Getting life insurance with bicuspid aortic valve is not always difficult, but you must deal with an independent agent or broker who’s familiar with cardiac issues and can offer you rates from all of the competitive insurance companies.

Having had a bicuspid aortic valve and heart valve surgery myself, I know all about bicuspid valves and the potential problems they can cause in life insurance underwriting.

According to the Bicuspid Aortic Foundation, they estimate that approximately 1 in 50 people is born with a bicuspid valve. So there's a lot of us out there.

What are the underwriting issues with regard to having a bicuspid aortic valve?

Is Bicuspid Aortic Valve Serious?

An increased risk of endocarditis, aortic dissection, and severe aortic valve dysfunction due to stenosis are just a few of the more serious issues that can result from having a bicuspid aortic valve (BAV).

Congestive heart failure, permanent heart damage, abnormal coronary arteries, and unstable blood pressure are other potential issues.

All of the above are potentially fatal complications and the reason that people with bicuspid valves can pay more for life insurance.

Many with Bicuspid Aortic Valve will require surgery

According to the Cleveland Clinic approximately 80% of people with BAV will require some surgical intervention.

There is risk involved with the surgery and there's also post-operative risk.

All life insurance companies will not "rate" you the same with regard to your bicuspid valve and Regular rates are possible.

Choosing the wrong company could cost you thousands of dollars over the life of your policy.

Don't pay more than you have to!

What does life insurance cost with bicuspid valve

The best prognosis for life insurance underwriting purposes is to have a bicuspid valve with mild to no regurgitation, no shortness of breath or other symptoms, a relatively normal echocardiogram, a good ejection fraction over 50% and very good health otherwise.

Most bicuspid valves get progressively worse as you age and many will ultimately require an aortic valve replacement or repair.

So buy as much life insurance as you may need and can afford it while you’re younger and healthier.

Buy Insurance When Younger and Healthier

Following are $250,000- 20 year term “range of cost” rates you can expect to pay if you have a bicuspid valve with no more than mild regurgitation and good health otherwise. These are monthly rates and are only estimates as the actual rate for which you qualify could be lower or higher:

Male Female

Age 30: $23- $28 $21- $25

Age 35: $27- $33 $22- $27

Age 40: $35- $44 $29- $36

Age 45: $56- $73 $44- $56

Age 50: $68- $88 $52- $64

Age 55: $112- $133 $77- $93

Age 60: $183- $235 $132- $166

I’ve shown you 2 rates in each category above as a range of the likely cost.

Every insurance company rates bicuspid valves differently

Remember that every life insurance company can rate you differently based on their opinion of your overall health and your exact bicuspid valve history.

Shorter duration 10 or 15 year term rates would cost less than rates above and longer duration 25 year to 40 year term or permanent life insurance would cost more than the rates above.

Buy the longest duration at the highest amount that best fits your needs and budget since all rates are based on age and health.

More Complicated Bicuspid Valve Cases

If you have a bicuspid valve with moderate to severe aortic stenosis or regurgitation or if you have an enlarged or dilated aorta or aortic root, then many insurance companies will automatically decline you or charge you an even higher rate than rates shown above.

It is a common syndrome for people with bicuspid aortic valves to also develop an enlargement or an aneurysm in the aorta or aortic root.

Mine was 5.3 cm and was the main reason I had surgery when I did.

For an aneurysm greater than 4.5 cm, most of the regular insurance companies will decline or postpone until after it's corrected with surgery.

Bicuspid valve with complications can increase cost

Following are $250,000- 20 year term rates you can expect to pay if you have a bicuspid valve with moderate or worse regurgitation or stenosis or if you have an enlarged aorta and/or if you have other issues (i.e. overweight, high cholesterol, high blood pressure, etc.). These are monthly rate estimates as the actual rate for which you qualify could be lower or higher:

Male Female

Age 30: $34- $39 $30- $34

Age 35: $39- $46 $32- $37

Age 40: $53- $63 $43- $50

Age 45: $89- $105 $69- $81

Age 50: $115- $142 $82- $101

Age 55: $175- $217 $122- $150

Age 60: $310- $386 $219- $271

Remember that shorter duration rates would cost less and longer duration rates would cost more than the 20 year term rates above.

