We can offer you insurance from the best life insurance companies in US.

Whether you're looking for the insurance carrier that offers the absolute lowest rates in the country, or just the lowest life insurance rates for diabetics or if you have other preexisting conditions.

Doesn't matter if you want term life insurance or other type of guaranteed life insurance...

If you want insurance with chronic and critical illness living benefits, best Guaranteed Universal Life insurance or if you just want a policy to pay for estate taxes or even just seniors final expense life insurance for funeral costs...

We can help you!

Top Life Insurance Companies 2023

We have a database of life insurance rates from hundreds of different insurance companies and we analyzed the best term life insurance plans and guaranteed permanent life insurance rates from ages 30 to 70, and below are the top companies for people in good to average or slightly below average health along with their AM Best financial strength ratings.

There are many other companies available that could be better for you based on your exact medical and other history and depending on the plan and amount of insurance you want.

Banner Life- A+ Superior AM Best- offer great low cost term life, can be good for people with health issues, great customer service, easy application process, conversion option available for level premium term period up to age 70 but only allows conversion to one high priced guaranteed universal life product and they currently offer no living benefits besides for terminal illness.

Ethos- Best instant-approval life insurance (usually). Ethos is actually 4 different companies in 1 and you can get both term life or whole life insurance from Ethos. Click here to see comparison of Ethos to the other "instant" coverage carriers including Haven Life, Ladder Life, Bestow and Hero Life.

Pacific Life- A+ Superior AM Best- definitely a top pick that offers low cost term and permanent insurance options, can be good for slightly overweight and people with other health issues, good customer service, no exam required for people age 50- 69, decent conversion option, offers terminal illness living benefit on term and you can add chronic illness benefit to permanent product for additional charge.

Protective Life- A+ Superior AM Best- offers great low cost term and permanent coverage, can be very good for people with weight and cardiac issues, good customer service, offers slightly higher costing term plan with more flexibility to convert or continue coverage after original term period ends, includes terminal living benefit on term and can add a chronic and critical illness living benefits rider on permanent coverage.

American General/AIG- A Excellent AM Best- offers good low cost term and permanent products, can be good for people with health issues, okay customer service, term conversion option is good in early policy years but with limitations in later policy years, only includes terminal illness living benefit on term but can add chronic illness benefit to permanent insurance for additional charge

American National Life- A Excellent AM Best- offers good low cost permanent life insurance products with chronic, critical and terminal illness living benefits built in to all of their policies, okay for people with some minor health issues. No medical exam required up to $250k amount and age 65, customer service is okay, allows conversion of old term products to ANY of their permanent products for full level premium term period up to age 65.

North American Company for Life & Health- A+ Superior AM Best- offers good low cost term and permanent life insurance with chronic, critical and terminal illness living benefits built in to most of their policies, okay for people with some health issues, very good customer service, good conversion option and great products to convert to.

Lincoln Financial- A+ Superior AM Best- offers good low cost term and permanent life insurance options with terminal illness living benefits only, great customer service, okay for people with some health issues but more aggressive in underwriting on permanent products, conversion option on term is okay with limitations in later policy years.

Thrivent Financial- A++ Superior AM Best- offers some of the best low cost term life insurance coverage in the United States now. For a few dollars more they will also add an extended conversion option on their term policies so you can automatically extend it later. They do also offer permanent universal life and whole life insurance, but which is not as competitively priced as their term coverage.

Penn Mutual- A+ Superior AM Best- offers decent low cost term and very competitive permanent life insurance products including an excellent Guaranteed Universal Life policy and a Whole Life cash value insurance plan, good customer service, not so good for people with health issues, offers 2 term products one with no conversion option and the other with conversion for level premium term period up to age 70, chronic illness rider included on permanent products only.

SBLI (Savings Bank Life of MA)- A Excellent AM Best- offers good low cost term life insurance premiums that requires no blood or exam for ages 18 to 60 buying up to $500k, good customer service, not so good for people with health issues, conversion of term available for level term period up to age 70 but their products available for conversion are expensive.

John Hancock- A+ Superior AM Best- good term and permanent life insurance products, good customer service, can be good for people with some health issues like diabetes, good conversion option on term which is available for level premium term period up to age 70, can add long-term care rider to permanent life insurance plans for additional charge.

Symetra Life- A Excellent AM Best- Swift term product can be competitively priced and quickly issued for healthy people, decent permanent products, good customer service, okay for people with some health issues, have chronic illness benefits built into their permanent products and can pay extra to get even better chronic illness benefits.

Prudential- A+ Superior AM Best- good term and permanent options for life insurance, average customer service, can be good for people with more significant health issues, include a nursing home living benefit option on their term and permanent policies, term can be converted to any permanent product for level premium term period up to age 65.

Nationwide- A+ Superior AM Best- competitive permanent life insurance products, not so competitive for term insurance policies and not usually good for people with health issues, can add a long term care rider to their permanent products for an additional charge.

United of Omaha- A+ Superior AM Best- decent term and permanent products and they offer no exam "express" products that do not require an exam for amounts up to $300,000 and age 65, can be decent for people with health issues, they include chronic illness living benefits built into their permanent products for which everyone qualifies even on highly rated policies, good customer service, term can be converted for level premium term period up to age 75.

Minnesota Life- A+ Superior AM Best- competitive term and permanent life insurance products, offers 2 different term products one with better conversion option up to age 75, offers long term care agreement on some permanent products, not so good for people with health issues.

