I get it, you like going fast!!

You like to rip through those turns sliding your wheels. I do too!

The problem is if you drive or ride too hard on the street, you’re asking for trouble...

Speeding tickets from police, points on your license, broken bones or worse.

So you get on the race track and do track days or club racing, but when it comes to life insurance, the best life insurance company for motor racing can get expensive if you buy it from the wrong insurance agent.

It doesn't matter if you want term life or permanent life insurance, you need to deal with an agent, broker or website that knows what they’re doing and can shop your case to many different companies.

Your agent needs to be able to offer you life insurance coverage from MANY carriers and must have a system to summarize your racing in the best possible way to get offers from these insurance companies...and then needs to be able to negotiate on your behalf to avoid an extra charge.

Only then will you be pleasantly surprised with the lowest rates!

Whether you race cars, motorcycles, boats or anything else with a motor, as long as it’s closed circuit racing with a sanctioning organization making sure all vehicles are inspected and safe, you will be insurable for personal insurance.

That's me in Daytona in the 90's

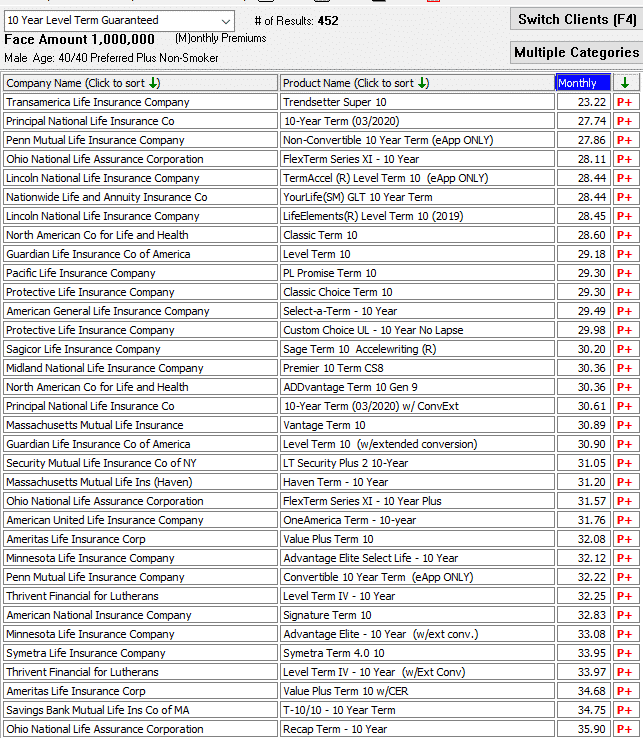

Below is a screen shot from our database of just some of the carriers we'll shop with on your behalf...

We also have a system for which you can complete our 5 minute e-app and then we can have you apply to any carriers.

This is only small handful of carriers in our database

Doing A Track Day is NOT Racing

A track day is the perfect and safe way to drive your car or ride your motorcycle faster than is allowed on the streets...

So if you want to drive your Porsche, Ferrari, Lamborghini or your R1, R6, KTM Duke (like I have) or any other car or motorcycle the way it was meant to be driven or ridden, you have to get on a race track.

But do you have to admit to doing it on a life insurance application?

That depends...here’s why:

Here are two different random insurance companies' application questions involving hazardous avocations:

App #1- In the past 5 years, has the primary proposed insured engaged in motor sports events or racing (auto, truck, motorcycle, boat, aircraft or other motorized vehicle)……

App #2- Have you in the past 2 years engaged in, or within the next 2 years do you intend to engage in, certain activities such as hang-gliding, hot-air ballooning, ultra-light flying, heli-skiing, mountain, ice or rock climbing, cliff or base jumping, motor vehicle racing, motorcycle or any other motorized land or water vehicle racing, or scuba or sky diving?

All life Insurance apps have different "racing" questions

Note that in application #1 above, the question pertains to “motor sports events or racing”…..I’d avoid this company if you do any track days since there is a definite “gray area” as to what an “event” is considered.

The # 2 application above specifically only asks about motor vehicle “racing”……so this is the company that I’d recommend you apply to if you do an occasional track day.

All insurance companies have different wording when it comes to their question about hazardous avocations, so make sure you only apply to a company that only has question about “racing” on their application.

Don't over-share or provide any more information than what is specifically asked.....

You also never want to lie or "mislead" on an insurance application, so you don’t have to risk a death claim ever being contested...so just make sure that your agent chooses the best insurance company for you.

Best Life Insurance for Race Car Drivers

The goal should be for you or your agent to find the best life insurance rates and insurance company for your amateur or professional race car driver status.

Here’s an example of a great outcome after shopping to find best offer for this occasional racer:

Client races his Porsche. He is a member of the Porsche Club of America. 2005 Porsche 911 GT3, 3.6 liters displacement, 390HP. Full roll cage and automatic fire suppression system.

Strictly amateur racing for fun

Types of tracks – Various East Coast Tracks, closed circuit road course.

Last 12 months – 5 races, total miles 210. Avg distance each race 40 miles.

Contemplated next 12 months – 5 races, total miles 210; avg max circuit speed is 85 mph, typical circuit length is 2 miles

Feedback from the best term life insurance companies available to him:

“P” - Super Preferred

“J” - Standard

“B”- Tentative Standard due to auto racing activities.

