Almost everyone who’s had coronary artery disease (CAD) and who's had a heart stent, stents, bypass surgery or just a coronary angioplasty with no stenting is insurable for life insurance...

The cost can vary greatly depending on your exact diagnosis, treatment, how well you’re doing since treatment, and your overall health otherwise.

Applying to the wrong insurance company could cost you thousands of dollars more than you should pay...

For example: 70 Year old male had a double bypass 6 years ago, but great health otherwise based on questions he answered for us. He needed $250,000 but wasn't sure if he wanted shorter duration term or longer duration to age 90 or longer. We had him apply to three companies and here's the result:

- Company A postponed him due to mention of abnormal EKG in medical records.

- Company B offered Table 4 rate due to CAD and A1C of 6.2 within past year.

- Company C offered him Standard rate which was $3,044 less per year than table 4 rate.

How do you know if you're getting an accurate quote and how do you go about actually getting approved for life insurance?

We'll tell you everything you need to know with regard to getting affordable life insurance with stent or stents and getting life insurance after bypass surgery on this page.

Underwriting Considerations After a Stent or Bypass

There are a lot of variables involved with regard to what rate class you'll qualify for after a stent surgery or bypass surgery...

#1 Your age at time of diagnosis...the older you are when diagnosed, the better.

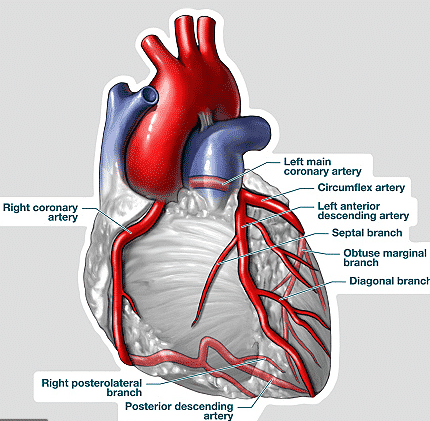

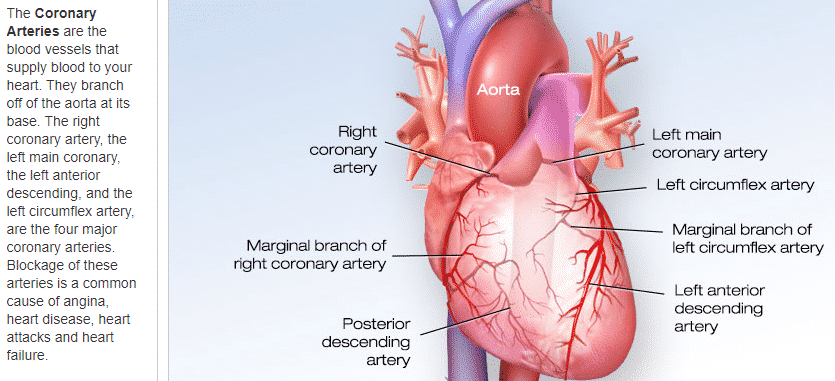

#2 How many and which vessels had blockages, was it left main, left anterior descending, right coronary artery, circumflex?

#3 What was the % of blockage in each artery prior to angioplasty/stents or bypass?

#4 Did the heart cath show evidence of other blood vessel blockages that may not have been large enough to treat now?

#5 Did you sustain any heart damage from the blockage and/or do you have a normal ejection fraction?

If You're Like Most, You May Not Know the Specifics

Most people don't know the answers to all of the questions above, but that's okay...

An independent life insurance agent that's experienced with stent or bypass cases should quote you a range of what the cost could be based on the info you provide.

We'll always show you a range of the cost and we'd have you apply to multiple insurance carriers right off the bat...

We have the easiest system to submit multiple life insurance applications at one time and only one medical exam is required.

Because anything can turn up during underwriting, on your medical exam or in your medical records that you may not have even been aware of.

We recently had a case for a gentleman that had a mild heart attack and 2 stents, which he was well aware of...but his medical records also showed he had a cardiac arrest while in hospital after the heart stent procedure. These are 2 different issues, which adds to the life insurance underwriting concern.

For What Rate Class Will You Qualify After Stent or Bypass?

