So having had a heart valve replacement myself due to a congenital heart defect and also having shopped for my own life insurance, I understand the struggles you may go through to get affordable life insurance coverage after heart valve surgery.

Or you may have been told that you can’t qualify for life insurance, so haven't bothered to look harder.

Click here for details about my heart valve surgery and check out my operative report.

First thing you need to understand when you're considering buying life insurance after having heart valve surgery or for other heart disease life insurance issues is that you’re not going to qualify for Preferred Plus or Preferred rates, but this doesn’t mean you cannot get affordable coverage with a history of heart valve disease.

You will likely be “rated” or offered substandard rates, but they could still be affordable rates.

We'll Fight To Get You Great Offer!

Our goal is to find you the quality life insurance provider that will offer you the smallest table rating or additional charge on your life insurance coverage.

We know all too well how frustrating it can be to not qualify for the better rates when you may feel perfectly fine and your doctor tells you you’re doing great, but there are a LOT of variables involved in determining what you will actually pay after heart surgery.

While your cardiologist has probably told you that you'll live a normal life expectancy and you probably will, there are things that can go wrong and you are at a higher risk of having a stroke, a heart attack, atrial fibrillation or other potential cardiac issues which could lead to premature death.

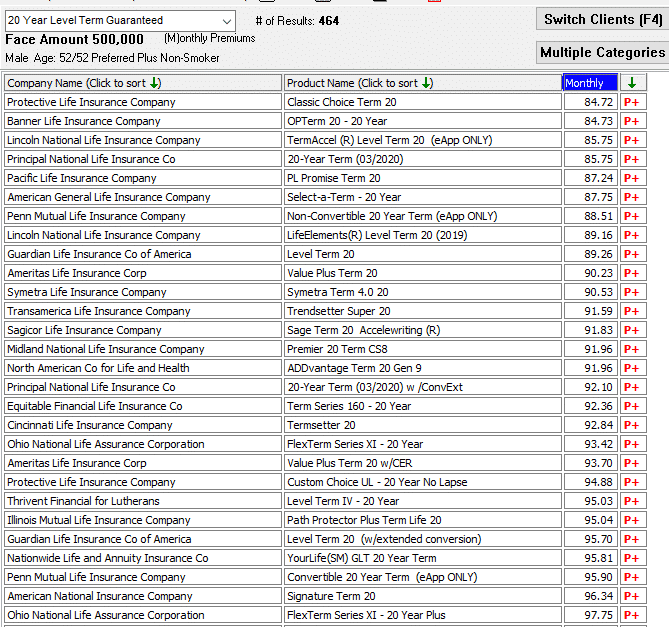

Don't waste time on instant life insurance quotes

If you've been shopping on line for life insurance after heart valve surgery or heart disease, then you've seen websites with the "Instant Quoters" that look like the one below:

These instant quoters will NEVER show you accurate rates, and the only goal is to get you to provide contact information, which many times are sold to other agents or organizations.

For example, below are the best $500,000- 20 year term rates available to me from small handful of the 100+ carriers we offer, but none of the carriers below will offer me those rates because of my aortic valve replacement and aortic aneurysm repair...but these are the rates I see after completing the instant quoters!

Our Promise to You: We will shop with every competitive life insurance company to seek out the best rate and value for you and we will do everything we can to convince the underwriters to make the absolute best offer!

Between the two of us here, we have over 69 combined years working in the life insurance industry to find consumers the best rate and value. We have no loyalty to any one particular life insurance company.

Our loyalty is to you, the consumer. We work for you!

We have developed relationships with underwriters and representatives at every major life insurance company, which has helped us secure offers on the toughest cases.

We recently placed a case for a gentleman who had an aortic valve replacement and a stroke in recent past. We even thought this case may not work out, but we shopped it with EVERY life insurance company and ultimately got a table 5 offer from an A+ Superior AM Best rated mutual company. This offer was even better than the Table 6 to 8 ratings we were expecting.

If we cannot get you the BEST offer, nobody else can either.

