A common question we've gotten from people with potential underwriting issues is what information do life insurance companies have access to...

A lot of people believe that life insurance companies won’t find out about health or other issues if you just don’t admit to the issue on the insurance application or during a life insurance exam.

Whether you apply for a no exam life insurance policy or one that does require an exam, the insurance companies can do an MIB search (www.mib.com), Labpiqture analysis, pharmacy records search, they’ll get your driving history and some will use LexisNexis to search vast amounts of electronic data on everyone.

For people with medical issues, oftentimes the carriers will request medical records or they'll access electronic records directly from your doctor or medical facility.

Let's take a look at each platform that insurance companies use to gather information in more detail...

What is a MIB in life insurance?

The MIB is an insurance industry database used by most life insurance companies so the underwriters can see your past life insurance application history.

The MIB will show any medical or other issues that may have shown up on any life insurance applications you submitted over the past seven years. After seven years has passed since you last applied for life insurance, there will be no information about you on the MIB.

Some common things that show up on the MIB are recent tobacco use or substance abuse that may not have been admitted to on new application.

We’ve seen the MIB turn up almost every issue you could possibly think of which will often result in higher life insurance rates by people who think they can just apply to another company and the new company won’t find out.

MIB shows life insurance application history over past 7 years

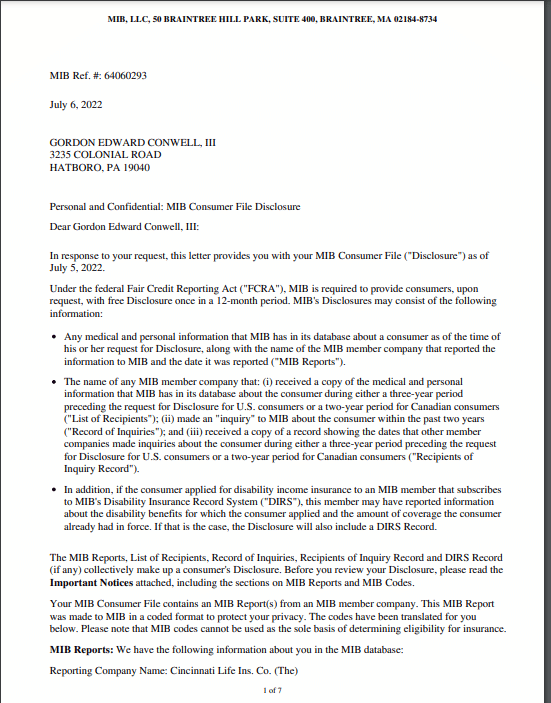

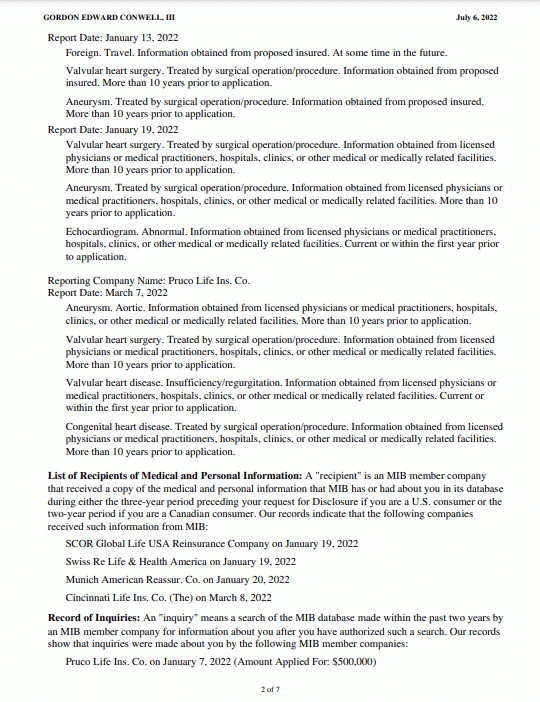

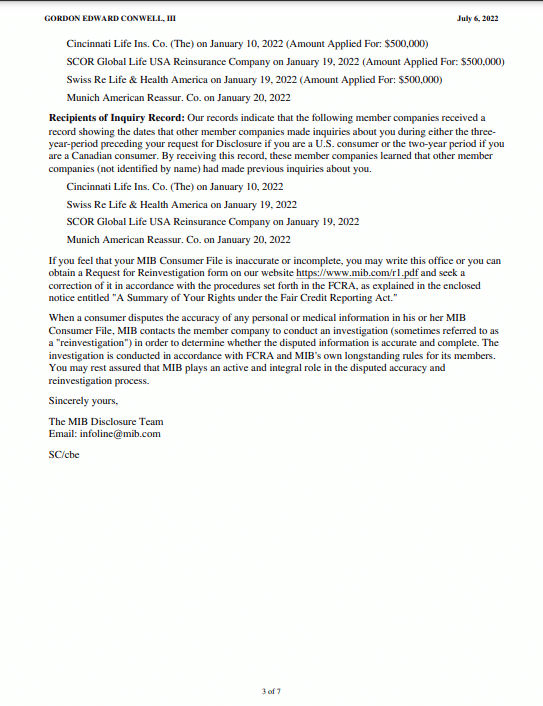

If you want to see what an MIB report looks like, check out my MIB report below:

*Nothing too exciting on my report, except for notations on top of page 2 about valvular heart surgery and aneurysm repair and that I applied to both Cincinnati Life and Prudential (Pruco).

Can an insurance company deny an individual based on MIB?

No the insurance company cannot deny you just based on the MIB alone, but you can be sure they will fully evaluate information found on the MIB.

