Banner Life Term Life Insurance Company

Banner Life is owned by Legal & General America, which has been in existence since 1836. With an A+ (Superior) AM Best financial strength rating, Banner is one of the best term life insurance companies that offer some of the lowest term policies in America today!

Banner is known as William Penn Life in the State of New York, but with same rates and products available in New York as the other States including the District of Columbia.

Down below, we've provided info on all of the good and bad aspects of Banner Life term insurance.

Banner Life No Exam Life Insurance

You can buy up to $2,000,000 of Banner Life insurance products without a medical exam up to age 60, as long as you have had a checkup and blood test with your own doctor within past 18 months.

Banner Life coverage is available at higher amounts than $2 Million but they may require an insurance exam.

We compare quotes using our database of rates from 100's of quality life insurance carriers to find you the best rate and value!!!

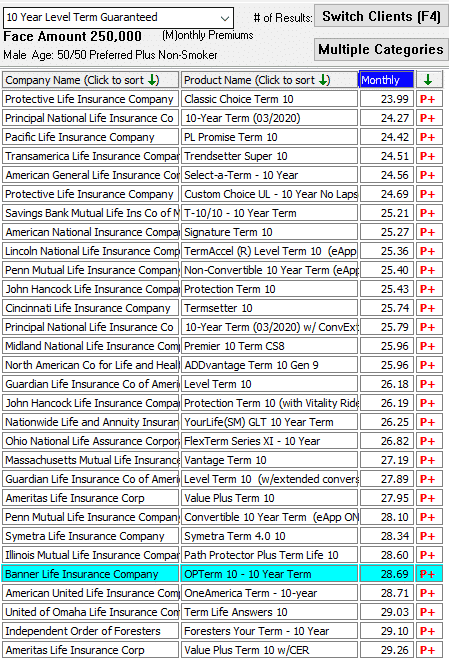

See snap shot below of our database with $250,000- 10 year term rates for a 50 year old male in good health...just to give you an idea of some of the top rated carriers we'll shop with on your behalf:

Banners 10 term is where they are least competitive, as you can see above...

We place a lot of business with Banner Life and all of their major competitors, including American General/AIG, Cincinnati Life, Pacific Life, Principal Life, Protective Life, Prudential, SBLI, Thrivent Financial, American National, United of Omaha, Lincoln Financial, John Hancock and the list goes on and on…

Banner Life does have some of the best insurance underwriters in the business (shout out to Alan S, Debbie P and Becky S - you are awesome!) and Banner Life always needs to be considered on every term insurance case.

If you'd like to use one of the exact databases we use to see Banner Life's and ALL other competitive companies rates available to you, at ALL rate classifications including table ratings, click link below:

CLICK HERE TO VIEW INSTANT QUOTES FROM ALL CARRIERS

If you want an accurate quote and to find out whether Banner Life or another carrier may be better for you, click on link below and we'll email you details:

Banner Life Insurance with preexisting conditions

Some areas where Banners underwriting really “shines”…

- Diabetes Life Insurance cases, later age onset type 1 or 2

- Some cancer cases

- All heart and cardiac related cases

- Anxiety and Depression

- Sleep Apnea

- Asthma

- Overweight

- Cholesterol and Blood Pressure with medication

- Family History of Cancer

- Tobacco Users

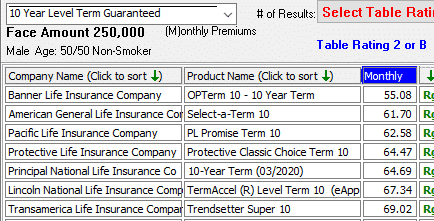

Banner Life also has an unusual table rating structure which bases ratings off of their Standard Plus rate class. This gives them an advantage over most of the competition when it comes to underwriting tougher cases.

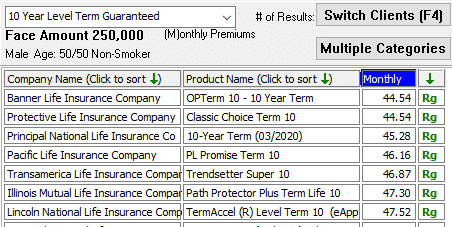

For example, if you can qualify for a standard or a table 2 rating (i.e. average to slightly below average health), check out snap shot below of both Standard/Regular (Rg) and Table 2 rates for Banner and their competition. Also showing $250k- 10 year rates for 50 year old male:

Banner term life insurance is never going to be the best offer for every medical condition, so we’ve developed a system to ensure our clients get the absolute best rate possible every time by getting multiple real offers on tougher cases!

DON'T make the mistake of believing every carrier will rate you the same way!!

