Or at least that’s how long my heart was not pumping when the good doctors were replacing my aortic valve and repairing my aortic aneurysm.

Thank you to all involved in creating the cardiopulmonary bypass machine!

I was born with a bicuspid aortic valve, and my cardiologist told me for years that “someday” I’d have to have the valve replaced.

I just always thought it was going to be when I was older.

This is me after heart surgery

At the age of 40, my cardiologist saw something unusual on an echocardiogram that turned out to be an aortic aneurysm of 5.3 cm.

He told me at 5.5 cm they would have recommended emergency surgery. I was lucky I had time to pick and choose the right doctor to do my surgery.

When you have to have open heart surgery, they want to fix all issues at one time. Now I have about 6 inches of a dacron blood vessel and a bovine (cow) valve.

Click on this link if you'd like to view the operative report from my surgery: Gordon Conwell Heart Surgery Operative Report

I feel fortunate that all went well, and I’m still able to do just about everything I did before my surgery.

Life Insurance for Heart Patients

Shopping for my own life insurance with heart disease has always been a hassle because of my surgery and my old bicuspid aortic valve that caused some aortic insufficiency.

Every insurance company will charge me more because of my issues.

I’ve shopped my medical records to lots of different insurance companies, which has enabled me to save thousands of dollars and learn a lot about insurance companies and how they underwrite.

I also learned that underwriting exceptions can be made, but I have to ask for the exception and put the PRESSURE on to get it!!

If you’ve had any type of heart valve replacement, repair, or any other cardiac issues, you may very well be insurable at better rates than you’re expecting. You’ll need someone who will work in your best interest and can shop your case to many different companies to get you the best offer.

Even after you apply to any insurance companies, the work for your agent is not necessarily complete if they really want to do what’s best for you.

Life Insurance After Heart Valve Surgery

A perfect example of shopping a case effectively is an aortic valve replacement case I did for Chris from Indiana.

After shopping his medical history to numerous companies, I had him apply to the two most probable best insurance companies for him.

There’s never any way to know the exact rate until underwriting is complete.

He was initially offered a $250,000- 20 year term rate of $61 per month with one company and $70 per month with the second company.

Chris was still a relatively young guy, and these offers were pretty good. Still, it never hurts to ask for a better rate.

I told the underwriter who made the $70 per month offer that I needed him to improve on the rate by two rate classifications, or there was no way I could place the coverage with his company.

The underwriter honored my request and offered Chris a rate of $57 per month.

Chris happened to be in very good health otherwise, so this helped me in getting the offer changed.

Finding The Best Rate With All The "Experts"?

If you had a valve replacement, repair, or other heart surgery, make sure to find an agent who you believe will work in your best interest and will do their best to really get you the best offer possible.

Nowadays, the trend in online shopping for life insurance is for companies to set up "niche" websites that only focus on one particular issue...

We've checked out many of these sites. Some we can tell are very good, but others are not.

FYI- Any company that uses a spokesperson (i.e. Suze Ormen, Dave Ramsey, Alex Trebek, etc.) pay's handsomely for that endorsement, and we can guarantee you'll be "hard sold" and you won't get the best offer if you deal with any life insurance agency endorsed by any celebrity.

We're "nobodies", but really good at getting people best insurance offers!!

How To Effectively Shop for Best Life Insurance

My own case is a really tough one, and yours may be a lot easier than mine...

There is a system to getting the best rate and value, regardless of whether you have very minor issues or significant issues like me.

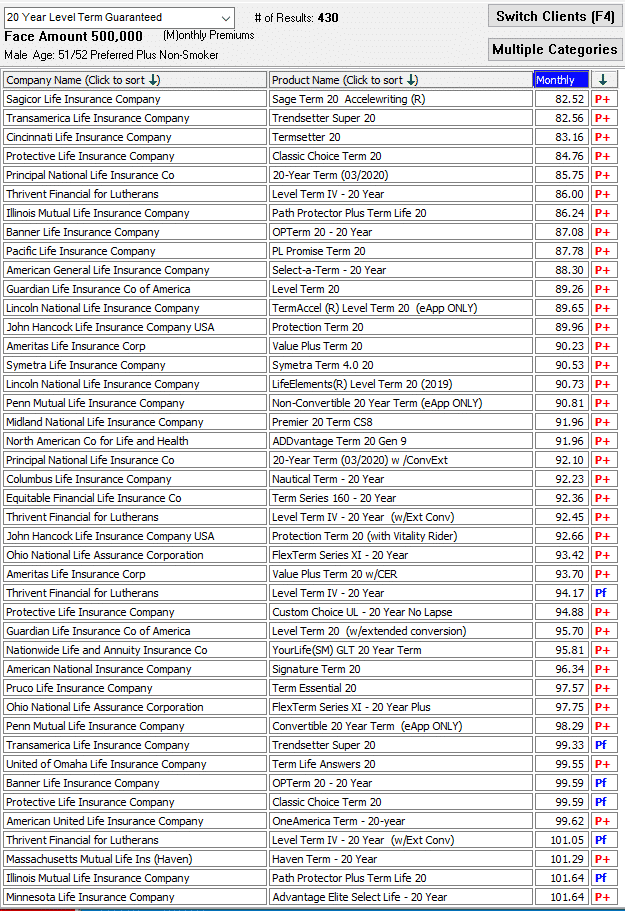

Below is screenshot of one of the exact databases we use to narrow down best rates for anyone.