If you have a bicuspid valve with an aneurysm of 4.5 cm or less, then you may possibly be insurable with the “regular” insurance companies.

If the aneurysm is greater than 4.5 cm, then all of the competitive or “regular” insurers will likely decline you unless the aneurysm is only slightly larger and has been stable for many years.

Most bicuspid valve patients can qualify for life insurance

There is still life insurance available to you if you do have an aneurysm greater than 4.5 cm or if you're declined for other reasons, but it may not be the “perfect” life insurance.

There's "group like" type of life insurance plans that individuals can buy and that don't require detailed health criteria to qualify for up to $100,000 or $150,000 of coverage.

There is also guaranteed issue life insurance for which almost anyone can qualify, but that has a 2 or sometimes 3 year waiting period before full life insurance amount would be paid out if death was due to a heart condition or other disease or illness.

Best life insurance co's for bicuspid aortic valve

Your overall health and exact bicuspid valve history will determine best carriers for you.

We'll need the following information to effectively shop your case:

- 1Date of birth

- 2Prescription medications

- 3Any other past or present health issues?

- 4Height and weight

- 5Do you get regular cardiac checkups and echocardiograms?

- 6Do you have any aortic valve stenosis or regurgitation, and is it mild, moderate or severe?

- 7Has cardiologist indicated when you may need to have valve replaced/repaired?

- 8Do you have other cardiac issues (i.e. irregular heartbeat, coronary artery disease, etc.)?

Then we'll review our database of rates from hundreds of quality carriers to narrow down best rates and carriers available to you.

Whether you want term life insurance or permanent life insurance, we'll find you the best rate and value.

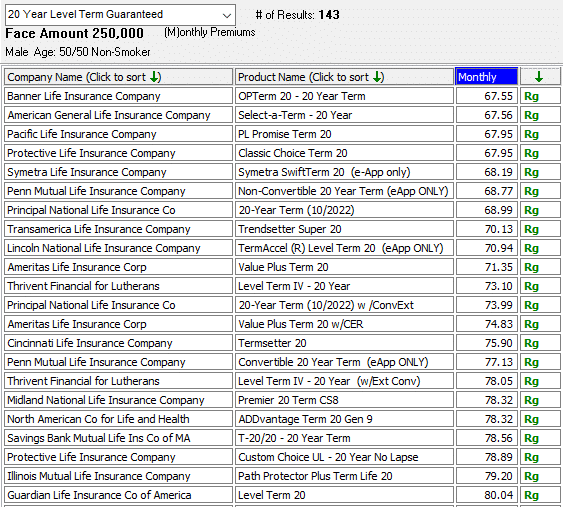

Below are best case $250,000- 20 year term plans available to a 50 year old male w BAV:

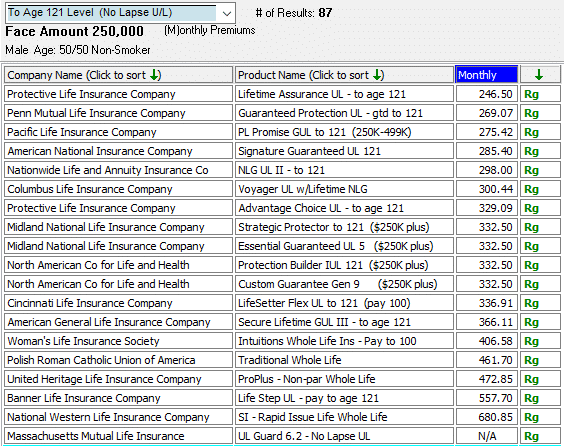

Below are best case $250,000- lifetime guaranteed plans available to a 50 year old male w BAV:

Case studies

Bicuspid Valve with Disease Progression

Female age 46, indicated BAV with mild regurgitation and very good health otherwise on initial consultation.

Had her apply to multiple carriers as we've learned you can never rely on any one company to make best offer.

