If you're shopping for life insurance and are able to get life insurance through any captive agent, you MUST shop for alternative offers or you will overpay significantly!

A captive agent is anyone that can only offer you or that tries to persuade you to buy from one insurance company, like State Farm, Farmers, Northwestern Mutual, New York Life, etc.

These companies’ term life insurance rates are not competitively priced.

For example, check out each carriers $1,000,000 - 20 year term "Preferred Plus" monthly rates offered to people in excellent health to "Standard" rates offered to people in average/slightly below average health for males and females from ages 40 - 65:

Male | Northwestern Mutual | State Farm | NY Life | Farmers |

|---|---|---|---|---|

Age 40 | $72 - $121 | $69 - $130 | $79 - $146 | $87 - $150 |

Age 50 | $163 - $295 | $170 - $313 | $200 - $329 | $224 - $367 |

Age 60 | $392 - $725 | $490 - $888 | $660 - $926 | $808 - $1117 |

Age 65 | n/a | $875 - $1569 | $1078 - $1653 | $1294- $1719 |

Female | Northwestern Mutual | State Farm | NY Life | Farmers |

|---|---|---|---|---|

Age 40 | $68 - $113 | $54 - $102 | $70 - $120 | $76 - $139 |

Age 50 | $126 - $242 | $123 - $221 | $152 - $238 | $190 - $321 |

Age 60 | $327 - $602 | $336 - $605 | $458 - $684 | $479 - $735 |

Age 65 | n/a | $609 - $1091 | $760 - $1163 | $974 - $1200 |

Now let's see how much you can save with BEST carriers

Below are the absolute lowest preferred plus and standard monthly rates for $1,000,000- 20 year term for males and females at ages 40 - 65 from the best "Superior" AM Best rated carriers in our database of rates from 100's of quality companies...these are lowest, better and best value rates:

Male | Lowest | Better Conversion | Best Conversion & Living Benefits | |

|---|---|---|---|---|

Age 40 | $49 - $101 | $53 - $102 | $55 - $114 | |

Age 50 | $132 - $248 | $142 - $254 | $145 - $273 | |

Age 60 | $388 - $712 | $411 - $723 | $420 - $772 | |

Age 65 | $733 - $1368 | $784 - $1387 | $799 - $1463 |

Female | Lowest | Better Conversion | Best Conversion & Living Benefits | |

|---|---|---|---|---|

Age 40 | $41 - $80 | $45 - $81 | $56 - $88 | |

Age 50 | $96 - $184 | $105 - $185 | $106 - $205 | |

Age 60 | $268 - $478 | $277 - $479 | $286 - $514 | |

Age 65 | $485 - $887 | $501 - $888 | $527 - $946 |

Life insurance for seniors over age 60

As you can see in comparisons above, everyone should be able to save money by NOT purchasing with Northwestern, State Farm, NY Life or Farmers...

If you're age 60 or older, you'll save significant money and/or get a much better value by going with the lowest, better conversion or best conversion & LB rates instead of ANY of the "captives" above.

The older you get, the more you'll potentially save as you can clearly see from the life insurance age 65 rates...

For example, a 65 year old male could save $142 per month by purchasing lowest rate over State Farm's lowest rate...which equates to a savings of $34,080 over the 20 year term!

Or a 65 year old female could save $124 per month by purchasing lowest rate over State Farm's lowest rate...which equates to a savings of $29,760 over the 20 year term!

There is significant savings to be had by shopping around!!

Life insurance with pre-existing conditions

A pre-existing condition could be something as simple as high cholesterol to a more significant issue like type 1 diabetes or heart disease.

If you have any pre-existing conditions whatsoever, then you'll save even more money by purchasing insurance other than from State Farm, NY Life, Farmers or Northwestern Mutual.

A LOT of carriers have a niche, like being better for overweight, people with high cholesterol, diabetes, heart disease, etc.

Don't just take my word for it, request a quote and I'll shop to find you best offer!

Other reasons NOT to buy from captives

Lowest price is rarely the best value, but even the "best conversion & living benefits" rates above will save you money and provide you with a better value than by going with any of the captives.

Below we describe each carriers term products in a little more detail:

Northwestern Mutual Term Life Insurance

They have top financial ratings, but their term coverage is expensive but they can pay dividends to help reduce your term cost, they offer no chronic or critical illness living benefits and they only allow you to convert (or automatically extend) term insurance in the first 10 policy years to max of age 70, which is a negative if you buy 20 year term.

They are known to have excellent Whole Life insurance, which also happens to be the most expensive type of life insurance. If you are looking for Whole life insurance, make sure to compare Northwestern whole life to Penn Mutual, Mass Mutual, New York Life and The Guardian as these others are "players" in the whole life market.

State Farm Term Life

They have the highest financial ratings, but someone has to pay for those Jake from State Farm commercials, and that would be their policyholders!

Their term coverage is also expensive, they offer no chronic or critical illness living benefits but they do allow you to convert (or automatically extend) up to age 75 which is excellent.

New York Life Insurance

Great financial ratings, but their term life insurance is overpriced!

Their name recognition may help them to sell more term policies, but they also offer no chronic or critical illness living benefits and their term plans are also only convertible for the first 10 policy years, which is a negative if you purchase 20 year term.

If traditional Whole Life insurance is what you want, then you definitely need to get a NY Life whole life quote to compare.

Farmers - Farm Bureau Life Insurance

Sold under Farmers New World Life Insurance Company, with an A (Excellent) AM Best financial rating, they currently offer some of the highest term insurance rates out of all of the captive agent carriers!!

I guess paying big name actors like J.K. Simmons for their commercials, ain't cheap...and that is definitely reflected in their term insurance cost. They also do not offer chronic or critical illness living benefits and their term policies are only convertible to age 65, which is not ideal.