MIB is a key database that protects insurance companies from fraud...

For example, John Doe has a cigarette the night before his insurance exam and is offered a higher tobacco rate. Then he applies to another carrier, has new exam with no nicotine and expects to get a non-tobacco rate. The new carrier will see the MIB info about nicotine and will also offer higher tobacco rate since nicotine showed up in previous 12 months, according to MIB.

What gets reported to MIB?

*Previous or exiting medical conditions.

*Prescription medications of concern.

*Hazardous occupations or avocations.

*Past alcohol or drug abuse history.

*Driving history.

*Height and weight.

*Family history.

Anything that has an underwriting implication can be listed on the MIB.

If you've been offered higher rate and you're unsure as to why, then you should obtain copy of your MIB report by going to this page on MIB and making the request.

Should only take a few days to receive via email.

What is Labpiqture

Labpiqture by Exam One is a quick and easy way for carriers to review lab results that your Dr. or another facility may have ordered.

With Quest Diagnostics and Lab Corp's extensive clinical laboratory database, insurance carriers can get access to lab results ordered by physicians, hospitals, preventative care and disease monitoring services.

This service may also go back 7 years...

So if you may have been pre-diabetic at some point, had high cholesterol, elevated kidney or liver functions, this information may be "out there" for all insurance carriers to see.

As long as any past issues are well controlled now, either with or without medication, it may not be a problem for some carriers but could be an issue for others that may deem it as a possible future issue.

It's in ALL insurance companies best interest to charge as much as they can!

It's been our motto for years that you can never rely on any one insurance company to come through with best offer!!

We have a system for getting multiple real offers and then negotiating for best, and can easily shop with other carriers if first offers are higher than expected.

If you need an advocate or consultant working on your behalf, see contact info on top right of this page. Call, email or text and let me know!

Or simply click on the blue button below and complete the questionnaire, and we'll research best offers for you with no obligation on your part.

Can life insurance companies see your prescription history?

Millman Intelliscript's prescription database history is available to every insurance carrier.

The pharmacy records database search can go back as far as five to seven years, possibly longer.

Any medication you've been prescribed by any doctor, whether you ever took it or not, is information that is available to insurance companies.

Many medications have more than one use, so with combination of Rx history and medical records all carriers can get a "risk score" on any individual.

Do you know all medications that were prescribed to you over past several years?

If you've been declined for life insurance or offered a higher rate and you're not sure why, you may have had a poor risk score...

So in addition to getting copy of your MIB report you should also get a copy of your prescription report.

You can request a copy of your prescription report on the bottom of the page at this link: https://www.rxhistories.com/for-consumers/.

What prescriptions cause life insurance denial?

This really depends on how you're applying...

If you're applying for an instant issue or no exam product, then these carriers will decline for many more medications than if you're applying for a fully underwritten policy that requires an exam, medical records, etc.

Below are the red flag medications for which the "regular" insurance companies will NOT insure:

IMPORTANT to remember when applying, that it's NOT only medications you're taking right now, but all meds that you've been prescribed in recent years that the companies will see.

As a last resort, if you cannot qualify for "regular" life insurance, there's always guaranteed issue life insurance available.

There's no health questions to answer and no medical exam or medical records are required to qualify for guaranteed issue (GI) or guaranteed acceptance life insurance.

While Guaranteed Issue is never the Ideal coverage, some people are willing to buy it.

Our recommendation is always to exhaust ALL regular life insurance options before buying any GI policy.

What is Lexis Nexis?

If you Google "define Lexis", you'll get "the totality of vocabulary items in a language"

For Nexis (Nexus) you'll get "connection, link".

So what does LexisNexis do? according to Google search:

LexisNexis® Risk Solutions provides customers with solutions and decision tools that combine public and industry specific content with advanced technology and analytics to assist them in evaluating and predicting risk and enhancing operational efficiency.

"Big brother" really is always watching!!

According to LexisNexis website, they can search 65 billion records from 10,000+ sources, with 800,000 records added daily.

A bunch of times now, we've had clients apply for quick issue or no exam products, and they did not qualify due to their LexisNexis risk score...

When we've asked the underwriter to elaborate on the exact issue, even they cannot tell us..."it's the algorithm" is the common reply.

Do carriers use "black box" technology?

Artificial Intelligence (AI) is alive and well!

Not too long ago an engineer for one of the largest tech companies in the world said he believed that their AI had become sentient or able to perceive or feel things.

If you haven't seen the movie Terminator, with Arnold Schwarzenegger, check it out.

No matter how you feel about AI, it's here and I cannot see any reason that insurance carriers and companies like LexisNexis wouldn't use ALL data "out there" to better determine risk.

Will Artificial Intelligence take over the world? Yikes!!!

Several years ago a friendly acquaintance was helping to develop an instant issue life insurance platform and mentioned black box technology to me, and I had never even heard the term...

He said to me, "what if carriers could instantaneously review all social media platforms on anyone...and what if they saw some people skydiving, smoking cigarette/cigar in pictures..."

He also said, "what if carriers had access to credit card purchases and saw that one individual purchased a gallon of vodka every week", and how these things may affect underwriting outcome.

I've asked other underwriters about this black box tech since I first heard of it, but none have ever admitted it's being used and some have kind of laughed and indicated they've heard same rumors.

Insurance companies have access to LOTS of information

Now that you know ALL of the information that life insurance companies have access to, the next step is to find the BEST offer available to you!!

Call, email or text and let us know if we can help further, or simply click on link below and answer the questions and we'll get back to you promptly.