Can You Get Life Insurance After Heart Valve Surgery?

Yes, you can. There are hundred's of different insurance companies that offer life insurance in the United States, so you just need to find the best insurance company for you.

We shop with EVERY quality life insurance company when narrowing down best rates and life insurance companies for you, regardless of what type of heart valve issue you've had.

Most carriers will not offer you life insurance until 6 to 12 months after successful heart valve surgery.

Things we'll need to know to shop your case effectively are as follows:

- Your exact diagnosis and age at diagnosis?

- Date of your surgery?

- What surgical procedure you had?

- Have all follow ups and cardiac testing been normal or good since surgery (i.e. echocardiograms, EKG's, stress tests, etc.)?

- Do you have any other health conditions and how is your overall health otherwise (i.e. do you exercise regularly, have good blood pressure, cholesterol, diet, no smoking, etc)

Tell Us Your Heart Risk Factors, Then We'll Shop For Best Offers for You!

All of the above will be taken into consideration and will play a big factor in determining the rate for which you'll qualify and the insurance company that will be best for you.

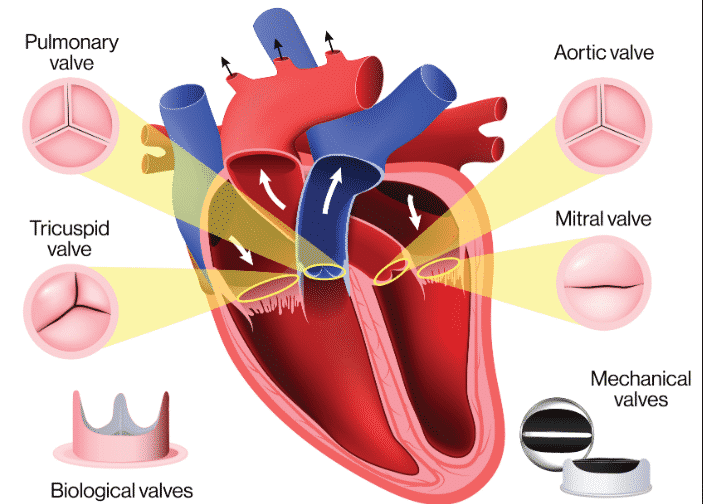

Below we'll take a look at the different type of valve issues, whether it's the mitral valve, aortic valve, pulmonary valve or tricuspid valve for which you have an issue and what it could cost you to get life insurance.

IMPORTANT: Any quotes below are only conservative estimates and the actual rate for which you qualify could be lower or higher than the estimates shown. No 2 heart valve surgery cases are alike so it’s impossible to provide a generic quote that is 100% accurate.

Below is our 3 step process to find you best offer:

Step 1 - We make preliminary inquiry to underwriters

Based on information you provide, we'll anonymously get preliminary offers. If the offers are acceptable to you ,we'll have you apply to multiple carriers to get the real offers! This is no more difficult than applying to only one carrier.

Step 2 - Apply and go through underwriting

We make the process simple for you, one 10 minute e-app, one insurance exam, we obtain all cardiac and other medical records required. Then we get carriers to make offers.

Step 3 - We get your approvals and then negotiate for best!

After approvals are made, we negotiate between underwriters for better offers, then you decide to accept or not after reviewing policies. If you're not 100% satisfied, you're under no obligation to accept any policy or pay anything!

Life Insurance After Mitral Valve Repair

Mitral valve repairs are usually underwritten a little more favorably than mitral valve replacements

Balloon valvuloplasty or valvuloplasty for which a ring is placed so that the valve leaflets close correctly reducing your degree of mitral valve regurgitation are common mitral valve repairs.

Best prognosis and best life insurance rates if you've had a mitral valve repair will be most favorable if you have no more than mild residual mitral regurgitation or insufficiency after repair, your left ventricular ejection fraction is 55% or greater, you have good exercise capacity and you've had no post operative complications.

