Thrivent Life Insurance Company, also known as Thrivent Financial or Thrivent Lutheran Life Insurance is a Christian fraternal organization that currently offers some of the lowest term life insurance rates in the industry.

Thrivent also offers Whole Life and Universal Life insurance, in addition to Long Term Care insurance...but their term rates are there most competitively priced product when compared to other carriers.

With some of the best financial ratings in the life insurance industry, A++ Superior with AM Best, they are a carrier to consider when shopping for term life.

We'll get into their term insurance rates and underwriting criteria below and we can state with 100% certainty that they are an unusual company, but Thrivent has some of the best underwriters we've encountered...Page and Rebecca are awesome!!!

Thrivent Financial a rather unusual carrier

You must sign form stating you have some Christian affiliation to buy their products. This can be through marriage or by any other Christian affiliation. You do NOT have to go to church or show any proof of the affiliation, you only need to sign form.

They are only carrier we're aware of that on approval requires payment and statement of good health before they'll issue the actual policy.

There is a 30 day free look period after receipt of the policy for which you can return policy and get a 100% refund of premium if you decide you do not want the policy for ANY reason.

Thrivent offers an electronic application to apply, but currently offer no electronic delivery of policies and they don't accept Docusign or other electronic signatures which we find to be frustrating.

Thrivent Term Life Insurance

Most people don't seem to care much about Thrivent's peculiarities after seeing their term life rates.

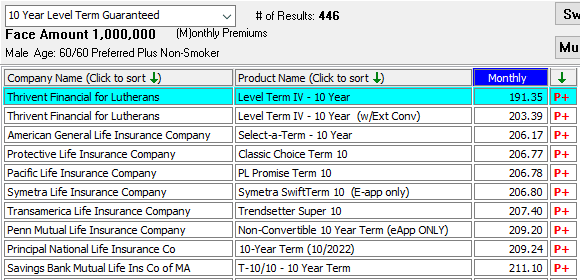

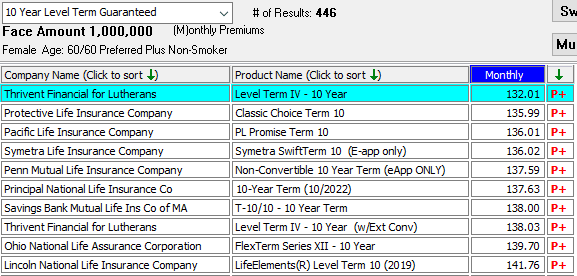

If you're in good health around age 60 looking for up to $1,000,000 of term life, then Thrivent often cannot be beat in price by American General, Banner Life, Penn Mutual, Pacific Life, Protective Life or the other competitive term carriers.

Check out Thrivent $1 million 10 year term rates below for male and female age 60 in excellent health:

As you can see above, Thrivent can offer some of the lowest term rates to some people, but not all!

There are two different Thrivent Life insurance rates in each category above as the lower is only convertible for first 5 policy years, whereas the slightly higher rates include an extended conversion option for full level premium term period up to age 70, whichever comes first.

Thrivent does also have fairly liberal height/weight guidelines, which are even more liberal for ages 61-75...so if you are even borderline overweight they can be very competitive.

Most of their guidelines are more liberal for ages 61-75, so their term life insurance for seniors can also be the best available to many seniors.

Thrivent used to sponsor a NASCAR racing team and have made excellent offers to some life insurance for race car drivers whether amateur or professional.

Like I mentioned above, they do have some great underwriters that are willing to discuss cases and they have improved on initial offers a number of times.

Thrivent Whole Life Insurance

Thrivent does not publish their dividend paying history on their Whole Life product, like the other competitive Whole Life carriers do (see below):

15-year historical dividend returns from WL policies

Mass Mutual 7.24%

Guardian 6.65%

Northwestern Mutual 6.51%

Penn Mutual 6.26%

Highest dividend does not always equate to the best product for you, as there are other variables involved.

Out of curiosity, we compared Thrivent whole life insurance to Mass Mutual, Guardian Life and Penn Mutual whole life products.

Below are the whole life values by paying the identical premium into each product at various ages for males and females.

We're showing the initial face amount, the guaranteed cash value and projected (non-guaranteed) cash value in policy year 15 based on dividends used to buy paid up additional insurance.

