If you need life insurance and have asthma, you need to make sure you apply to the best life insurance companies for asthma or you may be unpleasantly surprised by the rates you're offered.

Many life insurance companies will put all asthmatics that take medication for asthma in their Regular or Standard rate category, at best...

This is ridiculous and you need to make sure you avoid these companies.

If you have more severe asthma, with regular hospitalizations and ER visits, or if you have asthma and you smoke, then you could be "rated for life insurance" and charged an additional premium.

You need to shop around, or let us shop for you

Not everyone with Asthma should be lumped together, like some insurance companies seem to do.

There are a handful of insurance companies that will offer their best Preferred Plus or Preferred rates to well controlled asthmatics that have had no recent hospitalizations or ER visits due to asthma and the asthma is well controlled with one medication.

If you are rated, there are several carriers that offer significantly better table ratings than other companies!

Does asthma affect life insurance rates?

Yes, it will with most life insurance carriers.

According to the Asthma and Allergy Foundation of America, 3,524 people died from asthma in 2019!

Getting life insurance with asthma at the best rate possible can be easy, if you deal with the right agent or broker, and if they have a system to shop your case to many companies by getting real offers!

Some important things we'll need to know to determine which life insurance companies and rates may be best for you are:

- 1When were you diagnosed with Asthma?

- 2What medications, including inhalers, do you take and how often (daily or as needed)?

- 3Is your asthma seasonal or allergy related?

- 4Have you ever been hospitalized or to the emergency room for an asthma attack? If yes, when and how many times?

- 5Do you smoke cigarettes or use other inhaled tobacco (cigars, pipe, etc.)?

- 6Do you have any other health issues?

If your health is good otherwise and your asthma is well controlled then you may be able to qualify for Preferred Plus or Preferred rates with some of the better insurance companies for asthma.

Even if your asthma is more severe and you've had hospitalizations and ER visits for the asthma, there are still better insurance companies for you.

Which life insurance companies are better for people with asthma

If you have occasional, seasonal asthma or if it shows up only when you have a cold and you use occasional inhaler or other medication, there are more carriers than even those below that may offer you Preferred Plus or Preferred rates.

If you do use daily medication, especially steroid inhalers, and/or if you have regular asthma symptoms, this is when most carriers will offer Standard rates at best...

Carriers that may offer Preferred Plus, Preferred or better than Standard rates more often than the others are:

There are a lot of underwriting variables that all carriers take into consideration when underwriting asthmatics...things like driving record, family history, height/weight, other health and non-health related issues, all get taken into consideration.

So every case really needs to be shopped thoroughly to ALL the carriers above and many more to ensure you really get the best offer!

What life insurance carriers look for in asthma sufferers?

The underwriters want to see your asthma has been stable with no recent ER visits or emergency visits to your doctor...

The less frequently you have attacks, the better.

The less the number of medications you require for your asthma, the better for life insurance underwriting purposes also.

Below are details on how one of the most aggressive carriers for asthma determines the rate classification they'll offer you and their description of mild, moderate and severe asthma:

Mild Asthma- Infrequent short, not incapacitating attacks; lungs clear between attacks; ongoing regular medication not required. Preferred categories possible.

Moderate Asthma- More severe attacks; requiring regular medication; there may be slight wheezing on examination; Oral steroid treatment given less than once a year. Standard Plus to Standard categories possible.

Severe Asthma- Prolonged, frequently disabling attacks for periods of more than 24 hours; requiring frequent medication; and/or attacks which require ER visit or hospitalization. Standard to Table Ratings possible, also possibility of decline in more severe cases.

How does coronavirus and asthma affect life insurance?

Insurance carriers are taking greatly different stances on the coronavirus in underwriting now...

Some are way more liberal than others!

That being said, if you have NOT been vaccinated and have severe asthma or other conditions like obesity or heart disease that could result in bad outcome if you get COVID 19, more carriers will either charge you more or possibly decline you now.

How do we get asthmatics best rate?

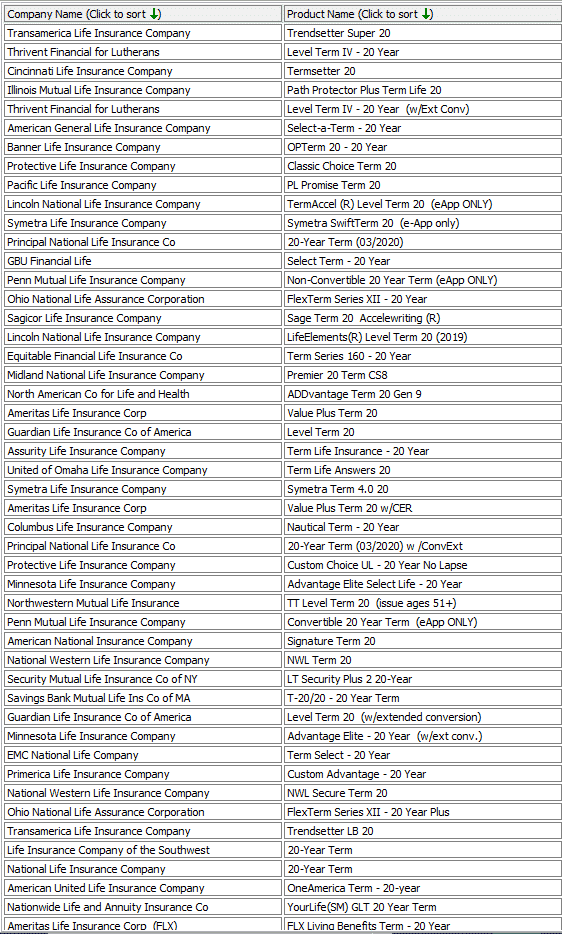

First we review our database of rates to narrow down best carriers for you...see screen shot below of top 48 twenty year term carriers when I input my age:

We'll make preliminary inquires and then get real offers

We have underwriting contacts at every carrier that we'll contact to get preliminary quotes to narrow down which could make you best offers.

We'll quote you best preliminary offers and can then have you easily apply to the best carriers for you if the preliminary quotes are acceptable to you.

We'll negotiate for best offers after underwriting's complete and you can decide to accept or not, after you have chance to review the actual policy.

Bottom Line- life insurance for asthmatics

Whether you have mild, moderate or severe asthma, how many and what type of medications you use and how often you need medication will all be factors in determining your cost.

Let us know if we can help, and feel free to call or text us at 800-380-3533, click here to email us or simply click on the accurate asthma quote button above, complete the questionnaire and we'll send you quotes !