Wait to apply until at least 6 months has passed since your repair

IMPORTANT: You will usually be postponed from obtaining life insurance until it has been 6 months since your successful mitral valve repair.

Keep in mind that rates are always changing, but below are some conservative estimates of the possible cost to you at various ages if you've had a successful mitral valve repair.

These are all 20 year guaranteed level rates for $250,000 of life insurance and are MONTHLY rates:

MALE FEMALE

Age 30: $39 $33

Age 40: $49 $41

Age 50: $105 $75

Age 60: $189 $134

Age 70: $593 $373

Life Insurance After Mitral Valve Replacement

When the mitral valve cannot be repaired, then it will be replaced with a mechanical valve like the St. Jude or Starr-Edwards valve OR it could be replaced with a tissue valve or bioprostheses like a specially treated human valve or animal valve like the Hancock porcine or pig valve.

Each type of valve used for replacement has its advantages and disadvantages.

While the mechanical valves are supposed to last longer than the tissue valves, the mechanical valves have a higher risk of causing clotting issues which cannot be completely eliminated by using blood thinners.

While you are less likely to experience clotting issues with a tissue valve, the tissue valves can deteriorate and may not last more than 10 to 15 years. Then there are always risks regarding re-operation.

Underwriting is similar for tissue or mechanical valves

Best life insurance rates if you've had a mitral valve replacement will be most favorable if your left ventricular ejection fraction is 55% or greater, you have good exercise capacity and you've had no post operative complications.

IMPORTANT: You will usually be postponed from obtaining life insurance until it has been at least 6 months since your successful mitral valve replacement OR you may be declined if it's been 10 or more years since you had your mitral valve replaced with a tissue valve (due to the re-operation risk).

Below are some estimates of the possible cost to you at various ages if you've had a successful mitral valve replacement.

These are all 20 year guaranteed level rates for $250,000 of life insurance and are MONTHLY rates:

MALE FEMALE

Age 30: $46 $39

Age 40: $66 $54

Age 50: $134 $96

Age 60: $319 $224

Age 70: $594 $463

Life Insurance After Aortic Valve Repair

Aortic valve repairs can also be underwritten more favorably than aortic valve replacements.

If your aortic valve was only leaky, with no evidence of stenosis, than a repair may be your best option.

The surgeon could reshape your aortic valve leaflets or patch them if they are torn or have holes in them.

Best prognosis and best life insurance rates if you've had an aortic valve repair will be most favorable if you have no more than trace amounts of leakage after repair, your left ventricular ejection fraction is 55% or greater, you have good exercise capacity and you've had no post operative complications.

Repairs usually get better offer than replacements

IMPORTANT: You will usually be postponed from obtaining life insurance until it has been at least 6 months since your successful aortic valve repair, assuming all follow ups since the repair are good.

Remember that rates are constantly changing as are life insurance companies underwriting guidelines. No two aortic valve repair cases will be offered the same rate classification as there are many variables involved in determining the actual rate for which you’ll qualify. Below are some estimates of the possible cost to you at various ages if you've had a successful aortic valve repair.

These are all 20 year guaranteed level rates for $250,000 of life insurance and are MONTHLY rates:

MALE FEMALE

Age 30: $46 $39

Age 40: $60 $49

Age 50: $134 $96

Age 60: $241 $169

Age 70: $618 $374

The Terminator had heart valve surgery too!

Life Insurance After Aortic Valve Replacement

When you have aortic valve stenosis or narrowing in addition to the leaking or regurgitation which could damage your heart, the aortic valve will need to be replaced with a mechanical valve, a human valve or with a tissue valve like from a pig or cow.

While the mechanical valves are supposed to last longer than the tissue valves, lifetime use of blood thinners life Warfarin and Plavix are required when you have a mechanical valve and there is always some risk involved with long term use of prescription blood thinning medications due to the risk of bleeding.

While you are not usually required to take prescription blood thinners for life when you have a tissue valve, the tissue valves are not expected to last as long as the mechanical valves. So there is always some additional risk involved since many people with tissue valves may likely have to have another heart valve replacement surgery in the future.

