Overweight life insurance or life insurance for overweight people can make it challenging to find affordable life insurance.

There are niche companies we can offer you that specialize in life insurance for overweight people or anyone with a weight issue.

Life insurance companies can make it hard for overweight individuals to get life insurance because of their height and weight or BMI guidelines.

These guidelines can make it difficult for overweight people to qualify for Preferred Plus, Preferred, Standard Plus or even Standard (Regular) rates.

Being overweight is one of the number one reasons that people who are healthy otherwise don't qualify for better life insurance rates and pay more for insurance premiums.

IMPORTANT: All insurance companies have different height/weight guidelines and applying to the wrong company can cost you thousands of dollars!!

Overweight Life Insurance Case Studies

Here are some great results we've had recently:

Female age 31 and 5'2" - 270 pounds.

She wanted $100,000 of 20 year term and she did NOT want to have an exam due to concerns over the Coronavirus.

Most comanies would automatically decline her at this height/weight. Prudential was one of the companies that may make her an offer, but they would have required an exam.

Thru our realtionship with another "Excellent" AM Best rated carrier, we were able to get her a "no exam" exception and she was approved at rate of $26 per month for $100,000 of 20 year term..

Male age 32 and 6' 5" - 475 pounds

He wanted $150,000 of permanent life insurance, but his BMI was higher than what ALL of the "regular" carriers would insure.

We were able to offer him a specialty carrier that has no height/weight reuirement at all, and he was able to buy $150,000 of Universal Life insurance with monthly cost of $104.

Male age 34 and 5' 9" - 350 pounds

He wanted $1,000,000 of term and indicated he was relatively stable weight over past year and we had him apply to the two most probable best companies for him...

Anything can turn up in underwriting, and we knew not to rely on any one company to come thru for us.

His medical records showed weight fluctuations of about 35 pounds over previous 12 months and both companies declined since they require a more stable weight.

He was committed to losing weight and just over 1 year later he was 5' 9" - 310 pounds and we were able to get him a $1,000,000- 30 year term rate of $242 per month.

What Is Obese or Overweight Life Insurance

Being overweight or obese is determined by something known as your BMI or Body Mass Index.

Below is a screenshot of the different BMI ranges:

If you want to see what your current BMI is, you can click here.

According to data from the National Health and Nutrition Examination Survey:

If we look at the numbers above you can easily see that being overweight or obese isn't a rare thing and that most of America is overweight or obese.

Below is a quick Ted Talk on TedEd about what obesity is:

Best Life Insurance Rate If Your Overweight

It really doesn't matter if you’re an overweight male or female.

If you've been “rated” or charged a higher rate, or told that you’d be declined for life insurance due to weight, than we’ve got great news for you!

While being overweight always affects life insurance cost, there are a number of companies that make much better offers for people who are overweight than the majority of the other competitive insurance companies.

These companies allow people who weigh 20 – 30 pounds more (than most other companies would allow) to still qualify for their Preferred Plus to Standard or Regular rates.

We detail this list of companies below:

Best Life Insurance Companies for Overweight

Some of the best insurance companies for people who are overweight are:

The company that will offer the best life insurance premiums for you will depend on your specific height/weight, other health conditions and the amount and type of life insurance that you want.

Life Insurance Weight Chart

Below are some of the overweight life insurance companies maximum height/weights that can still qualify for Regular or Standard life insurance rates.

