62 – $67 | $50 – $55 |

45 Years Old | $67 – $94

| $53 – $73

|

50 Years Old | $91 – $120

| $66 – $86

|

55 Years Old | $119 – $136

| $82 – $96

|

60 Years Old | $194 – $241

| $138 – $167

|

65 Years Old | $372 – $436

| $241 – $306 |

70 Years Old | $574 – $653 | $374 – $550 |

Your Ejection Fraction Matters

If your ejection fraction is over 45% to 50%, you have no other health issues and you’re doing everything you should be doing like:

And if your overall health is good, then you should qualify for affordable life insurance with a great insurance company.

If your ejection fraction is less than 45%, and you:

Then you could be declined with all of the competitive insurance carriers for heart disease.

There are still insurance companies that may insure you, but it could be for overpriced and inferior types of life insurance coverage.

How To Apply For Heart Disease Life Insurance

No matter what your cardiac issue may be, we can help you, whether it was a:

PRO TIP: Applying to more than one insurance company is the only way to verify you're getting a good offer...and we have the perfect system to do this!

Below is the process that has enabled us to get thousands of heart disease patients the absolute best offer possible and this is the ONLY way for you to get the best offer:

1

Get detailed cardiac and other health/avocation information from you.

2

Review database of rates from over 100 quality insurance companies to see all of top insurance companies available to you.

3

Make inquiries to underwriters at numerous high risk life insurance companies to better narrow down the best for you based on information you provide to us.

None of your personal or identifying info is ever provided to anyone else during these inquiries.

4

Based on feedback from the underwriters, we'd then show you most probable rates for all life insurance plans available to you (term and permanent insurance).

If you decide to proceed, we'd have you apply to 2 or more companies for best rate/product that fits your needs, whether it's Term Life, Universal Life or Whole Life.

We have the easiest 5 minute electronic application process!

5

Expedite underwriting by getting weekly updates from case managers or case underwriters and by contacting doctor's offices to make sure medical reports are sent in a reasonable time frame.

We do our best to expedite, but some things are out of our control.

6

If something turns up in underwriting or your medical history which results in you qualifying for higher rates than we were expecting, we'll negotiate on your behalf to improve the offer.

Then we'll shop your medical records to other insurance companies to get better offers if necessary.

We can use the results of any one insurance exam for any life insurance companies later, and we'll have access to your medical records so we can quickly and easily get offers from other insurance companies.

This process will be hassle free for you.

7

After we get approvals and verify the exact rates for which you qualify, you can make a final decision on the exact plan and amount of life insurance that you want.

8

After we get you best offer, we'll send you policy with detailed letter of policy explanation and complete instructions on how to place the policy in force.

If you are satisfied with the policy and the rate, you can accept the policy and make first payment.

If you're not satisfied with the insurance plan for ANY reason, then you pay nothing.

9

We will periodically review your policy to see if a better rate/product may be available in the future as rates/products are constantly changing.

Since 1969, we have been able to get approx 70% of existing clients a better rate or policy after their initial purchase since rates and products are always changing.

Best No Exam Life Insurance For Heart Patients

No Exam insurance is available to people with many heart conditions, but you may pay more to avoid the exam.

We shop with numerous insurance companies daily, including the best "no exam" companies, to find the best offers for our clients with all types of heart conditions.

Some of the more aggressive no exam carriers do require that you've had a checkup and blood test with your own doctor within past 12 to 18 months, otherwise they may require you to have free exam.

If you have NOT had a checkup/blood test with your own doctor within past 18 months, below are best case "exam" and "no exam" monthly rates for a $250,000, 20 year term life insurance quotes for a 50-year-old male non-smoker in the different rate categories:

RATING | EXAM | NO EXAM |

|---|---|---|

Preferred | $45

| $52

|

Standard | $66

| $79

|

Table 2 | $88

| $115

|

Table 4 | $115

| $151 |

Table 6 | $142 | $187 |

While we would have to "shop" your case since all heart conditions are underwritten differently, you could be looking at the below situation.

If you can qualify for a rate of $66 per month that requires an exam, you may likely only qualify for a table 2 no-exam rate of $115 or more per month since most no exam carriers are not good for people with heart disease.

However, "no exam" coverage is probably available to you if you don't mind paying more.