Best life insurance offers will be made to those who have an after surgery left ventricular ejection fraction of 55% or greater, good exercise capacity and no post operative complications.

When you apply and the procedure will have impact on rate for which you qualify

IMPORTANT: You will usually be postponed from obtaining life insurance until it has been about 1 year since your successful aortic valve replacement OR you may be declined if it's been 10 or more years since you had your aortic valve replaced with a pig, cow or other tissue valve (the concern here is the increased likelihood of having to have another valve replacement). Transcatheter aortic valve replacements (i.e. minimally invasive for which old valve is not removed) will also likely be declined as this procedure is still too new.

While the actual rates for which you qualify could be lower or higher than rates below, these are some conservative estimates of the possible cost to you at various ages if you've had a successful aortic valve replacement.

These are all 20 year guaranteed level rates for $250,000 of life insurance and are MONTHLY rates:

MALE FEMALE

Age 30: $53 $45

Age 40: $72 $58

Age 50: $148 $106

Age 60: $398 $277

Age 70: $641 $530

Life Insurance After Tricuspid or Pulmonary Valve Repair

Whether you have regurgitation or stenosis of your tricuspid or pulmonary valve that requires prosthetic ring annuloplasty, valve leaflet patching or another type of repair, we will find the best rate and insurance company for you.

Similar to any other heart valve surgery, the echocardiogram and other cardiac test results after your repair will have the biggest impact on the rate for which you’ll actually qualify.

Normal cardiac test results after the valve repair in addition to overall good health otherwise will help us to get you the best offer possible.

The healthier you are, the better the offer should be

A 6 month waiting period after successful tricuspid or pulmonary valve repair is still required before any of the competitive life insurance companies will make you an offer.

Below are conservative estimates of what you could expect to pay for life insurance after your successful repair assuming good health otherwise with no other cardiac issues.

These are all 20 year guaranteed level rates for $250,000 of life insurance and are MONTHLY rates:

MALE FEMALE

Age 30: $32 $28

Age 40: $39 $32

Age 50: $70 $54

Age 60: $189 $134

Age 70: $593 $373

Life Insurance After Tricuspid or Pulmonary Valve Replacement

If your tricuspid or pulmonary valve has abnormalities which require surgical intervention and they cannot be repaired, then the valve needs to be replaced.

As with the other types of valve replacement surgery, you’ll either get an artificial heart valve or a tissue valve from a pig, cow or a human.

There a pros and cons to each type of valve and while the artificial valves are expected to last longer than the tissue valves, artificial valves require life long use of blood thinning medications which have their own underwriting issues.

Tissue vs artificial valve, one NOT better than the other

Regardless of the type of valve you’ve had placed, the results of all cardiac testing after the valve replacement in addition to your overall health will determine the rate for which you’ll qualify.

A 6 to 12 month waiting period after successful tricuspid or pulmonary valve replacement will be required before you could qualify for coverage.

Below are some estimates of what you could expect to pay for life insurance after your successful tricuspid or pulmonary heart valve replacement with good health otherwise.

These are all 20 year guaranteed level rates for $250,000 of life insurance and are MONTHLY rates:

MALE FEMALE

Age 30: $36 $31

Age 40: $42 $36

Age 50: $91 $65

Age 60: $240 $169

Age 70: $593 $373

Bottom Line- Life Insurance After Heart Valve Surgery

There are no better rates available to you than what we can offer you from the 100's of quality insurance companies in our database!

Every week we shop really tough heart disease cases to every life insurance company to narrow down which will be best.

We have a system to get you multiple real offers, not just quotes, and we negotiate between underwriters to get you the BEST offer.

Getting insurance after heart surgery is possible even with valvular heart conditions.

Feel free to call or text us at 800-380-3533, email us or simply complete the information in the accurate quote link above and we will find you the best offer possible.

Whether your valve was replaced or just repaired, it won't cost you anything to get insurance quotes or to apply for life insurance protection!

Other Articles That May Interest You: