You need life insurance for an SBA loan. That's no problem, but how do you get the best rate and coverage to fit your specific need?

How do you also know you'll get approved fast at best best rate and type of insurance to suit your lender's life insurance requirement?

There's close to 1,000 life insurance carriers that offer insurance in the United States, but only about 100 of these will offer the best rates and products for the general population.

The number of insurance companies gets smaller if you're only looking for a level term insurance policy to cover the SBA loan balance.

Life insurance is usually required for an SBA loan

If you don't care about getting the most affordable life insurance and the best value, then you could call local life insurance agents in your town or just buy from the first website that shows up when you google "need life insurance for an SBA loan"...but this may not be best!

If you need the life insurance "yesterday", then you may want to apply for an instant approval life insurance policy.

Beware of possible issues and read our SBA loan life insurance guide below which will save you both time and money when you need to secure life insurance for any business loan life insurance amount you need.

Term life insurance for SBA loan

Since the policy will serve as collateral for the loan in the event of your premature death, then a term life insurance policy to provide coverage for the full duration of your loan should suffice.

Definitely check with your lender to find out the exact amount and duration of life insurance they'll require you to have.

You can buy term insurance for any duration from 1 year to 40 years. The longer the premium is guaranteed to remain level, the more expensive the insurance will be.

Term life is the most inexpensive type of life insurance

Nowadays, you can even buy term life insurance policies that can pay out while you're living if you suffer a chronic or critical illness...

These living benefits could help you to continue to pay off your loan if you are unable to work due to a chronic or critical illness like a heart attach, stroke, cancer.

Below are $1,000,000- 10 year to 40 year guaranteed level monthly rates for males and females from ages 30 to 60. Showing absolute lowest Preferred Plus rates for people in excellent health to higher Standard/Regular rates for people in average to below average health.

$1,000,000 | 10 Year | 20 Year | 30 Year | 40 Year |

|---|---|---|---|---|

Male 30 | $18 - $43 | $29 - $59 | $51 - $96 | $101 - $173 |

Male 40 | $26 - $61 | $49 - $99 | $92 - $173 | $219 - $323 |

Male 50 | $69 - $151 | $129 - $242 | $238 - $448 | $584 - $741 |

Male 60 | $191 - $356 | $381 - $703 | $935 - $1179 | $1185 - $1474 |

$1,000,000 | 10 Year | 20 Year | 30 Year | 40 Year |

|---|---|---|---|---|

Female 30 | $15 - $34 | $23 - $48 | $39 - $73 | $72 - $134 |

Female 40 | $24 - $52 | $41 - $78 | $72 - $133 | $174 - $261 |

Female 50 | $57 - $112 | $95 - $181 | $178- $325 | $487 - $598 |

Female 60 | $132 - $221 | $264 - $472 | $757 - $937 | $1021 - $1213 |

Rates at $500,000 would cost half as much as rates above.

Rates at $250,000 would cost 1/4th as much as rates above.

Full disclosure- Some of the 30 and 40 year rates above are Guaranteed Universal Life rates for when term life was not available due to age and duration of coverage.

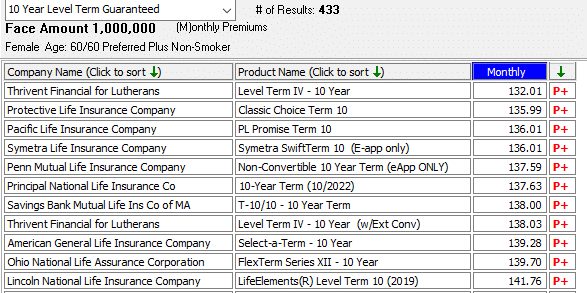

Below are sample $1,000,000- 10 year term rates for females age 60, so that you can see some of the best carriers available:

Cost of life insurance to cover short term loan

Unless you may need the life insurance for another purpose after the loan is paid off, than you may want to purchase the most inexpensive plan that covers the duration of the loan and that suits the requirement of the lender.

If you plan on paying off the loan over the next few years, then buying an annual renewable term policy or one year term could be best.

If you're going to need the insurance for more than a few years, then buying a 10 year or longer duration term may the best option.

Below are some $1,000,000- Annual Renewable Term (ART) or 1 year term rates by age for males/females. These are monthly range of cost rates and assume very good health to average/slightly below average health:

ART or 1 Year Term

Male 30: $20 - $42

Male 40: $26 - $46

Male 50: $54 - $107

Male 60: $109 - $261

Female 30: $13 - $30

Female 40: $20 - $40

Female 50: $48 - $70

Female 60: $99 - $165

FYI- IMPORTANT to remember that if you may need the insurance for longer than a few years, it won't likely make sense to buy ART or 1 year term.