Because of all of the variables involved, below are generalizations and we've gotten exceptions made numerous times because of our negotiating system:

Preferred Plus and Preferred rates for life insurance are not currently available to anyone who's had a stent procedure or bypass surgery.

You could possibly qualify for “Regular” or Standard rates if you’ve had no heart attack or heart damage and your health is good otherwise, you were diagnosed over the age of 50 (the older, the better), you only have one or two coronary arteries involved other than the left main (LM) or left anterior descending (LAD) arteries and all of your cardiac checkups since onset have been good with (preferably) a good recent stress test (completed within the past 18 months).

The Older You Are When First Treated, The Better

If you were diagnosed with CAD before the age of 50 and/or if you have had a heart attack with no significant heart damage and ejection fraction of 50% or higher, with only one or two coronary arteries involved, you could qualify for substandard rates or a policy with a Table 2 or 3 rating or additional charge.

If you’ve had a heart attack or were diagnosed with coronary artery disease prior to the age of 40 or 45, your coronary heart disease involves 3 or more of your coronary arteries, or you’ve had multiple stent procedures or more than a triple bypass, then many insurance companies may decline your application, or you’ll be more highly “rated” or charged a table rating of 4, 6, or even 8 or higher...

We fight for the best live insurance approval on every case and our system cannot be beat!

If all aggressive life insurance carriers decline your application, guaranteed issue life insurance is always a last resort option.

Did you know David Letterman had a quintuple bypass?

Life Insurance Stent-Bypass Sample Rates By Age

Below are some sample monthly rates by age for males and females for $250,000 of 10 year term at Standard or Regular rates and at Table Rating 2, 4, 6 and 8:

Stand Table 2 Table 4 Table 6 Table 8

Male 40: $19 $27 $34 $41 $48

Male 50: $46 $55 $72 $89 $106

Male 60: $92 $133 $176 $219 $262

Male 70: $314 $389 $518 $646 $775

Stand Table 2 Table 4 Table 6 Table 8

Female 40: $17 $23 $28 $34 $40

Female 50: $36 $44 $57 $70 $83

Female 60: $65 $94 $123 $152 $181

Female 70: $193 $276 $363 $442 $522

Rates can vary slightly depending on the State that you live in, but the above rates are some of the lowest available in most States now.

Rates at $500,000 would cost about twice as much as rates above. Rates at $1,000,000 would cost about 4 times as much as rates above.

Reasons You Could Be Declined After a Stent or Bypass?

If you have had a heart attack with more significant heart damage and your ejection fraction is less than about 40% - 45%, which can be indicative of heart failure.

If you continue to have recurrent chest pain after treatment.

If you've had an abnormal stress test after treatment and blood flow through the coronary arteries is not good.

If you have more than one type of heart disease like CAD and Afib or multiple medical conditions like more severe CAD and diabetes or heart attack and stroke, many carriers with better insurance rates will decline you.

On tougher cases, we do sometimes have one or more insurance companies that declines but another makes a life insurance approval...which is a reason we use our multi-app system on all CAD cases.

Just because one, two or three companies decline, doesn't mean they ALL will!!

If I've Been Treated, Why Can't I Get a Better Offer?

Coronary artery disease is a progressive type of disease, so you’re never really “cured,” even if you had heart stent surgery, bypass surgery or just a coronary angioplasty.

We've dealt with a large number of people over the years that have required more than one cardiac intervention due to re-stenosis or closure of previously stented or bypassed arteries.

The extent of your disease (i.e. the more coronary arteries involved and the percentage of blockage in each artery prior to treatment) and how well you’ve done since treatment will be a big determining factor regarding the rate and insurance options for which you’ll qualify.

Having no heart attack prior to the discovery of your CAD is better than having a heart attack.

One stent being placed is better than two stents, two stents is better than three stents, etc. The less stents installed, the better for all of the high risk life insurance companies.

Life insurance for heart bypass patients will have a different outcome depending on whether you had a double bypass which is better than a triple bypass, or a triple bypass which is better than a quadruple bypass, etc.

CAD Is a Progressive Disease

If the cardiac catheterization report from your CAD incident showed that you had other blockages that were not large enough to require treatment at that time, this could be another issue which could result in a higher than expected rate being offered.

Even if the blood is flowing smoothly through your coronary arteries now, this does not mean it will continue to do so in the future.