Banner Life vs American General vs Protective Life

The ongoing battle of term life supremacy between Banner Life, American General, Protective Life and all the others can be entertaining to watch.

Banner lowers premiums and then so does American General, and then Protective does same.

American General reduces their monthly modal factor so that their monthly rates show up a little lower than Banner's or Protective's.

Banner adds a 25 year term plan to mimic American General.

American General started offering 35 year term and then Banner Life and Protective Life started offering 35 and 40 year term!

So which company's better?

Whose Better, Banner Life, American General, Protective?

That depends on your health and other history and what is most important to you...

For example, do you care more about absolute lowest rate or getting the best value, or both?

Some of the time Banner Life makes best offer and some of the time American General, Protective, Principal, Pacific Life or another carrier altogether makes a better offer...

Protective offers a product with a much better conversion or automatic extension option than both American General and Banner...this would be important if you need/want any portion of longer duration coverage later.

Next week though, it's always possible that Banner or American General could improve their conversion option in this never ending battle!

Banner Life Living Benefits

The only living benefits that Banner Life currently offers is for terminal illness.

This means that if you're diagnosed with a terminal illness you can accelerate getting a portion of your life insurance amount prior to your death...most insurance companies offer this benefit nowadays.

Banner Life does not currently offer the better chronic illness or critical illness accelerated death benefit rider or "living benefits" that American National, Ameritas, American General/Corebridge(QOL), North American Co. for Life & Health, Columbus Life, National Life and some others currently offer on their term products.

If chronic and critical illness accelerated death benefits are important to you, the carriers above could end up costing only a little more, or possibly less than what Banner may offer you.

Banner Life to Ladder Your Insurance

If you want to buy more than one policy at varying durations (i.e. one 20 year term and one 30 year term), then Banner Life will rarely be beat on price.

The reason Banner is usually best in this scenario is they will only charge their $90 policy fee on one of your policies.

Buy 2 policies save $90, buy 3 policies and save $180

All life insurance companies have a policy fee built into their rates. So most insurance companies will have their policy fee built into the premium payment of each policy you buy.

Banner Life waives their policy fee on your 2nd, 3rd or any additional term life policies you buy from them on your own life.

Banner Life is the only company that is doing this right now!

The Negative About Banner Life Term Insurance

While Banner Life is a great company and can sometimes offer the lowest term insurance rates in the country, they are not the "perfect" term life insurance product.

As mentioned above, Banner Life does not offer the better term life insurance with chronic and critical illness accelerated living benefits.

Banner only allows you to convert (or automatically extend) to their very expensive life step universal life product which is over-priced compared to what some other term carriers offer for conversion.

This expensive conversion could be an issue if you wanted to extend your life insurance later, but have developed more significant health issues which could preclude you from qualifying for new life coverage or may result in a higher rate than what the conversion would cost.

Banner Not Competitive for Universal Life

While Banner does offer both term and Universal Life insurance, with their life step UL product providing lifetime coverage and cash value, their term life insurance product line is where they are most competitive.

For example, Banner Life's BEST Guaranteed Universal Life rate for $250,000 for 50 year old male in good health and that is guaranteed for life is $385 per month.

Whereas the absolute lowest $250k- lifetime guaranteed level rate is $203 per month.

Click here to email us if you have any questions about or if you need more information about Banner Life.

At same time we email you with the Banner Life quote, we'll send you quotes for other insurance companies that may make you a better offer or provide better value.

Lowest Term Rates Not Always Best

If you request a quote, we'll compare products offered by Banner Life and we'll also show you the absolute lowest rates available and the better value rates with the chronic/critical living benefits and/or the best conversion option.

If the difference between term cost is close, you may want the peace of mind of getting the best living benefits or accelerated death benefit rider and a better conversion option on your term life insurance coverage!

Is Banner Life Insurance Company Good?

Sometimes!

They are one of the few companies offering 40 year level premium term right now.

If you want more than one life insurance policies at varying amounts or term lengths, Banner Life may not be beat on price.

If you have any preexisting conditions, get a quote from Banner Life, and remember they place table ratings on a better rate classification than most other companies.

Banner Life Insurance Company should at least be considered by everyone seeking the most affordable term life insurance and Banner can offer life insurance for diabetics at a great rate.

Is Banner Life Best for You?

Click Here to email us, call or text us at 800-380-3533 if you have any questions or need additional information or simply click on red button above/below if you’d like an accurate quote from Banner Life to see what they'll offer you to protect your loved ones.

At the same time we will review rates available to you from other companies that may make you a better offer/value than Banner and we'll send you their quotes also.

If you'd like to check out all rates/products offered by Banner Life or just want to compare all of the best life insurance products offered without any licensed agent involvement, you can use this quoting tool link by clicking here to see what all life insurance companies may offer you.