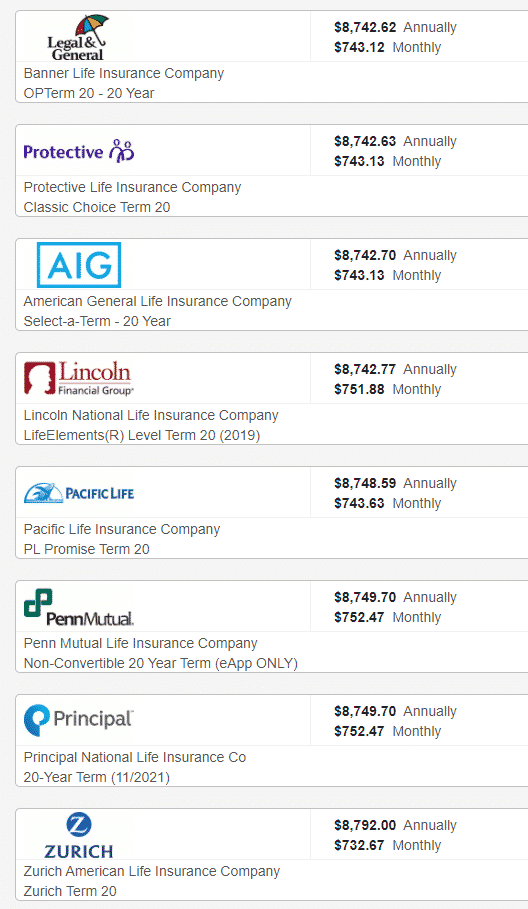

Absolute lowest male age 65 $1,000,000- 20 year term

All Male age 65 $1,000,000- 20 Year Term - Best Rates

Lowest rates quoted above

Are all from quality carriers, and if you don't care about conversion or being able to easily extend your term duration later without having to re-apply, and if the chronic and critical illness living benefits don't interest you, then I would recommend purchasing one of these policies instead of ANY of the other captive rates/carriers above...

But for the small difference in cost, I always recommend rates with best conversion and the great living benefits.

Best conversion rates quoted above

These include Pacific Life, Penn Mutual (convertible product only) and Protective Life (custom choice product only), as these carriers allow you to convert or automatically extend to ANY of their permanent longer duration products or a competitively priced product, including lowest cost Guaranteed Universal Life insurance products for the entire level premium term period up to a max of age 70.

Best conversion & living benefits rates

This the latest and greatest term life insurance from quality carriers including North American Company for Life & Health, American National, Columbus Life and others.

These rates and products allow you to take a portion of your life insurance amount while you're living if you suffer a chronic illness and need long term care or home health care and/or a critical illness like a heart attack, stroke, cancer, etc.

North American allows you to convert to ANY of their permanent longer duration products including their GUL and Indexed UL products for the level premium term period up to a max of age 75.

American National allows you to convert to any of their permanent longer duration products, but only up to a maximum of age 65.

Columbus Life allows you to convert to any of their permanent longer duration products, but only up to a maximum of age 70.

NOT a significant increase in cost from lowest to best value!

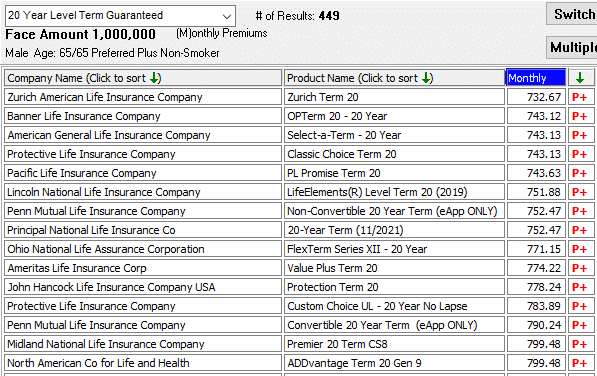

For comparative purposes, below are the BEST - $1,000,000- 20 year term rates in our database of rates from 100's of different carriers, also for a 65 year old male in good health...

As you can see below, when comparing lowest rate (Zurich) to best value rate (North American) below, the cost is not that much higher to get a significantly better value!

All below are much better than State Farms best rate of $875 per month!

Don't fall for the captive agent "go to" response to get you to pay more

One trick some captive agents use to get you to buy over-priced life insurance from them is to try to frighten you into believing that other insurance companies may go out of business due to their less than perfect financial ratings.

If this happens to you, then ask the agent to tell you the name of one life insurance company that has gone out of business over the past 50 years.

If they can tell you the name of even one life insurance company that has gone out of business, please let me know. I don’t know of any.

We have dealt with hundreds and hundreds of different insurance companies over the past 50+ years, and there has never been one carrier that we dealt with that has gone out of business and unable to pay a death claim...

There are many insurance companies that have merged with others throughout the years and have changed names. There are also some companies that no longer sell new life insurance policies, but that still maintain all old policies and continue to pay all death claims.

Find a good independent agent or broker and compare rates/value!

If you really like your captive agent, you believe they’re working in your best interest, and you don’t mind paying more than you have to, then by all means buy their life insurance.

However, if you want to save money, pay off your mortgage early, buy a new car, or you just hate wasting your hard earned money, find a good independent agent or broker.

There are hundreds of quality insurance companies with great financial ratings to choose from, no matter what type of life insurance coverage you want.

Don’t fall for the scam if any captive insurance agent tries to frighten you into buying from them because of their insurance company’s financial ratings or name brand.

If you'd like to compare quotes from all carriers above and more, simply click on the SSL Secure link below, complete the questionnaire and we'll send you quotes/info that are best for you with no obligation on your part: