Get a Protective Life insurance quote today as they are one of the most innovative companies with unique products that are a little different than the products of their competition.

Products offered by Protective life are competitive term life insurance, term universal life, guaranteed universal life, indexed universal life and variable universal life insurance. They do also offer a whole life insurance plan, but it's not competitively priced.

Protective Life is a major player in the life insurance industry. In business since 1907 with great financial strength ratings, including A+ (Superior) AM Best rating, a low complaint index, and with great products and great underwriters!

Having acquired West Coast Life, MONY Life and Federal Kemper Life, Protective is a powerhouse of an insurance company with excellent underwriters and products that can make them one of the best companies for life insurance planning!

Protective Life Classic Choice Term & Custom Choice UL

Protective Life Insurance Company’s Classic Choice Term offers some of the lowest term rates in the insurance industry.

You can buy Classic Choice Term as 10, 15, 20, 25, 30, 35 or 40 year guaranteed level premium term, which is currently the longest duration term insurance available.

Protective also offers a second term-like product with a higher cost called Custom Choice Universal Life which is sold as term life insurance for a guaranteed level premium term duration from 10 years to 30 years.

What's the difference, Protective Classic Choice term and Custom Choice UL?

The classic choice term is less expensive, but the custom choice UL offers a better exchange option in the future, if you'd ever like to extend the duration of your life insurance later.

You can automatically exchange or convert without having to go through underwriting again.

On the classic choice term, this exchange option is limited to the first 8 years on 10 year term, the first 13 years on 15 year term and the first 18 years on the 20, 25 or 30 year term.

Also on the classic choice term insurance product, Protective only allows you to convert or exchange to their absolute best products in the first 5 policy years. After 5 years, you can only exchange to Protective Life's more expensive permanent life products.

Custom Choice UL offers more flexibility than Classic Choice Term!

On the Custom Choice UL product, you can exchange/convert to Protective Life's best products, including the Lifetime Assurance UL and the Advantage Choice UL for the first 20 policy years to a maximum of age 70.

On Custom Choice UL you can continue to pay the same premium amount for a decreasing amount of life insurance after your 10 to 30 year guaranteed level premium period is over. Whereas, Classic Choice rates will increase dramatically after the initial 10 to 40 year period is over.

Is Protective Life Insurance Good?

Protective Life currently almost always shows up as one of the lowest cost term rates on most comparisons.

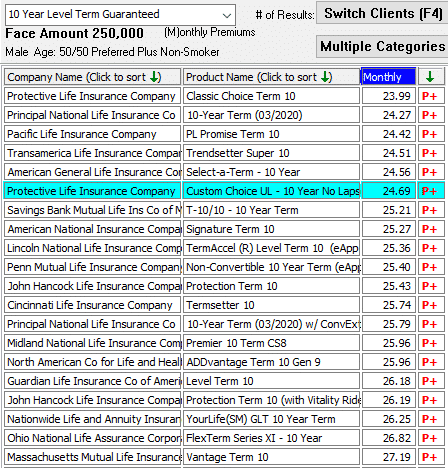

For example, check out these $250,000- 10 year term rates for a 50 year old male non-smoker in good health based on my database search of rates from 100's of quality carriers:

NOTE: In scenario above, Protective classic Choice term was absolute lowest rate, but for less than $2 more you can get the better Custom Choice UL product.

Want to see ALL Protective Life rates available to you, whether you're in great health, average health or poor health?

Protective-How To Lower Cost of Insurance

Protective Life also offers an Income Provider Option (IPO) for which you can choose to have the life insurance coverage amount paid out to your beneficiaries over a period of time instead of in one lump sum. Taking advantage of this IPO could save you money on your annual premium, see example below:

Male age 46, approved for a Standard Non Tobacco rate for $2 Million of 20-Year Custom Choice UL with annual premium of $4,911.

He originally applied for insurance coverage at a Preferred Non Tobacco rate of $3,019 per year, but due to unforeseen medical impairments that turned up on his medical exam, the client only qualified for the higher standard rate. This was a 63% increase in cost from the "preferred" quote!

Solution: Use the IPO to provide an income stream of $67,870 to the insured’s beneficiary for 30 years with a new annual premium of $3,000. The premium is now even slightly lower than the Preferred Non-Tobacco rate that was originally quoted.

The IPO installment option for the death benefit payout can be any time frame from 1 year to 30 years.

This IPO option can be added to any of Protective's term, term-UL or permanent universal life policies, not including their non-par Whole Life product..

The longer the time frame for the payout of the death benefit, the bigger the discount will be on your premiums and coverage!

Protective Lifetime Assurance UL

If you'd like guaranteed level premium coverage for longer than 30 or 40 years, then Protective Lifetime Assurance UL product is their most competitively priced permanent product that is guaranteed for the time frame you choose...from age 90 to lifetime.

The Lifetime Assurance UL is also one of the few Guaranteed Universal Life policies that builds a cash surrender value, which is an amount of money you'd get back if you ever cancel the policy.

The cash value starts in year 10 and equals an amount equal to 25% of the premiums paid in to policy.

You can also add additional benefits or riders to Lifetime Assurance UL, including an extend care rider which advances a portion of your life insurance amount if you're diagnosed as chronically ill and need ongoing care. This accelerated death benefit can be very appealing to seniors who are concerned about paying for long term care or home health care someday!!

Other benefits riders are waiver of premium so you don't need to pay ongoing premiums if you're disabled, an accidental death rider that will payout more to your beneficiary if you were to die in an accident and a children's insurance rider to cover all children for up to $25,000.

Protective Life Advantage Choice UL

Advantage Choice UL is Protective's second most competitive permanent life insurance product.