Ohio National Life- A+ Superior AM Best- decent term and permanent products, they offer 2 different term products one with better conversion, not so good for people with health issues, good customer service.

Columbus Life- A+ Superior AM Best- decent term and permanent products with chronic and critical illness living benefits, they are one of the only companies that offers a predictable chronic and critical illness living benefit payout, excellent customer service and are more liberal in underwriting on permanent products.

Cincinnati Life- A Excellent AM Best- decent term and permanent products, have one of the lowest costing whole life products available, age last birthday advantage and great for non-cigarette tobacco users.

Principal Life and Principal National Life - A+ Superior AM Best. Their focus is on business life insurance market and Group insurance products as of 9/30/2021. Still a great carrier with aggressive underwriting and we use them frequently.

Again, there may be other companies than the above that could make you the best offer...

Life Insurance Companies USA

Best Life Insurance Rates 2023

Below are the best case scenario $250,000 term and permanent insurance rates from 10 year to 50 year guaranteed level rates. These are all monthly rates from ages 40- 70 for males and females:

Male Age 40 | Male Age 50 | Male Age 60 | Male Age 70 | |

|---|---|---|---|---|

10 Year Level: | $12 | $23 | $53 | $162 |

20 Year Level: | $17 | $38 | $105 | $407 |

30 Year Level: | $28 | $67 | $247 | $601 |

40 Year Level: | $61 | $167 | $324 | $627 |

50 Year Level: | $120 | $191 | $345 | $640 |

Female Age 40 | Female Age 50 | Female Age 60 | Female Age 70 | |

|---|---|---|---|---|

10 Year Level: | $11 | $20 | $37 | $103 |

20 Year Level: | $15 | $31 | $74 | $317 |

30 Year Level: | $23 | $52 | $221 | $522 |

40 Year Level: | $48 | $141 | $278 | $538 |

50 Year Level: | $100 | $165 | $294 | $549 |

Beware of Wrong Information Online

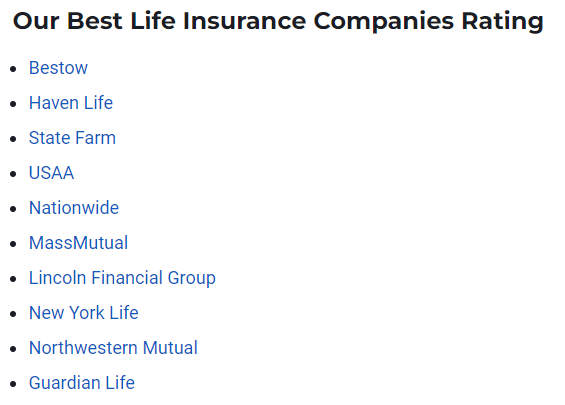

Even from reputable sources. For example, I googled "best life insurance companies" and the #1 organic listing was from usnews.com and below is screenshot of their list. These are all financially strong and quality companies, but may not be best for you.

Below the list above was sample rates, most of which were NOT accurate but did have disclaimer "Any rates listed are for illustrative purposes only. You should contact the insurance company or insurance agent directly for applicable quotes".

Nerdwallet had 2nd highest listing in organic search engine results page with almost identical carriers to above except they included Pacific Life, but did not include Bestow or Nationwide in their list.

With so much "best life insurance companies" info, who do you believe?

We can compare each carrier above's term life insurance rates to every other competitive carriers rates to verify if they are or are not lowest cost or even the best value for you, depending on what's important to you!

For Universal Life and Whole Life, we do NOT have access to run illustrations for State Farm, USAA or Northwestern Mutual, but we do for all the others...

If you happen to have a UL or WL illustration for State Farm, USAA or Northwestern Mutual for which you'd like us to compare, you can simply send us copy and we'll do an analysis and compare to other similar products.

How To Find Best Life Insurance Company

Process is the same regardless of the type of life insurance you want or your health condition.

We'll need to gather the basic information from you below and then we'll shop with every competitive life insurance company to find you the best offers.

- 1Date of birth and State of residence?

- 2Prescription medications?

- 3Any past or present medical history?

- 4Any immediate family history of cardiovascular disease or cancer prior to age 65?

- 5Any hazardous avocations?

- 6Do you have a clean driving record?

- 7Height and weight?

- 8Any tobacco, nicotine or marijuana used in past 5 years?

- 9Amount of life insurance?

We’ll Find Best Insurance Company For You

With answers to the questions above we’ll be able to shop with all carriers shown above to find you the absolute lowest rate, best value life insurance with chronic and critical illness living benefits or both lowest and best value!!

Whether you want 10 year term or other duration, guaranteed universal life, whole life insurance or even guaranteed acceptance life insurance, we’ll find you the best insurance premiums and we’ll make buying life insurance a hassle free process.

We will order your medical records when they’re required so that we are in control and can use them to get offers from ANY life insurance companies.

There is NEVER one company that’s best for everyone

We’re independent agents and have no bias towards or against ANY life insurance companies and our only goal is to get you the best rate and value.

We can offer you coverage from ANY competitive life insurance company as long as they have good financial strength and are quality companies!

Need help? Call or text us today at 800-380-3533 if you’d like a life insurance quote or any insurance information…or just click on link below if you only want to compare quotes and don’t want to speak to an insurance agent.