“R”- Based on the information provided, best case would be Standard Non-Tobacco.

“A” - Ok possible standard plus.

Applying for life insurance with wrong carrier could cost you $1,000's

Keep in mind the above were the best offers....there are insurance companies that would charge this gentleman a flat extra charge (or additional fee) of $2.50 per $1,000 or higher.

On a $1,000,000 policy, this $2.50 flat extra equates to an additional $2,500 per year that this gentleman would have to pay in addition to the regular rate.

I don't know about you, but I want to pay as little as possible for my life insurance...and I definitely don't want any company tacking on an additional $2,500 to my base premium.

Professional or amateur racing status will have an impact on the rate for which you're offered.

3 types of race car driving hazards which affect life insurance quotes

Speed of the vehicle - depends mainly on engine power, aerodynamics and weight of the vehicle. The type and nature of circuit/venue can also promote or restrict potential speeds.

Design and construction of the vehicle - open wheeled vehicles (e.g. Indy) are more likely to tip or roll over due to entangling of wheels. Open construction vehicles (e.g. Indy cars) provide limited protection to the driver's head; the rest of the driver's body is usually well protected by a "survival cell'. Closed construction vehicles (e.g. stock cars) envelop and protect the driver more, although the driver's head is often in close proximity to the tubular steel cage.

Degree of exposure - professional race car drivers will drive significantly more than amateurs and therefore have 2 or 3 times the exposure to potential risk. In any one year most drivers will compete in only one championship series which can consist of 17 to 38 races depending on the racing series. NASCAR drivers, for example, may compete in 36 races over a season.

Best Life Insurance for Motorcycle Racing

Motorcycle racing is a potentially dangerous sport...like they tell you in road racing school, there's 2 kinds of motorcycle racers....those that have crashed and those that will crash!!

As long as you’re on a closed circuit race track, like Daytona, Road Atlanta, Willow Springs, Road America, etc...

And you race in an organization like the AMA, CCS or WERA, that requires safety inspections, you should have no problem qualifying...but the offers you'll get can vary GREATLY!!!

Check out this case below to see how the offers can vary:

30 YO male non-smoker excellent health needs $1,000,000 of life insurance. He's only raced 1 time in last 12 months and will race 8 weekends in next 12 months (approximately 3-4 - 20 minute races per weekend). He races 600cc sport bike in CCS and WERA events on tracks like Pocono raceway, top speeds 150 mph, average speeds 75-85 mph. It's amateur racing strictly for fun.

Feed back from insurance companies for him are as follows:

“A” - Standard

“C” - Standard

“J”- Preferred plus $2.50 per 1,000

“L” - Standard plus $5 per 1,000

“P”- Non-Smoker plus $7.50 per 1,000

Many motorcycle racers will be charged a flat extra fee

On a $1,000,000 policy, the above $7.50 per 1,000 extra premium equates to $7,500 more than you'd be paying without the extra premium...OUCH, that hurts more than actually crashing the motorcycle!

Without the 4 walls and 4 wheels of automobiles, motorcycle racers get underwritten a little more strictly due to the increased likelihood of injuries in motorcycle crashes...

I, unfortunately, know about this all to well with some nagging old racing injuries.

What affects your life insurance quote in motorcycle racing?

Engine size, engine capacity and power of the cycle, maximum speeds, type of race, location, and experience of the driver are of concern in underwriting.

Whether you're a professional or amateur racer and how often you race.

Type of track or terrain you race on...eg. close circuit road racing, closed course enduro, dirt tack, drag racing, hare scrambles, hill climbs, supercross, etc.

Some endurance races take place in deserts where heat and the elements are factors to consider.

Crashes and collisions.

Best Life Insurance for Boat Racing

Example of a case we shopped:

Professional boat racing: 800ft drag race

Type: STV Boat 18’ w/ safety capsule; Mercury outboard 2.5 LT 200 engine; Sanctioning Bodies- Virginia Outlaw Drag Boat

Max speed attained: 92 mph

4 races in last 24 months; 4 races in last 12 months

Elapsed time 8.5 seconds in 800ft

Feedback

"P" - Non-tobacco/Super Preferred.

"J" - Appears tentative Standard Plus Nonsmoker

"A"- Standard plus with a $2.50 per thousand flat extra

"N" - Tentative Standard and up to $2.50 per thousand flat extra subject to Avocation Quest

"L" - Flat of $2.50 per thousand subject to avocation supplement, MVR, full records, etc.

"R" - Assuming there is no hydroplane racing, that this is off-shore racing with speeds under 150 mph, then we would apply a 5.00/1000 flat extra and standard rates are the best available assuming he otherwise qualifies.

Other Motorized Racing

Whether you race snowmobiles, lawnmowers or anything else with a motor, there's going to be one insurance company that offers you the best rate...

Finding that company may be the hard part.

Avoid having to apply for life insurance over and over again with our shopping system.

We have shopping for life insurance for motorized racers down to a science, plus we have 100's of quality insurance companies we can offer you.

If you don't feel your agent can get you the best rate and value possible, give us a call, send us an email or simply click on the life insurance quote link above and we will send you quotes and information on the best life insurance available to you!