Cincinnati Life Insurance Company was founded in 1950 and may just be the best of the "not so well known" life insurance companies.

Click on the secure link below to get a Cincinnati Life Insurance quote or simply use the quoting tool to the right to check out their rates along with the other competitive insurers.

Most people are probably not familiar with Cincinnati Life, but with an A+ Superior AM Best financial rating and being in business since 1950, they are a company that offers some great term and permanent life insurance policies.

They may end up being one of the best life insurance companies in the U.S. for you, with great underwriters that are easy to talk to (thanks Gary and Stacey) and that have gone out of there way to make great offers on our cases.

When Cincinnati Life is competitive

Cincinnati Life bases age on "last birthday”, whereas most other life insurance companies base age on nearest birthday.

In other words, most life insurance companies will consider you to be the next older age when you are within 6 months of your next birthday.

Cincinnati Life's age last birthday calculation can result in a lower rate for you.

Cincinnati Life is Great for Non-Cigarette Tobacco users

If you are an alternate tobacco or nicotine user (i.e. you use cigars, pipe, snuff, chew, gum, patch) and have not used cigarettes in the past, Cincinnati Life will give you a non-tobacco rate and can almost never be beaten on price.

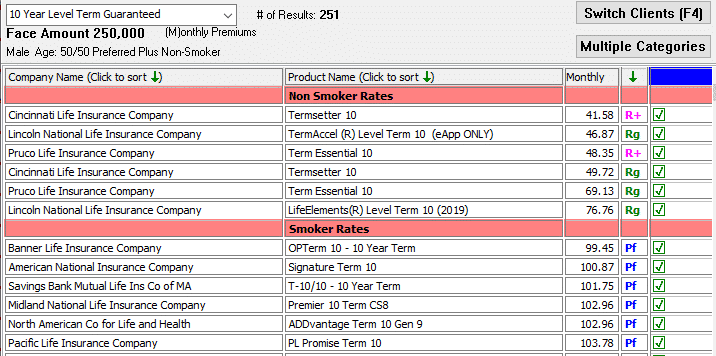

Check out screen shot below of Cincinnati Life's best non-tobacco rates compared to the other carriers that are non-cigarette tobacco friendly...

These are $250,000- 10 year term rates to a 50 year old male who uses daily tobacco or nicotine, but not cigarettes:

Cincinnati Life term as low as $25,000

Cincinnati Life offers term life insurance at amounts as low as $25,000 and they should always be considered at this small amount.

They're not always absolute lowest cost at low face amounts, but they may make best offer to you...

We'll compare Cincinnati Life's rates to all the other carriers available to you.

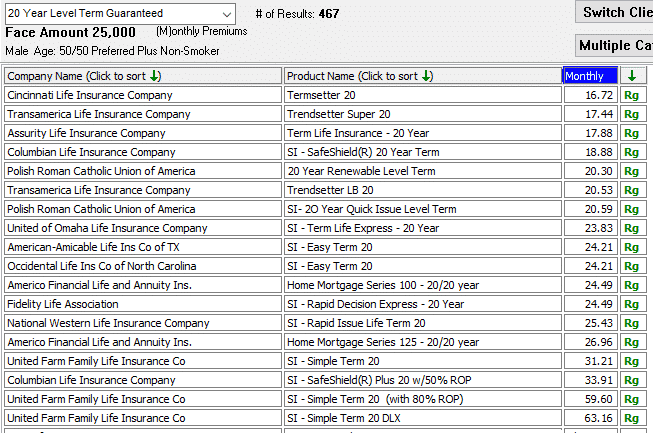

Check out screenshot below of best $25,000- 20 year term "standard" rates to 50 year old male:

Cincinnati Life Return of Premium Term

Cincinnati Life has some of the best Return of Premium (ROP) term life insurance rates available.

At the end of your term, you would get 100% of premiums paid into policy back as a refund...

You could also get a partial refund of premiums or a paid up policy at a reduced amount if you cancel your policy or decide to no longer make premium payments after policy year 6 but prior to the end of the term.

Check out these Cincinnati Life best case $100,000- 30 year Return of Premium monthly term rates for males and females age 30, 40 and 50:

Male 30: $37 Female 30: $31

Male 40: $54 Female 40: $47

Male 50: $112 Female 50: $93

Cincinnati Life guaranteed whole life insurance

Cincinnati Life has one of the best and lowest cost non-participating whole life insurance products available.

So if you are looking for a permanent cash value policy for $10,000 or even $100,000, Cincinnati Life may just offer you the best rate.

Check out these $10,000 and $100,000 whole life monthly rates for males and females age 30- 70:

$10,000 $100,000

Male 30: $13 $65

Male 40: $16 $96

Male 50: $23 $144

Male 60: $36 $224

Male 70: $64 $387

$10,000 $100,000

Female 30: $12 $57

Female 40: $15 $84

Female 50: $21 $125

Female 60: $32 $192

Female 70: $54 $333

Cincinnati Life Universal Life insurance

Cincinnati Life does also offer two Universal Life products, LifeSetter Flex UL and Heritage UL.

LifeSetter Flex is a Guaranteed Universal Life product for which you can choose how long you'd like to maintain guaranteed coverage at a guaranteed level rate to age 90, 95 or for life.

Heritage UL is non-guaranteed Universal Life product that can be projected to provide coverage for any time you choose.

Both LifeSetter Flex UL and Heritage UL include chronic illness living benefits, so that you could access a portion of the life insurance if you're diagnosed with a chronic illness for which you'd need ongoing care.

Neither of these UL products are very competitively priced right now, unless you're a regular non-cigarette tobacco user.

If you are an alternate tobacco user and want permanent life insurance, then get a quote today!!

Bottom Line- Cincinnati Life insurance company

While Cincinnati Life is far from a well known insurance company, they are a great company that could possibly offer you the best price on term life, UL or a guaranteed whole life insurance policy with cash value.

Call or text us at 800-380-3533, Click Here to email us or just click on the secure link above to get an accurate Cincinnati Life insurance company quote.

At the same time we will review and then email you quotes from Cincinnati Life's biggest competitors including Prudential, Lincoln National, John Hancock, United of Omaha, Ohio National, Columbus Life, Transamerica, American General, Lafayette Life, United Home Life, Assurity Life and all others that may be better for you.