With a minimum guaranteed level premium to age 75, with the Advantage Choice UL you can also buy any guaranteed level life insurance product for longer than to age 75 that you'd like.

Simply Choose Any Time Frame For Which You'd Like Coverage

You could buy life insurance coverage with a guaranteed level rate to your age 80, age 83, age 87, age 90 all the way up to your entire lifetime.

You can also do short-pay scenarios with Advantage Choice, like pay for 20 years and get guaranteed coverage for up to your entire lifetime.

Protective Life’s Advantage Choice UL is fully customizable to your needs.

Protective Life Index Choice UL

If you're interested in using life insurance as an investment for cash accumulation, then Protective's Index Choice UL or even their Variable UL could be a good option.

Just remember that cash value is never guaranteed on any indexed or variable products.

Cash value is determined by interest rates credited to the policy and by policy charges, like cost of insurance and administrative charges which can also change.

While you can also guarantee the death benefit portion of the Index Choice UL, this would cost more than it would on the Lifetime Assurance policy.

Protective Life-Great for Some Health Issues

Some preexisting medical conditions for which Protective Life can be very aggressive:

- Obese people who need life insurance

- Life insurance for diabetics type 2 diagnosed after age 50

- Coronary Artery Disease life insurance

- Well controlled type 2 diabetics who smoke

- Heart valve disorders

Protective Life has great underwriters who are always willing to listen to our pitch for a better offer for any of our clients that need life insurance with preexisting issues.

Protective Life also has some of the best longer duration guaranteed universal life insurance rates to age 85, age 90 and age 95 for people with some health issues.

If you're over age 65 with health issues, then these age 85, age 90 and age 95 guaranteed level rates could cost you less than a 15 or 20 year term plan.

Protective Life is a great addition to the hundred's of other insurance companies we can offer you.

Just how competitive is Protective for health issues?

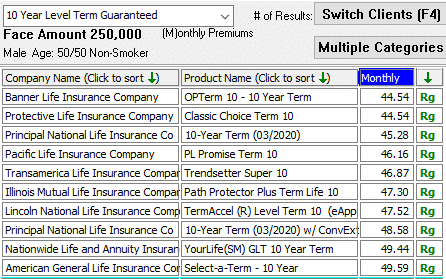

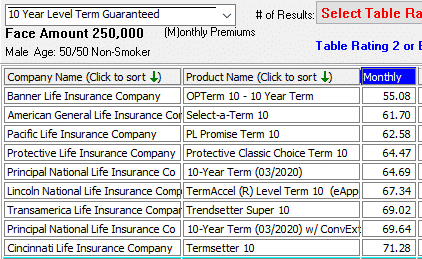

Check out the top 10 Standard/Regular (Rg) rates below and then top 10 table 2 rates underneath for $250,000- 10 year term for 50 year old male non-smoker with some health issues:

Based on comparison above, you're probably thinking you should just apply to Banner Life instead, right?

BUT...what if Protective offers you the Rg rate and Banner offers you a table 2 or higher rate?

The difference in cost gets amplified depending on your age, or if you buy longer duration insurance, a higher face amount, or if you're rated higher (i.e. table 3, 4, 5, etc.).

So How Do You Really Get Best Rate

Whether it's Protective Life, Banner Life, Principal Life, Pacific Life or any other company, the first thing to do is to get an accurate quote since they ALL have different criteria to qualify for the many different rates they offer.

Click on link below for an accurate quote and we'll compare rates and send you an unbiased comparison of Protective's best rates to other carriers best rates available to you.

Protective Term Life Through Costco

Protective does offer a 10% to 15% discount for Costco members that buy the insurance policies through Costco.

The Costco Protective term product is only 10 or 20 year term and the discount only applies in the first 5 policy years. The premium you pay will increase starting in year 6.

Costco Protective term also offers a poor conversion or automatic exchange option on these 10 and 20 year products.

If you are really in excellent health, with no other underwriting issues, and only care about getting the absolute lowest initial cost on term, then Costco Protective term may be all you need.

You'll get what you get with Costco Protective Term...so don't get upset!

Without an independent agent to help you, there's no way you can know if Costco Protective term life or another carriers term products may be better for you...

And you'll have no negotiating room to try for better offer when dealing through Costco, if you don't originally qualify for rate you're expecting...this is a common occurrence!!

And you won't have an (unbiased) agent to rely on when you need to discuss anything regarding your policy.

And having to call the home office customer service department for help- ughh, don't you hate waiting and going through all voicemail prompts, and then getting routed to wrong dept!!.

If you have any pre-existing conditions, don't bother with Costco Protective Life Term

But if you're healthy and only want cheap term insurance, then the Costsco 10 or 20 year term products may be a good fit for you!

Click here if you'd like Costco Protective term life insurance quotes

Bottom Line on Protective Life

With fully customizable and guaranteed life insurance policies and great financial strength, Protective Life is always a “player”.

Whether you want term life or a cash value life insurance option, Protective may be the best insurance company for you.

We will figure out if they are or are not the best for you and we will quote you alternative company’s rates that may be better for you than Protective.

We'll compare Protective To All Other Companies For You

At the same time we will also email you rates from other life insurance companies that may be better for you.

We'll compare the Protective Life quote for you to other companies, like Banner Life, American General/AIG, Pacific Life, Principal Life, North American Company, American National, Prudential, Lincoln National Life, John Hancock, Mutual of Omaha, Thrivent Financial and any others that may offer you a better rate and/or value.

Click here to email us if with any questions/concerns, or click on the secure link below to get an accurate Protective Life online quote or simply call us at 1-800-380-3533 if you’d prefer to speak with us and better protect your loved ones today!!