Case Studies-Life Insurance After Heart Attack

Case Study 1 - 69 Year Old Male - 2 Stents & Heart Attack

We had a 69 year old male who had 2 stents and a heart attack a year and a half ago.

The customer had already been approved for a $350,000 15 Year Term Policy (through another agent) for $1,392.00 per month.

This rate was much higher than he was expecting, but his agent told him this was the best rate he was going to get.

He found our website and based on the information he provided, we knew we could get him a better rate.

While we knew about the heart attack and 2 stents placed for this 69 year old gentleman, we didn't know about his cardiac arrest.

His medical records showed that while he was in the hospital, after the heart attack and 2 stents, the EKG in hospital witnessed cardiac arrest which converted with 1 DC cardioversion shock.”

After the underwriting process was completed, we were able to get the customer approved for rate of $933 per month.

However, we weren’t satisfied with the outcome, so we went back to this underwriter, emphasized to her how the cardiac arrest was likely a fluke and how this gentleman recently had an excellent stress test that showed no heart defect and good blood flow.

We pleaded for her to bump this gentleman up to a better rate class, which she did!

She re-approved him for a $350,000 15 Year Term policy for $817 per month.

Total Savings = $575.00 Per Month or $6,900 per year.

Case Study 2 - 62 Year Old Male - No Stents, No Bypass

We did a case with an exciting result for a 62-year-old male who had a “mild” heart attack at age 49.

He was treated with medication only (no stents, no bypass) and all follow-up cardiac test results had been great including a good stress test within the last 12 months.

He had applied through another agency and was offered a table 6 rating and each table rating reflects a 25% additional cost over the “standard” rates.

The table 6 policy was going to cost him $4,972 per year even though he was the poster child for great health after a heart attack!

He happened to have his cardiac medical records, and his first cardiac catheterization showed no evidence of blockage in any of his major coronary arteries.

It also mentioned that the mild heart attack must have been caused by plaque rupture of the obtuse marginal branch of the circumflex artery.

He had no heart damage caused by the mild heart attack, with a current ejection fraction of 55%.

We were completely confident that we could get him a better offer than table 6 offer he was previously given based on info he provided and his healthy lifestyle.

We submitted applications to two insurance companies that offer the best life insurance with heart conditions since we never want to have "all of our eggs in one basket".

The first offer for this gentleman came back at a table 3 rating, which was a much better price than the original table 6 offer.

We still thought we could get him a better rate, so waited for the second offer before doing any negotiating.

The second offer came back at a Standard rate with no additional rating.

He was able save $2,340.45 per year or $35,107 over 15 years, compared to what he would have paid for his offer from the other agency.

Total Savings = $195.00 Per Month or $2,340.45 per year.

Taking Action

We can offer you life insurance after heart attack from more life insurance companies than any insurance professional, agent, website or brokers.

We make purchasing life insurance with heart disease easy and our process will greatly increase your chance of getting the absolute lowest insurance premiums.

Just use the accurate quote button above to get quotes and we'll compare best rates for you from the best insurance companies in America.

Our impaired risk experience and relationship's with the best insurance companies for cardiac issues allows us to get the best offer possible and will pay off big time for you!!

We'll find best rates for you from all of the top life insurance carriers

Rates, products and underwriting guidelines are always changing, and we're constantly on the lookout for new products and guidelines that will help us to get you a better offer.

So we can insure almost everyone that wants to apply for life insurance and has preexisting conditions!

See testimonials from some of our success stories to the right side of this page.

Call or text us at 800-380-3533, request an accurate quote using the link directly above or CLICK HERE to email us for more information and we will start the process of getting you the best life insurance rate possible.

Check out our other articles about getting life insurance if you have heart disease.

- Getting Life Insurance after Stent or Bypass Surgery

- Cardiac Arrhythmia Life Insurance

- Getting Life Insurance After Heart Valve Surgery

- Problems In Life Insurance Underwriting For Heart Conditions

- 2 Stents & Heart Attack Saves $103,500 On Life Insurance

- Can I Get Life Insurance If My Parent Died of A Heart Attack?

- Heart Attack Survivor Saves $35,107 On Life Insurance

- I Was Dead For 163 Minutes!

- Getting Life Insurance With Bicuspid Aortic Valve