Ages 18 - 60

5’ 0” tall- 220 pounds

5’ 1” tall- 227 pounds

5’ 2” tall- 235 pounds

5’ 3” tall- 242 pounds

5’ 4” tall- 250 pounds

5’ 5” tall- 258 pounds

5’ 6” tall- 266 pounds

5’ 7” tall- 274 pounds

5’ 8” tall- 282 pounds

5’ 9” tall- 291 pounds

5’ 10” tall- 299 pounds

5’ 11” tall- 308 pounds

6’ 0” tall- 316 pounds

6’ 1” tall- 325 pounds

6’ 2” tall- 334 pounds

6’ 3” tall- 343 pounds

6’ 4” tall- 353 pounds

6’ 5” tall- 363 pounds

6’ 6” tall- 372 pounds

Ages 61 and Older

5’ 0” tall- 230 pounds

5’ 1” tall- 238 pounds

5’ 2” tall- 246 pounds

5’ 3” tall- 254 pounds

5’ 4” tall- 262 pounds

5’ 5” tall- 270 pounds

5’ 6” tall- 278 pounds

5’ 7” tall- 287 pounds

5’ 8” tall- 295 pounds

5’ 9” tall- 304 pounds

5’ 10” tall- 313 pounds

5’ 11” tall- 322 pounds

6’ 0” tall- 331 pounds

6’ 1” tall- 340 pounds

6’ 2” tall- 350 pounds

6’ 3” tall- 359 pounds

6’ 4” tall- 369 pounds

6’ 5” tall- 379 pounds

6’ 6” tall- 389 pounds

What If You're At or Above These Guidelines

If you are close to the maximum weight using height/weight chart above then you're considered overweight and you will need to make sure everything else is in a normal range during the underwriting process.

Your total cholesterol, HDL cholesterol, blood pressure, blood glucose and/or A1C must be within normal range.

Or:

You must have had a good stress test, nuclear stress test, or stress echocardiogram that was completed within the previous 12 months to rule out heart disease.

If you’re morbidly obese or if your weight is over the above guidelines, you can still qualify for life insurance if you're overweight.

We’ll have to shop for best rates available to you depending on your exact height and weight and other medical condition.

Especially if you are looking for life insurance for diabetics type 1 or 2 or need seniors life insurance as some insurance companies have more liberal weight guidelines for seniors.

Life Insurance Maximum Weight Limits

Below are the maximum weight limits allowed before insurance underwriters will decline.

Being even 1 pound heavier than limits shown below will result in a decline with the most liberal life insurance companies for the morbidly obese.

Ages 18 - 60

5’ 0” tall- 282 pounds

5’ 1” tall- 294 pounds

5’ 2” tall- 298 pounds

5’ 3” tall- 306 pounds

5’ 4” tall- 312 pounds

5’ 5” tall- 318 pounds

5’ 6” tall- 326 pounds

5’ 7” tall- 330 pounds

5’ 8” tall- 341 pounds

5’ 9” tall- 347 pounds

5’ 10” tall- 355 pounds

5’ 11” tall- 361 pounds

6’ 0” tall- 378 pounds

6’ 1” tall- 385 pounds

6’ 2” tall- 393 Pounds

6’ 3” tall- 399 pounds

6’ 4” tall- 410 pounds

6’ 5” tall- 422 pounds

6’ 6” tall- 433 pounds

Ages 61 and Older

5’ 0” tall- 282 pounds

5’ 1” tall- 294 pounds

5’ 2” tall- 298 pounds

5’ 3” tall- 310 pounds

5’ 4” tall- 320 pounds

5’ 5” tall- 330 pounds

5’ 6” tall- 341 pounds

5’ 7” tall- 351 pounds

5’ 8” tall- 368 pounds

5’ 9” tall- 372 pounds

5’ 10” tall- 383 pounds

5’ 11” tall- 394 pounds

6’ 0” tall- 405 pounds

6’ 1” tall- 417 pounds

6’ 2” tall- 428 pounds

6’ 3” tall- 440 pounds

6’ 4” tall- 452 pounds

6’ 5” tall- 464 pounds

6’ 6” tall- 476 pounds

If You Weigh More Than The Maximum Life Insurance Weight Limits

If you're overweight and obese and weigh more than the above, even only a pound or two more, the best insurance companies for overweight people will likely decline you.

Important to note: Any insurance company can change their height and weight guidelines at anytime.

We shop each case thoroughly to make sure we don't miss any updates, as we can offer you coverage from hundreds of different insurance companies.

If you do happen to weigh more than the above, you’re still insurable, as there are a few insurance companies that currently have no height/weight requirement.

While most of these companies only offer Whole Life insurance, there is currently one company that offers term life with no height/weight requirement.

Lose Weight Before Applying for Insurance

Beware when trying to drop weight just prior to applying for life insurance.

Insurance companies like to see a stable weight for 1 full year, as they know people try to drop weight before applying for life insurance coverage.

Weight gain or loss is a question on all insurance exams and/or on the best “no exam” applications.

If you tell the examiner you lost 20 pounds in the past year, the competitive companies will debit you an amount equal to half of the weight that you lost.

So they'll consider you to be 10 pounds heavier than you actually are when you apply, and this debiting could put you in next higher rate category or table rating.