After I had a heart cath prior to my aortic valve replacement, my cardiologist told me it can take about 10 years for completely clean coronary arteries to build up enough plaque to cause a potential problem.

If you had a heart attack, stents, bypass surgery, or any heart disease diagnosis and don’t change your lifestyle including your diet, you don’t start exercising, you don’t lose weight, or don’t stop smoking, it's highly likely that you’ll have another cardiac issue that could potentially kill you.

Even if you do everything your cardiologist tells you to do, you could still have another incident.

This is why getting approved for life insurance with heart stents or past bypass surgery can be tougher and why insurance companies usually charge more for term life insurance with heart disease.

from the American Heart Association

How Do You Get the Best Life Insurance Offer After Stent Surgery or Bypass?

As you can see by now, insurance companies will take a lot of criteria into consideration during the underwriting process regarding your specific cardiac and other medical history when determining your life insurance costs...

Do everything you can to make sure your overall health, blood pressure, cholesterol and all cardiac test results have been good since your stent or bypass procedure.

If you've slacked off with the positive lifestyle changes the longer it's been since you had the heart procedure (like I did), get strict again and use qualifying for life insurance at best rate possible as your incentive.

Some insurance for heart disease companies are great for coronary artery disease, but MANY are definitely not.

If you don't want to go through the underwriting process or don't want to formally submit life insurance applications...a good strategy for you could be to obtain all of your cardiac medical records including the results of your cardiac catheterization report from your initial incident and any later cath reports you may have had.

You could provide these medical records to us or another independent agent or insurance agency you trust will work in your best interest, compare quotes and then buy life insurance at best rate and value for you.

Pulling Their Hair Out Before They Found Us

We’ve spoken to many extremely frustrated people who have applied for life insurance more than one time and were always declined for life insurance coverage or only offered life insurance premiums they could not afford.

Some of these people have been given completely wrong information by other agents and told that no insurance company will offer them life insurance.

Most life insurance companies will not insure me, but I’ve shopped my own cardiac medical records to so many insurance companies, and I was able to get life insurance at the best rate possible for my condition.

We shop life insurance for people with heart conditions and all types of preexisting conditions all of the time. I’d be happy to do this for you, and it won’t cost you a dime.

With your cardiac medical records, I (or any good agent independent agent who has a lot of experience with heart cases) can shop your records to the best insurance companies for heart issues and can deal directly with insurance underwriters to get offers from numerous insurance companies before having you sign any applications.

This will save you a lot of time and frustration as opposed to just applying to a random company through Joe Agent who represents only one or a few companies or who has little to no experience on heart issues.

Don't get to this point when shopping for life insurance...let us help you!

Case Studies- Getting Life Insurance with Coronary Artery Disease

Shopping heart stent or bypass cases is not easy, especially when only relying on the answers to questions that you provide.

Inevitably, most people don't know the real specifics about their cardiac history that the insurance companies will need to provide an accurate quote.

I don't know every detail that shows up on my echocardiograms, so I understand most people are not going to know a lot of details.

As I mentioned above, things like which vessels were bypassed or stented, what the percentage of blockage in your vessels was prior to intervention, what your current ejection fraction is, etc., will determine what your insurance will cost.

The following are some examples of some cases we shopped and the outcomes:

Male age 49 with 1 Stent placed at age 48

A 49 year old male with no heart attack and one stent placed at age 48 was definitely an exception to the norm.

We got this gentleman a Standard or Regular rate with no additional rating with one insurance company, whereas a different company offered him a Table 5 rating.

Table 5 is five higher rating classifications than the other "Standard" offer!

We quoted this gentleman Table 2 and 3 rates on term life prior to having him apply, as these are normal best-case ratings for anyone with one stent placed prior to age 50.

After shopping 25,000+ cases and selling thousands of insurance policies, we've learned never to rely on any one insurance company to make the best offer, since anything can turn up during underwriting.

We had this 49 year old apply for Standard rates with the two most probable best insurance companies for him (no downside in applying for best case scenario).

The first company offered him the standard rate of $3,184 per year, and the second company offered him the Table 5 rate of $5,724 per year due to "moderate to severe CAD at a young age."

This is a savings of $2,540 per year, or $50,800 over 20 years...these offers were from companies that are both aggressive for heart disease cases and both companies have offered Standard rates in the past for one stent CAD cases.