Problem buying life insurance for SBA loan

If you deal with the wrong independent agent, broker, or insurance company, it could take months for you to receive your policy.

You may also only qualify for a significantly higher rate than you're expecting, since you have to remember that ANY agent can quote you ANY rate whether it's accurate or not.

If you have health issues like heart problems, diabetes, or if you may be overweight, this can make qualifying even tougher.

Thousands of people are misquoted on their life insurance each month, so you want to make sure you don't get stuck paying much more than you have to for the amount of coverage you need.

Being incorrectly quoted up front is a big problem

There is an easy fix if you qualify for a higher rate than you're expecting and your agent is not willing to shop to get you a better offer, or if they lie to you and tell you that all insurance companies will make you a similar offer.

Find out before you apply to any company if your agent will make sure that your policy is assigned to the lender in a decent time frame after you're approved or if it is strictly up to you to make sure your policy is assigned to lender.

Dealing directly with any life insurance company can be a major hassle, going into voicemail system, getting re-routed from department to department, getting incompetent or "first day on the job" employees.

There are very few insurance companies with excellent or even good customer service nowadays.

A good independent agent or broker will handle getting the collateral assignment and other insurance requirements handled efficiently, so you don't have to deal directly with the insurance company.

How to get best insurance policy for SBA loan

The best way to describe this is to use an example of case we did for a 58 year old gentleman who needed $500,000 of 20 year term for his SBA loan.

During the first five minutes of contact with this gentleman, he answered health/avocation questions. We had a laugh that his overall health was excellent according to him, even though he eats donuts and drinks soda every day.

To compare quotes, I sent him an email with the top insurance companies available to him for $500,000 of 20 year term based on my database search of rates from 100's of different insurance companies. The lowest rate is not always the best value, so I showed him products from several different insurance companies with monthly cost as follows:

$181- $211- Cincinnati Life (Lowest Cost)

$198- $223- Columbus Life (Lowest Cost with best Critical & Chronic Illness Living Benefits)

$212- $251- Principal Life (Lowest Cost No Exam)

(Due to ongoing price war between term life companies, lowest rate right now is $158 monthly as best rate now are lower than above.)

Life Insurance Rates Are Always Changing

I usually show the two most probable best rate classifications for each company, since there is no way to know the exact rate class for which anyone will qualify until they go through underwriting.

Plus, the fact that this guy told me he eats donuts and drinks soda every day made me nervous about only quoting best rates.

This gentleman opted to apply for the lowest rate from Cincinnati Life, and we got his approval at best rate class of $181 per month within 14 days of submitting his application.

This was a quicker approval than most fully underwritten (i.e. that requires medical exam) products take, which is why I gave him the option of the "no exam" product up front. Getting the best rate was the most important factor for this client, so he was okay with getting a medical exam life insurance policy.

A Fast Approval Is Never Guaranteed

This gentleman was happy with the outcome and the fact that he got the lowest rate in the country for his life insurance. I told him to keep eating those donuts and drinking that soda, as it seems to be working for him!

After he paid for his policy, we provided him with the collateral assignment form immediately and offered to handle getting it executed ASAP by insurance company. The lender wanted to deal directly with the insurance company regarding the assignment, so I provided contact information to his lender and the lender did the rest.

Best type of life insurance for SBA loan

While you could buy any type of life insurance including Universal Life or other permanent life insurance, term life insurance is almost always the best option when the life insurance payout is required for bank loans.

So when the loan is paid off, you can cancel the term policy or use the coverage amount for other business life insurance or personal life insurance needs.

10 year term is a common life insurance requirement for SBA loan, but the term length required will be determined by the specific lender you deal with.

Level Premium Term Life Insurance Usually Best

Make sure to ask if the life insurance coverage amount is required for the entire duration of the loan or if purchasing life insurance for a lesser duration will suffice. The shorter the duration you can buy, the less expensive it will be.

IMPORTANT: Even though the loan amount will be decreasing as you pay off the loan, and there are decreasing term insurance policies available, I've never seen a case where a decreasing term life policy made sense. The reason is that all decreasing term plans I've ever seen are more expensive than the best 10 year or longer duration level term plans.

For a very short SBA loan life insurance need, you could purchase annual renewable term or increasing premium term. This is usually only best for loans that are less than 3 to 5 years.

