Experts in High Risk Life Insurance

We specialize in obtaining the best available life insurance for high risk individuals, even if they have more significant preexisting medical conditions.

That’s because we don’t stop at the first quote we receive from our partner insurance companies, we keep comparing quotes and negotiating with underwriters until we find you the most affordable life insurance policy with a reputable, reliable insurance company.

Applying to one company and hoping for best offer is NOT a good strategy for ANY higher risk individual.

Some of the more common underwriting issues we insure on a regular basis are:

- Life insurance for diabetics

- Life insurance for overweight people

- Life insurance for people with heart disease

- Life insurance for cardiac arrhythmia

- Life insurance after heart valve surgery

- Life insurance for cancer patients and cancer survivors

- Life insurance for smokers

- Life insurance for seniors

- Life insurance without medical exam even for people with health issues

- Life insurance for pilots

- Life insurance for people with family history issues

- Life insurance for people with asthma

- Life insurance for people with depression/anxiety

- Life insurance for people with sleep apnea

- Life insurance and autoimmune diseases

- Life insurance for motor racing

Non-Medical High Risk Life Insurance

Health conditions are not the only reason you'll be considered a high risk.

Hazardous avocations and occupations can also make it tough to find affordable insurance protection.

If you're involved in extreme sports like skydiving or hang gliding, then this will result in you paying more for insurance coverage.

Or if you're a contract worker working in potentially dangerous areas of the world, it will definitely be tougher for you to get affordable high risk life insurance.

Don't give up hope, there may still be life insurance plans available to you...

We're independent life insurance agents, so we can shop with hundred's of insurance companies to find you the best offer.

Not Considered High Risk for Life Insurance

We get inquiries regularly from people who are concerned that they won't be able to afford life insurance coverage due to minor issues, like for taking cholesterol or blood pressure medication.

Let's take a look at some issues that are not considered high risk life insurance medical conditions:

- 1Treatment for high cholesterol

- 2Treatment for high blood pressure

- 3Treatment for mild anxiety or depression

- 4Being mildly overweight

- 5Occasional smoking including marijuana

- 6Very well controlled mild sleep apnea

All of the above can potentially qualify for the best rate class with some insurance providers.

Now if you've had a heart attack and are taking cholesterol medication, or if you have bipolar disorder and are taking anxiety or depression medications, then you're a high risk.

Minor issues that have no real impact on life expectancy will not prevent you from getting cheap life insurance.

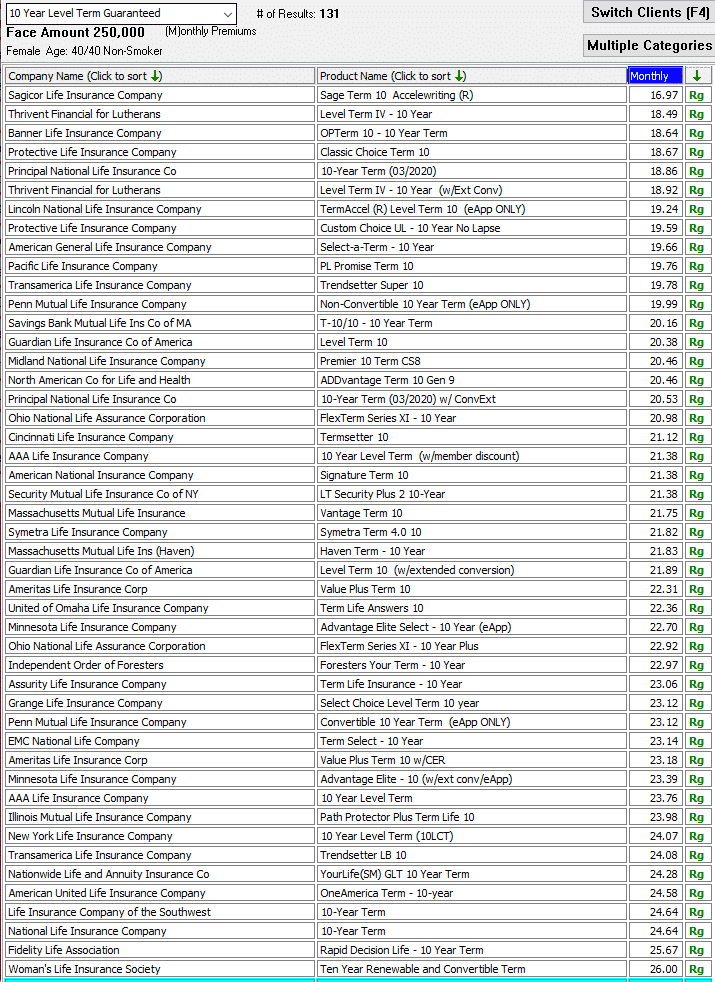

Life Insurance Companies We'll Shop On Your Behalf

Below is a screen shot of the first page of my database with just a small handful of some of the carriers we'll shop with for you:

CLICK HERE TO GET ACCURATE HIGH RISK LIFE QUOTE

Best High Risk Life Insurance Companies

While there are definitely some high risk life insurance carriers that tend to make better offers than other companies, we've found that every case is a little different and needs to be shopped thoroughly.