Rates shown are all "preferred plus" and some preferred rates available to me for $500,000 of 20 year term...but I can't qualify for these rates even though dozens of other websites will show me some of these rates if I make quote request.

While I can offer all of these companies and more, only a small handful will offer me coverage because of my medical history.

We'll find you the best rate and value by shopping your case to ALL the top carriers.

Get Accurate Life Insurance Quotes To Start

First you'll need to provide some basic medical and other history.

Below are common questions we'll need to get answers to start:

1. Please list all prescription medications you currently take:

2. Have you EVER had heart disease, diabetes, cancer, stroke or ANY health problems?

3. Have either of your parents or any of your brothers and sisters had a DIAGNOSIS of heart disease, cancer, stroke or diabetes prior to their age 65?

4. Do you scuba dive, have a pilots license, race motorized vehicles or engage in any hazardous activities?

5. Drivers license ever suspended/revoked or have you had more than 1 moving violation in the past 3 years?

6. Have you ever been treated for Alzheimer’s or dementia, anxiety or depression, any mental disorder or alcohol/substance abuse? If so, please give details

7. What is your height and weight?

8. Have you used tobacco, nicotine or marijuana in any form (cigarettes, cigars, pipe, chew, patch, gum, etc.) in past 5 years, if so, what type and when last used?

Every Insurance Company Has Different Criteria

Quick tip: If ANY agent tells you that ALL carriers will underwrite you the same, RUN from that agent as they will NEVER get you best rate and value!!

The criteria to qualify for Preferred Plus, Preferred, Standard Plus, Standard, Table 2...can be drastically different from carrier to carrier, which is another reason we can offer you so many different insurance companies.

Many people don't know this, but most carriers have around 10 different rate classifications for which any one person could qualify, from preferred plus to table 8, table 10 and sometimes higher depending on the carrier.

All the more reason you need an independent agent that's going to "go to bat" for you and has a system to get you best offer.

What Is Best Life Insurance Company for Me?

This is a question I'm asked almost every day. My answer is almost always, "it depends".

We first need to narrow down best carriers for you based on your medical and other history.

Sometimes this is easy and sometimes we must send 50+ underwriters email inquiries summarizing your issues to get "tentative" offers.

After we get the tentative offers, we can have you apply to one or more carriers to get the "real" offers.

Whether you want the lowest cost term life insurance or permanent insurance, or if you want life insurance with chronic illness or critical illness living benefits, this will also help us to determine best carriers for you.

Then after you're approved and have a chance to review the actual policy or policies, you can decide which to accept, if any...

You'll be under NO OBLIGATION to accept any policy or pay anything by applying for any life insurance policy.

Re-Shopping Tougher Life Insurance Cases

While we're pretty dam good at choosing best carriers on our first try, even if we don't get it right every time.

Anything can turn up in underwriting, whether something simple like high cholesterol or blood pressure on exam or maybe something a little more significant in your medical records.

There are things your doctor may feel are no concern, but they could be to the life insurance underwriters and may even be a reason for the carrier to offer you a higher rate.

The good thing is that we obtain medical records on every case when they're required.

And we can use one set of insurance exam results for ANY carriers, and the exam results are good for 12 months.

So we can easily re-shop your case if the first offers are not as good as we're expecting and if other better offers may be available...we'll find the better offers and can easily have you re-apply!!!

I Have Best Rate and I'll Get You Best Rate

For any of my fellow valve replacement or valve repair friends out there, there’s a good blog with lots of information about heart valve surgery that you may want to check out.

If you’re like me and will most likely need to have another surgery in the future, it’s nice to stay updated about what’s going on in that world. The blog is at heart-valve-surgery.com.

Whether you have cardiac or other issues doesn't matter. Our shopping process is the same regardless.

If I/we can help you in any way, or if you just want to verify that you have a good rate based on your cardiac and overall health history, feel free to call me at 1-800-380-3533 or click here to email me.

Check out our other articles about getting life insurance if you have heart disease.

- Life Insurance after a Heart Attack or Heart Disease

- Getting Life Insurance after Stent or Bypass Surgery

- Cardiac Arrhythmia Life Insurance

- Getting Life Insurance After Heart Valve Surgery

- Problems In Life Insurance Underwriting For Heart Conditions

- 2 Stents & Heart Attack Saves $103,500 On Life Insurance

- Can I Get Life Insurance If My Parent Died of A Heart Attack?

- Heart Attack Survivor Saves $35,107 On Life Insurance

- Getting Life Insurance With Bicuspid Aortic Valve