A proper component in a solid business continuation plan is arranging for succession planning in the event of the death of one of the primary partners in a business.

A life insurance funded buy sell agreement is the perfect tool for any business partners.

The very (very!) basic problem

The simplest case would be two equal partners in a business, each owning 50% of the company.

In the event of the death of one of the partners, their ownership would probably pass through to their estate or the spouse of the deceased partner.

The surviving partner is now in business with their partner's spouse, and the surviving spouse is now charged with trying to unload ownership in a company at fire sale prices.

As the surviving owner, how do you protect your business?

Buy Sell agreement life insurance as solution

Enter what is often called a buy sell agreement.

A business succession agreement is put into place that requires the remaining owner to purchase the deceased owners shares from the deceased owner's spouse or heirs.

In the same agreement, the spouse agrees to sell their ownership at a previously agreed upon price.

Great! In the event one of the partners dies, the remaining partner automatically gets complete ownership of the company and the surviving spouse gets paid a fair market value for their ownership in the company without any headaches.

How to pay for this buy-sell agreement?

The next problem in this arrangement is how is the remaining owner going to make sure they can afford to buy out the spouse? The answer lies with life insurance.

Each owner purchases life insurance on the life of the other partner, which is also referred to as a cross purchase plan.

You can also do a stock redemption agreement for which the corporation would be the owner and beneficiary of policy. Then the corporation is obligated to redeem the deceased owners shares to the surviving spouse or heirs.

Life Insurance Used to Buy Out Spouse or Heirs

When one owner dies, assurances are put in place that any insurance proceeds or death benefit must be used to buy out the surviving spouse or heirs.

Now in the event of the death of a partner, the insurance company pays the remaining partner the life insurance death benefit. The surviving spouse sells their ownership in the company to the remaining partner, who uses the life insurance to pay for it.

Be cautious! The above information is only a very simple concept outline of how you might start to structure such an agreement.

You will need to have a competent attorney to draft the agreement and a knowledgeable accountant to handle valuation of the company as well as tax issues surrounding the insurance premium and death benefit. And of course an experienced life insurance broker to help tie this all together with an inexpensive insurance product.

Buy-Sell Life Insurance with Chronic & Critical Benefits

The "latest and greatest" life insurance with chronic illness rider and/or critical illness benefits is also a great option for buy-sell agreements.

Premature death is never the only reason you may need to sell your portion of the business...

What if you can no longer work and need to sell your business due to a chronic illness or if you suffer a heart attack, cancer, or another critical illness and can't work for a long period of time?

Buying a life insurance policy that includes chronic illness or long-term care and critical illness living benefits could be the perfect solution, as these could also pay a claim to the policy owner when the partner needs to sell as a result of a chronic or critical illness.

Buy-Sell life insurance as a business plan

Buy sell agreement is an important part of many companies’ business plans, as it specifies what will happen if an owner passes away.

In general, inheritance laws state that the deceased’s ownership interests automatically pass through the line of succession—most commonly to a living spouse or adult child when the co-owner dies.

Yet this can wreak havoc on a business if the inheritor is not prepared to take on an active ownership role.

Do you want to be in business with partner's spouse?

Most owners will NOT want to be in business with the departed owners spouse or adult children!

A buy sell agreement states that on the death of one owner, the other(s) will buy out that partner’s successor.

To ensure that the cash is available for this buyout, it is often funded through life insurance purchased by the company.

The death benefit goes to the deceased’s successor, and that portion of ownership is transferred to the remaining owners.

Don't pay more than you have to!

While you could purchase universal life insurance or other types of permanent life insurance, buying an inexpensive 10, 15, 20 or 30 year term plan is often the best and most economical solution when funding a buy sell agreement with life insurance.

Just try to make sure the life insurance company you choose has a good conversion option, i.e. from companies like Columbus Life, Mutual of Omaha, North American Company for Life & Health, Pacific Life, Protective Life, Penn Mutual, Principal Life, Prudential, Thrivent Financial...

In case you may need longer coverage later, or so you could potentially sell the policy via a life settlement at the end of the term or when the buy sell life insurance is no longer needed.

Sample Buy Sell life insurance rates

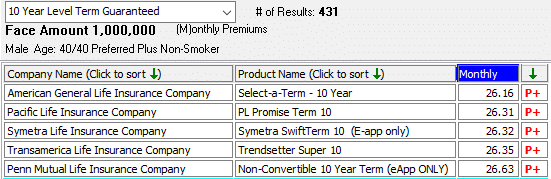

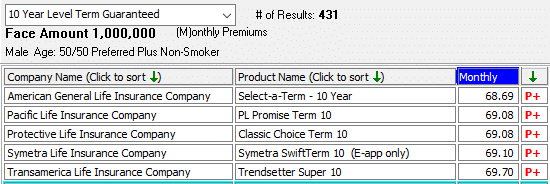

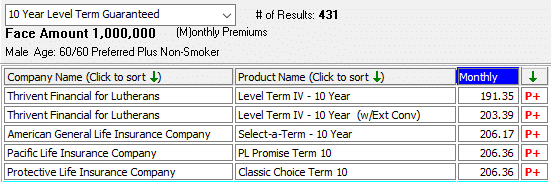

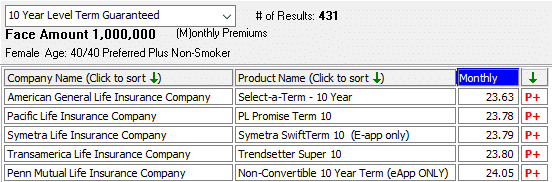

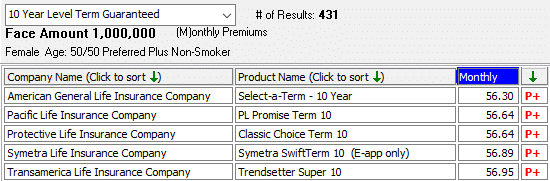

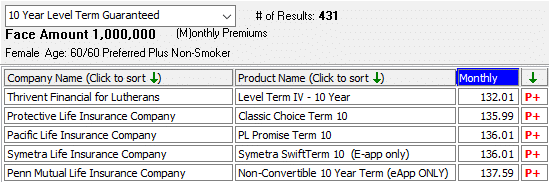

Below are the best $1,000,000- 10 year term rates for males and females ages 40, 50 and 60 so you can see how affordable life insurance can be:

Male Rates $1,000,000 ages 40, 50 and 60:

Female Rates $1,000,000 ages 40, 50 and 60:

Convertible term insurance great solution for Buy-Sell

All rates are based on age and health, so buy the longest duration plan you may need/want while you're younger. If you have any preexisting conditions, that's no problem as we shop tougher cases all the time.

Since 1969 we have been helping business owners to fund their buy-sell agreements, insure key persons, help with life insurance for SBA loan and help with other business life insurance matters.

We can help whether you want term life or any type of permanent life insurance...

We can offer you no medical exam term life or cash value permanent life insurance and every product in between...get a life insurance quote today using the orange quote button above.

If you need life insurance to fund buysell agreement, call or text us at 800-380-3533 or simply email us if you have questions or need any more information. We will help you to obtain the best rate and value!!