Need life insurance right away for SBA loan

MANY lenders may not tell you that you'll need life insurance right off the bat, so then you may have to scramble to get a life insurance policy quickly before you get final loan approval!

While not always ideal or least expensive option, we have a solution to get you same day life insurance if your health is good or average or within a week or so if your health is NOT good, but the cost may be significantly more than if you have the time to go through regular underwriting for best rate and value.

Same day life insurance approval for SBA loan

Ethos or Haven Life may be the best and fastest solution if you need life insurance for SBA loan in a hurry.

Ethos and Haven Life may not provide the amount you need if you have more significant health issues.

For example, we shopped a case for a 55 year old gentleman who needed $1,000,000 of life insurance for loan right away.

He had a stent placed 20 years prior, but with no heart attack prior and great health and excellent and annual cardiac checkups since.

We quoted him some conservative rates of $281- $326 per month as a range of cost for $1 Million of 10 year term, but told him it could several weeks to get him approved as he'd have to have free exam, we'd have to obtain all medical records, we'd surely have to negotiate the offers, etc.

One Week Approval Could Cost 3 to 4 Times More!

He could not wait for the fully underwritten rates above, so we got him fast approval quotes for $1,000,000 of $839 per month with cardiac exclusion or $1,029 per month without a cardiac exclusion.

Those are some expensive rates above, partially due to his cardiac history but these fast approval rates for higher risk individual are much higher for everyone.

You can always buy the fast insurance, then cancel as soon as you have time to get better offer!

Plan accordingly and apply for life insurance right away when you need an SBA loan to avoid having to possibly WAY overpay later!

Health problems & need insurance for loan?

If you need life insurance to cover an SBA loan and have health problems, the process is basically the same as for people with no health problems.

There will be more work for the agent/broker you deal with in trying to narrow down best rates and insurance companies for you if you have health or other underwriting issues (i.e. private piloting, scuba diving, etc), so you'll really need to ask more questions of the agent/broker you're going to deal with up front before you commit to applying.

Beware Of Smooth Talking Call Center Insurance Agents

Make sure to ask the agent things like:

- "How many (fill in your health or other issue) cases do you do each year?"

- "Do you think I'll have a shot at qualifying for a Standard rate?"

- "What is the likely best case table rating I can expect to get?"

- "How many different insurance companies can you offer me?"

- "What happens if I'm declined or I only qualify for a higher rate than you quote me?

- Do you have a system to find me better offers?"

What you don't want to have happen is getting suckered into applying from that smooth talking agent who has no clue how to quote people with your particular issue and/or applying to the agent who has no system or way of placing you with a different insurance company if the first doesn't work out.

Solution for even the toughest life insurance cases

A perfect example of a tough SBA loan case I shopped recently was for a 67 year old male with Granulomatosis with polyangiitis, also known as GPA Wegener's disease, an autoimmune disorder.

This gentleman just started taking prednisone and rituximab infusion a month before contacting me so I knew most companies would decline him as the norm is you must be off medication and symptom free from the GPA Wegener's before most insurance companies may consider making offer.

This gentleman was told he had to have $250,000 of 10 year term for his loan. We shopped with every life insurance company to find him offer and the best case offer was going to be $798 per month.

Use Another Form of Collateral if You Can

That is a lot of money to pay for a 10 year term, so I also quoted him a no exam product for which he could easily qualify. A $150,000 term would cost $603 per month, or $100,000 would cost $404 per month.

He inquired with a lender to see if any lower amount of insurance would suffice, and they ultimately allowed him to use another form of collateral for his loan.

IMPORTANT: If you have more serious health issues and are told that you must have life insurance to secure your SBA loan, first try to get the lender to accept any other form of collateral for loan repayment in the event of your death. Don't pay for life insurance if you don't have to.

If you are still required to have life insurance for your loan, make sure you find an agent or broker that is highly experienced in shopping tough life insurance cases.

Bottom line on getting life insurance for loan

After you verify that the life insurance is absolutely required, remember that applying to the wrong company or through wrong agent/broker could cost you thousands and thousands of dollars over the life of your policy, or you may end up not qualifying at all.

Having to to start the process all over again with new agent or broker would be an extreme waste of time!

We've Helped Thousands of People Since 1969

If you need information on obtaining an SBA Loan or you have loan related questions, you can visit the SBA loan program website.

If you'd like to compare rates or get instant quotes, just complete the information in the accurate quote button above and we'll send you quotes ASAP.

If you'd like help in finding the best life insurance for small business loan, or any loan for that matter, please feel free to call or text us at 800-380-3533 or just click here to email us.