Insurance Companies Are Sneaky

Most of these companies also order your medical records to verify health history, so they can find out about weight loss even if you don't mention it.

We don't like this weight loss debiting procedure either, but all of the competitive life insurance carriers do it.

So be honest, but underestimate as much as possible when answering question about weight loss and never admit to losing more than you actually did.

Tips for Quick Weight Loss

Regardless of the weight debiting procedure, it will still be in your best interest to be as light as possible on day you have insurance exam.

Keep in mind that we will always negotiate to get you best possible offer, so the absolute lowest you can weigh at time of exam can help us when negotiating.

According to Healthline.com, the best healthy way to lose weight quickly are:

If you can follow the above recommendations for a couple weeks or longer prior to having insurance exam, you could be 10 to 20 pounds lighter.

Also try to schedule your exam in the morning before eating or drinking anything (besides water)…as most people are at their lightest in the morning.

No Exam Life Insurance For Overweight

If you need life insurance, you’re very overweight or obese, and you don’t want to have an insurance exam with your height and weight measurements taken, then we have a solution for you.

You already know that being overweight will have an impact in life insurance underwriting and the cost of your policy, or it could result in you being declined altogether.

Fortunately, we can offer you insurance from a couple carriers that currently have no height/weight requirement.

The best one of these insurance carriers will currently offer you a maximum of $30,000 of whole life insurance, and the rates are surprisingly competitive.

For example, below are rates for $10,000, $20,000, and $30,000 of Whole Life insurance at various ages. The rates below are non-smoker monthly rates by age:

| | $10,000 | $20,000 | $30,000 |

| Male Age 30: Female Age 30: | $16 $15 | $32 $30 | $48 $45 |

| Male Age 40: Female Age 40: | $22 $21 | $48 $42 | $67 $62 |

| Male Age 50: Female Age 50: | $33 $30 | $65 $60 | $98 $91 |

| Male Age 60: Female Age 60: | $53 $47 | $106 $95 | $159 $142 |

| Male Age 70: Female Age 70: | $99 $80 | $197 $161 | $296 $241 |

If this doesn’t already sound too good to be true, you don’t even need to have an insurance exam or blood or urine test to qualify.

You must answer some health questions on application but height and weight are NOT taken into consideration to qualify for rates above.

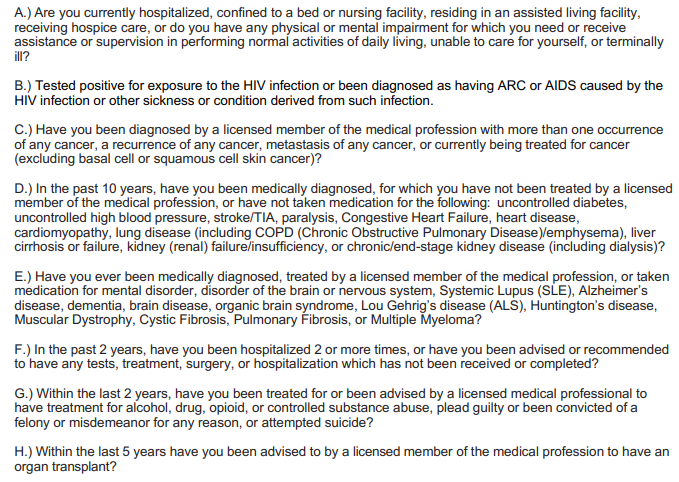

You must be able to answer "NO" to the questions below to qualify for up to $30,000:

How Do I Know If I Could Be Declined for Weight?

If you’re considering purchasing overweight life insurance and you weigh even close to the weights shown in life insurance maximum weight limits chart above, and/or if you are overweight and have any other preexisting conditions (i.e. diabetes, sleep apnea, uncontrolled cholesterol, uncontrolled high blood pressure, etc.), you could possibly be declined with most insurance companies.

If you are overweight and have not had a medical check up within past year or so, it is possible that your blood sugar, blood pressure, or cholesterol levels could be abnormal.

Any of these issues could cause you to be declined for the life insurance if your weight is even close to weight shown in chart above.

If you happen to apply to the wrong company, like Allstate, State Farm, Farmers, or any other insurance company that is not liberal for obese people, then you could be declined!