Upon receipt of her medical records, we realized she went from having mild regurgitation only 3 years ago, to mild to moderate regurgitation and mild aortic stenosis on most recent echocardiogram.

This is considered a progression and will usually cause insurance companies to offer a higher rate.

Medical records tell the real story

We emphasized her excellent health otherwise to the underwriters and were able to get her a table 2 rating, which is a great offer for anyone with echocardiograms like hers at her age.

What's interesting on case like hers is the different offers we got from the "aggressive" companies for heart conditions...

She wanted $2,000,000 of 20 year term and the lowest offer was $402 per month, and the highest offer was $947 per month.

Imagine saving $6,540 per year on life insurance

If she had not applied through us, using our system of getting multiple real offers...

And she only applied to one of the most recognizable carriers in the country (the "Rock") that provided rate of $947 monthly, she would have over paid by $545 per month, $6,540 per year or by $130,800 over 20 years!!!

This is a massive savings and no "chump change" and is the exact reason we use our system on every BAV case.

Bicuspid Valve with no recent echocardiogram

Male age 60, indicated BAV only diagnosed 5 years prior and he believed only had mild or no regurgitation and perfect health otherwise...

He had also not had a cardiac checkup since he was diagnosed 5 years prior.

I told him he could possibly be declined/postponed since no recent cardiac workup, but he needed the life insurance and wanted to try anyway.

Insurance companies require recent cardiac testing

This was going to be a tough one as almost every carrier requires a relatively current cardiac workup and recent echocardiogram before making an offer.

I had him apply to the top two carriers for those age 60 with bicuspid valves for $300,000 of 10-year term. One offered him a rate of $134 per month and the other postponed until he had a new echo.

He was happy with the one offer and didn't plan on having cardiac workup soon, so he accepted the offer.

This one even surprised me as I was expecting both carriers to require a new echo before offering!!

Male 51 bicuspid valve gets standard rate!!

Male age 51, has BAV but is an athlete and exercises and does triathlons regularly, health is great otherwise and the only medication was for mild hypertension.

Found out he had BAV as an adult and his echocardiogram showed:

"abnormally looking aortic valve with fused left and noncoronary cusps with a bicuspid morphology associated with mild to moderate aortic regurgitation. No other abnormality was seen in this echocardiographic study."

Can never rely on any one insurance company

The first carrier, which has made very aggressive offers on past bicuspid cases, approved him at a table 4, which is basically double the cost of most standard rates.

We made it clear to the second carrier that we had a "good" offer on the table and 2nd carrier approved him at their Standard or Regular rate class.

He purchased a $1,500,000 20-year term policy and this 2nd offer saved him $3,191 per year compared to the table-4 offer.

Bottom line- getting insurance with bicuspid valve

You must shop with ALL of the competitive insurance companies if you want the best offer on your life insurance and you have a bicuspid aortic valve.

You can't just shop with American General AIG, Banner Life, Protective Life, Prudential, and the more "mainstream" or well-known companies.

You also must look at the not-so-mainstream, but still quality companies, like AXA Equitable, Columbus Life, John Hancock, Nationwide, Principal Life, Security Mutual, and Thrivent Financial...

Or you must have an experienced agent/broker shop for you.

If you have already applied and have been offered a higher rate than you were expecting or if you just want to verify that the rate for which you qualified is a good offer, we will happily re-shop your case as we do this regularly.

If you’d like to get more information about getting life insurance with bicuspid aortic valve, please call or text us at 800-380-3533, click here to email us, or simply click on the orange button above to get an accurate quote.

Check out our other articles about getting life insurance if you have heart disease

- Life Insurance after a Heart Attack or Heart Disease

- Getting Life Insurance after Stent or Bypass Surgery

- Cardiac Arrhythmia Life Insurance

- Getting Life Insurance After Heart Valve Surgery

- Problems In Life Insurance Underwriting For Heart Conditions

- 2 Stents & Heart Attack Saves $103,500 On Life Insurance

- Preferred Plus Rates For Parent Death By Heart Attack Prior to Age 60

- Heart Attack Survivor Saves $35,107 On Life Insurance

- I Was Dead For 163 Minutes!