Important: These are all values based on best rate classification (i.e. excellent health, no underwriting issues), using each carriers lifetime pay product that is current as of 2023.

Thrivent Whole Life Illustrations

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Male 40 | $733 | $500,044 | $93,500 | $142,177 |

Male 50 | $1092 | $500,001 | $136,500 | $215,473 |

Male 60 | $1580 | $500,001 | $196,000 | $305,825 |

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Female 40 | $659 | $500,003 | $86,000 | $127,513 |

Female 50 | $978 | $500,002 | $124,500 | $191,288 |

Female 60 | $1400 | $500,001 | $182,500 | $270,096 |

Mass Mutual Whole Life Illustrations

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Male 40 | $733 | $519,362 | $91,501 | $130,092 |

Male 50 | $1092 | $505,015 | $132,245 | $190,855 |

Male 60 | $1580 | $438,273 | $163,493 | $268,411 |

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Female 40 | $659 | $560,507 | $93,728 | $117,501 |

Female 50 | $978 | $531,543 | $130,271 | $171,824 |

Female 60 | $1400 | $454,474 | $158,811 | $240,750 |

The Guardian Whole Life Illustrations

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Male 40 | $733 | $599,192 | $101,126 | $129,801 |

Male 50 | $1092 | $617,707 | $158,213 | $191,177 |

Male 60 | $1580 | $564,973 | $207,238 | $254,677 |

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Female 40 | $659 | $588,575 | $94,331 | $116,600 |

Female 50 | $978 | $604,127 | $144,362 | $172,524 |

Female 60 | $1400 | $548,620 | $187,853 | $233,794 |

Penn Mutual Whole Life Illustrations

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Male 40 | $733 | $548,003 | $111.223 | $147,823 |

Male 50 | $1092 | $547,758 | $158,768 | $216,655 |

Male 60 | $1580 | $480,652 | $192,030 | $288,669 |

monthly payment | initial face amount | guaranteed CV year 15 | projected CV year 15 | |

|---|---|---|---|---|

Female 40 | $659 | $559,646 | $108,381 | $134,388 |

Female 50 | $978 | $552,817 | $150,648 | $195,745 |

Female 60 | $1400 | $483,271 | $181,507 | $259,700 |

Result of Whole Life Insurance Comparison

It's complicated to compare. I'd also be hesitant to rely on "projected" non-guaranteed values.

All of the carriers above are of the highest quality which you want in a participating or dividend paying whole life product.

If you are a Christian and want to support Thrivent, they're a great company and could offer you the best whole life value depending on your exact health history and what you're looking for in a whole life insurance product.

If you're in your 40's or 50's and healthy and looking for highest cash value product, then Penn Mutual may be best for you.

If you're looking for the highest face amount that you can get for your payment and you're in good health, then Guardian Life may be best.

Even though they have a history of paying some of the highest dividends, Mass Mutual may not be absolute best product for you even though they're a great carrier with some of the highest dividends.

If you have any type of underwriting issues...cholesterol, overweight, diabetic, heart patient, etc., then we would really need to shop with all of the carriers above and more to find the absolute best whole life rate for you as every carrier can underwrite very differently!!

Thrivent Universal Life Insurance

Thrivent life insurance company does not currently offer the most popular Indexed Universal Life (IUL) or Guaranteed Universal Life (GUL) products.

Thrivent only offers a current assumption Universal Life, which is the least popular of the Universal Life types of coverage.

Thrivent's UL coverage does not offer the potential of higher interest rate crediting in and IUL or the guarantees of a GUL, but their UL is much less expensive than their Whole Life product.

Thrivent will currently allow their term policy holders to convert to either their Whole Life or Universal Life product, which can be a benefit for those with health issues and who would like to maintain some life insurance after their term period ends.

Bottom Line- Thrivent Life Insurance Company

If you're not willing to sign form stating you have a Christian affiliation, then don't apply to Thrivent.

They have great term life insurance rates, underwriters and a few niches that can make them better in underwriting for some people.

Best thing to do if you may be interested in applying to Thrivent life insurance for term life, whole life or universal life is to get a quote. Click the button above to get an accurate quote and at same time we'll compare to all other carriers that may be better for you than Thrivent.

We'll provide you with pros and cons of Thrivent and others and then you can make the decision that's best for you!!

We're happy to help you! Feel free to call or text 800-380-3533 or click here to email for more information.