What Are The Pros and Cons of This No Exam Coverage?

This no exam coverage provides full death benefit amount that you purchase on first day of the following month after you apply and make first payment.

Whether you die by any disease, sickness, illness or by accidental means, your beneficiary would get the full amount of life insurance as soon as the policy is placed in force.

This is NOT graded benefit or guaranteed issue high risk life insurance coverage for which there is a two or three year waiting period before full benefit amount would be paid for death by disease, sickness, or illness.

This coverage is not currently approved in every State.

The bottom line is that this is a great option for you if you are significantly overweight and you need life insurance but don’t want to have an insurance exam, especially until you can lose weight and possibly qualify for better coverage!!

Best No Exam Overweight Insurance Companies

Companies like American Amicable, American National, Banner Life, Foresters, Transamerica and SBLI can be competitive if you don’t want to have a medical exam.

Just keep in mind that most of these no exam life insurance companies can order medical records prior to making you an offer or if there is a death claim made in first 2 policy years.

So if you intend to apply to a "no exam" insurance company, be honest about your actual height/weight at the time you apply.

This way, you should have no problem getting approved and so that your beneficiary doesn’t have any problem when filing a death claim.

Life Insurance For Severely Overweight

The most aggressive insurance companies for people who are severely overweight or morbidly obese will continue to change...

Whether it's Prudential, Protective Life, Pacific Life, Met Life, Minnesota Life, John Hancock, Banner Life, Illinois Mutual, Security Mutual or any other companies that may have aggressive height/weight guidelines for the seriously obese right now, they may not next month.

Not too long ago, some of the companies above used to allow about 40 pounds more than they do now, before they'd decline anyone.

These companies must have been insuring too many overweight people and wanted to reduce that particular risk.

Guaranteed Issue Insurance is Always a Last Resort

If you weigh more than the maximum height-weight guidelines above, and are not currently employed and working...then as an absolute last resort for people that are severely overweight and/or have other serious health issues, there are graded benefit term and guaranteed issue Whole Life rates available.

You probably hear advertisement's for this type of guaranteed acceptance coverage from Colonial Penn, AARP and Gerber Life insurance company...

Don't buy this type of coverage unless you CANNOT qualify for regular life insurance or even the Group Term or Universal Life coverage mentioned above.

This type of final expense insurance is expensive, always has a waiting period and won’t pay out full death benefit amount for death by disease/illness in the first two or three years, and it’s usually only offered at low amounts like $50,000 or less to only cover final expenses.

It is a good thing to know that some life insurance for the severely overweight is available.

If You’re Denied Life Insurance Due to Weight

First thing you need to do if you’re denied, is to make sure your case has been shopped to all the top life insurance companies.

Most agents, brokers or insurance website’s only offer a limited number of companies, so there could be a company or 2 that has more liberal guidelines on life insurance and obesity.

Just because anyone tells you that you won’t qualify, doesn’t mean you really won’t.

There's Always Some Life Insurance Available To Obese

If you have exhausted ALL options, there are always guaranteed issue products available to most people ages 18 - 85.

Again, don’t buy Guaranteed Issue unless you CANNOT qualify for any regular life insurance.

IMPORTANT: You can always re-apply for life insurance after you've lost weight.

You'll be under no obligation to keep ANY life insurance policy for any period of time.

You should cancel any old insurance as soon as a better rate/policy is in force.

Getting Life Insurance If Your Obese

We can often get exceptions on overweight life insurance for people and sometimes get them better rates than the norm when their health checks out as good.

If cholesterol levels, blood sugar, blood pressure are good, your overall health is pretty good and you don't smoke, we've been able to get some insurance companies to improve on their initial offer.

We always do our best to get any overweight applicant the best rate possible!

Need Help...Let Us Know

Contact us by phone or text at 800-380-3533 or just click on the link above to get accurate life insurance quotes, whether you want term life insurance quotes or universal life and we'll email you with accurate overweight life insurance quotes so you can determine if you would like to apply.

We're not going to call and/or hassle you. We'll simply provide quotes and then you can decide to proceed or not!

Or simply click here to email us with your name, date of birth, height/weight, other health issues and your State of residence and we will email you with accurate quotes.

Please feel free to contact us by whichever way is most comfortable for you, by phone, email or by simply by clicking the accurate quote link above.