You can always reapply for a better life insurance rate, if you were approved for a higher rate than you expected.

The problem is if you deal with a captive agent, like from State Farm, Farmers, Allstate, then I suspect most of these agents will tell you that you won't do better...but this a LIE or they just don't know any better based on their sales training!!

Even if a broker who represents more than one company tells you that you won't qualify for better, we can easily give you a second opinion and would highly recommend that you get one!!

Since 1992, we've probably shopped over 20,000 cases to the best insurance carriers, many of which for people with health issues or pre-existing conditions.

We'll find you the best life insurance offer

We've shopped everything from high cholesterol or blood pressure cases to type 1 diabetes, cancer survivors, heart attack and other heart issues, cancer survivors, for those involved in motorized racing or other potentially hazardous activities. You name it, we've shopped it.

I still get surprised to this day on the difference in cost that carriers will offer one person for the same plan and amount of life insurance.

There are about 1,000 different companies offering life insurance in the United States, many of which have a niche.

Our goal is to find you the absolute best life insurance company for you, regardless of your specific issue or issues.

Process to getting best life insurance offer

After about 10 years in this business, and getting frustrated every time one of our clients did not qualify for the rate we quoted, I tried a new strategy on tougher life insurance cases..

I started applying to more than one carrier on tougher cases, and it was like the insurance Gods sang down upon me!!!!

Now I had the upper hand over every underwriter, since then there was always a better offer on the table!

NO better way to negotiate than by having more than one REAL offer!

This strategy has helped our clients to save thousands of dollars on their life insurance.

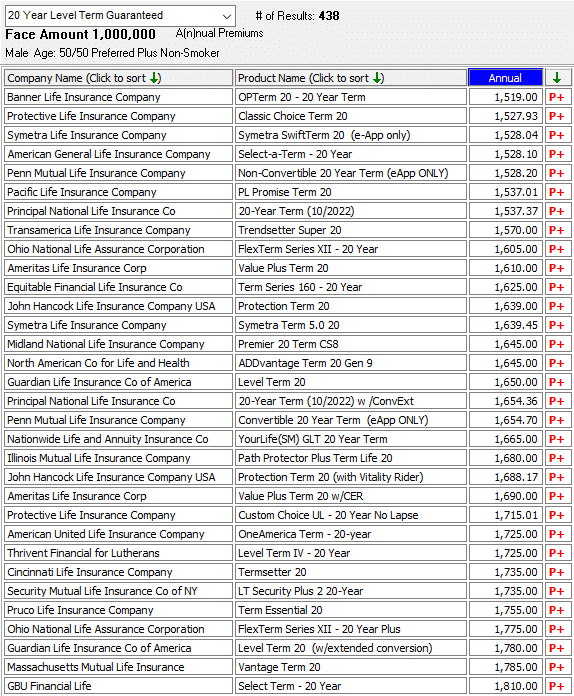

Check out this screenshot below of $1,000,000- 20 year term rates for a 50 year old male in excellent health...

Would be annoyed if you paid $1,810 for term insurance, if you could have gotten identical coverage for $1,519 per year? I would!

It is in every insurance companies best interest to charge you as much as they possibly can!

This is a simple fact.

I have gotten offers changed so many times now that I can say this with authority:

Insurance companies are for profit businesses, they're not your friend or my friend and they will always err on side of offering higher rate when they feel it's justified.

Life insurance underwriting criteria can be significantly different

For example, one carrier requires total cholesterol level to be 325 or less to qualify for best rate as long as HDL cholesterol is good, whereas another carrier requires total cholesterol to be 175 or less to qualify for their best rate.

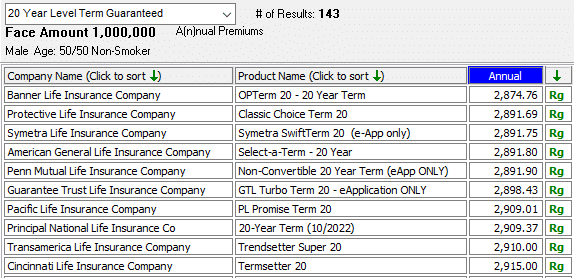

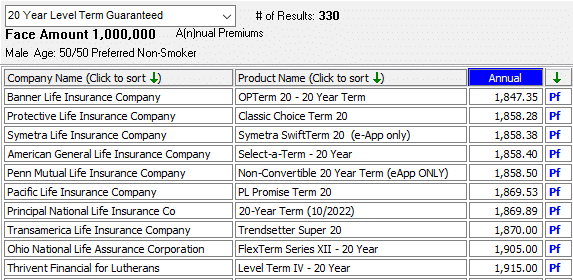

Below is screenshot of best $1,000,000- 20 year Standard or Regular rates, and right below it is best Preferred rates for same plan/amount also for a 50 year old male!

If Banner Life offers you a Standard rate of $2,874.76 per year, for whatever reason...

If we could get Protective, Symetra, American General, Penn Mutual or one of the others to offer you a Preferred rate, you will save about $1,000 a year or $20,000 over 20 years!!!

If you're a heart patient, a type 1 diabetic or if you have any more significant underwriting issues, then you definitely need an expert in high risk life insurance to help you.

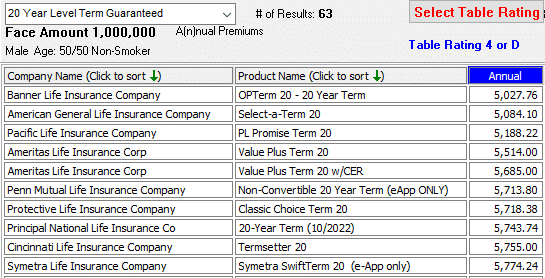

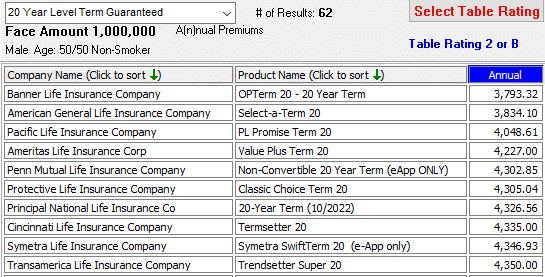

For example, below are $1,000,000- 20 year Table 4 or D rates, and right below it are Table 2 or B rates for same plan/amount also for a 50 year old male!

Again, not to pick on Banner Life, as I do a fair amount of business with them, but say they offer you a Table 4 rating, and we can get any of the other carriers to offer you a table 2 then you'll still save about $1,000 or more per year!!

Can always apply for better life insurance rate

The bottom line is you can always apply for a better rate!!

It will cost you nothing to re-apply elsewhere.

If you were approved for a policy with ANY other insurance carrier, have them issue the policy whether you want to accept it or not...as the medical questionnaire or exam will be attached.

With copy of medical questionnaire and lab results, if you did have free exam with blood test, these will be accepted by ANY other carriers as long as they're less than 6 to 12 months old.

We're happy to help you! Call or text us at 800-380-3533, click here to email us, or simply click on accurate quote button below and complete questionnaire.

Then we'll verify if you got a good offer or not!!

Articles that may interest you

Applied For Life Insurance But Didn’t Get Rate I Was Expecting

Applying For 2 Policies At One Time

It Can Take Work To Get Best Life Insurance Rate

I Was Declined For Life Insurance, Now What?

Buy Life Insurance From Captive Agent…Then You’ve Paid Too Much!

Family owned and operated since 1969, American Term is dedicated to getting you the right life insurance at the right price, even if you are considered high risk. Call us today at 1-800-380-3533 to learn how our unique dual application process can bring your life insurance premiums down.