Not only will your specific health or underwriting issues come into play, when determining the best high risk life insurance company for you, but so will the amount and insurance plan you're interested in.

Some of the carriers that can make better offers on high risk life insurance are as follows:

The above are not the only good companies for higher risk individuals, but some of them have unusual table ratings structure for which their ratings are based off of better than Standard rates.

What this means is that if all of the companies above would rate you as table 2, well then American General, Banner Life or Pacific Life may have the lowest cost.

It is rare that each company would offer one individual the same table rating, but it could happen.

Other Not So High Risk Life Insurance Companies

While all of the insurance companies mentioned above should be considered for all high risk cases, they are definitely not the only "players".

We also have had companies that are not traditionally considered good for high risk individuals make better offers than all of the companies above on occasion.

Some Examples:

Cincinnati Life made a Preferred offer to a woman diagnosed with Rheumatoid Arthritis. Next best offer was a table 2.

Zurich Life offered a recent breast cancer survivor a slight table rating whereas every other company offered a minimum $5 flat extra. Zurich's rate saved client thousands of dollars.

Assurity Life made a Standard rate offer to a 75 year old gentleman who had a triple bypass 14 years ago. Next best offer was a table 4.

Illinois Mutual made a preferred rate offer to a 73 year old gentleman who was previously declined with one of the high risk companies above because of a poor outcome on cognitive function portion of insurance exam.

North American Company for Life & Health made a Super Preferred offer to a 69 year old gentleman who had Oropharyngeal cancer 13 years ago, next best offer was Standard.

Thrivent Financial made a standard rate offer to a 63 year old gentleman with long term history of opioid pain medication use...Prudential, who can be great for these type cases, offered rate that was $7,075 more per year than Thrivent's offer for same plan and amount of insurance.

Ohio National made a table 4 offer to a man recently treated for substance abuse.

We have numerous other instances for which one of the more well known high risk companies cannot beat offers made by a smaller company.

Find out how much money you may be able to save on your impaired risk life insurance policy!

CLICK HERE FOR ACCURATE HIGH RISK LIFE QUOTE

Process To Get Best High Risk Life Insurance

IMPORTANT: Any quotes you're given up front, before you go through the actual underwriting process, could be WAY off.

A true high risk life insurance broker will use a system like ours to find you the best life insurance rate.

After you provide us with some basic information, we'll have you apply to multiple carriers using our easy one page insurance application to get more than one real offer.

Then we negotiate for best possible offer and you decide on the exact plan and amount of insurance you want.

If the rate's are not acceptable to you, you pay nothing.

If you qualify for a higher rate than we expected, we can then shop your medical records to other insurance companies to try to improve on the offers.

One insurance exam results are good for 12 months, so we can use these for any companies later.

High Risk Life Insurance Cost

Let's take a look at some of the most affordable high risk term life insurance rates by age below.

These are the best $250,000- 10 year term rates for men and woman at various ages.

Showing Standard (regular) rates through table 6 monthly rates:

Male | Standard | Table 2 | Table 4 | Table 6 |

|---|---|---|---|---|

Age 40 | $20 | $26 | $32 | $38 |

Age 50 | $44 | $58 | $75 | $90 |

Age 60 | $92 | $129 | $170 | $211 |

Age 70 | $298 | $387 | $513 | $639 |

Female | Standard | Table 2 | Table 4 | Table 6 |

|---|---|---|---|---|

Age 40 | $18 | $22 | $26 | $31 |

Age 50 | $34 | $43 | $54 | $66 |

Age 60 | $65 | $89 | $116 | $143 |

Age 70 | $192 | $267 | $353 | $439 |

As you can see from above, even high risk life insurance rates can be very affordable.

The younger you are when you purchase, the better your rates will be.

Some insurance companies also offer rate reduction programs on their universal life plans, so we'll look at all insurance options available to you.

CLICK HERE TO GET ACCURATE HIGH RISK LIFE QUOTE

Bottom Line- High Risk Life Insurance

We can help any high risk or "uninsurable" person to get insured, whether you want term or permanent life insurance.

We'll never recommend guaranteed issue or guaranteed acceptance coverage with waiting periods unless we cannot find you a regular type of life insurance.

Our life insurance underwriting process getting multiple real offers cannot be beat!!

Click on accurate quote link above and we'll shop with all of the top carriers to find you best rate and value!

Or you can simply call or text us at 800-380-3533 or email us and let us know your medical history or other issue and we will help you to narrow down best rate and policy for you.