Male age 49, 1 stent, left bundle branch block and sleep apnea

This case is similar to the above, but the outcome was much different.

This gentleman also had one stent placed a year ago, indicating he's had good cardiac follow ups since and good stress test results within past 12 months. He also has left bundle branch block and sleep apnea for which he uses mouthpiece, and he quit smoking about 18 months ago.

I also quoted him Table 2 to 3 rates as a range of the cost but had him apply for Standard rates with the two most probable best companies for him.

One company offered him a Table 4 rate, whereas the other offered him a Table 5 rate.

The reason for the higher than expected ratings was that even though he only had one stent placed in his circumflex artery, his medical records showed that he had coronary artery disease in other vessels including moderate disease in the left anterior descending artery. There was also mention in his records of fact that "he needs to be considered for intervention to two other lesions".

As we always do when we get a higher than expected offer, we shopped his case to other carriers.

We were given one Table 3 offer from another carrier, but this carrier's Table 3 rate was actually $637 more per year than the Table 4 offer that was made by the first company.

IMPORTANT: Pay less attention to the rate class for which you qualify (i.e. Standard, Table 2, Table 4, etc.), and instead focus on the actual cost of the policy.

We also got several other Table 4 offers, one Table 5, a couple Table 6 offers, one Table 8, and several companies indicated they'd actually decline this gentleman.

No other companies were able to beat the Table 4 rate for which this gentleman already qualified and this offer was accepted.

Even if we've quoted higher rates, we always have our clients apply for a better rate class, as we don't want the underwriters to assume we are okay with anything but the absolute best case offer.

Male age 58, 4 stents placed 3 years ago

This gentleman had a total of four stents placed in two separate procedures a month apart, never had heart attack, and indicated he had a good stress test six months ago. He also had two cardiac catheterizations since the stents were placed due to chest pain, but he suggested that these tests ruled out CAD as the issue for his pain.

I quoted him Table 4 and 5 rates based on above and had him apply to the three most probable best insurance companies for him because he wanted to apply for both whole life insurance and term life insurance.

The whole life company and one of the term companies declined him after we submitted his full medical records, and the one underwriter summarized her reason for the decline as follows:

“... progressive Coronary Artery Disease with need for multiple interventions in past, unstable Angina, Atrial Fibrillation, and excess Alcohol use. Insured has had 4 stents. He has had to have 4 cardiac caths due to either abnormal cardiac testing or ongoing cardiac symptoms. The last dr visit indicates he still had uncorrected CAD and if medical management does not work he will need bypass. So basically we have a guy only age 58 w/ multivessel disease and not all lesions have been corrected.”

While I can always go back to underwriter about having two to three Miller Lights a day to request reconsideration (what's the big deal underwriter), the other issues were significant and valid reasons for almost every company to decline.

The other term case was still alive, but there was mention of possible sleep apnea in medical records. His doctor recommended sleep study for which this gentleman just had and provided me with copy that showed moderate sleep apnea, for which he was prescribed CPAP.

There is usually a six month waiting period after a CPAP is prescribed to make sure the patient is compliant with its use. I was expecting another decline or postponement, but I provided the underwriter with all of the sleep apnea information and pushed for an approval. The underwriter approved at a Table 5 rating, which even shocked me, as I was fully expecting a higher rate to be offered.

The case was placed at Table 5, and this gentleman was happy to get such a great offer.

Male age 75 with 1 Stent placed LAD at age 67

This 75 year old male had 1 stent placed in Left Anterior Descending artery with no heart attack and was in good health otherwise.

The LAD is a major artery and most insurance companies will "rate" or charge more for life insurance when there's LAD or Left Main artery involvement.

We got this gentleman a Standard or Regular rate with no additional rating with one insurance company, whereas a different company offered him a Table 3 rating.

Table 3 is 75% more than Standard rates.

We quoted this gentleman Standard to Table 2 rates prior to having him apply, as we were confident we could get him these rates.

This gentleman purchased a Guaranteed Universal Life insurance policy to age 90 and the better rate was $2,392 less per year than the higher rate...

We'll have saved this gentleman $35,880 if he lives to age 90 and GUL offers the added flexibility of being able to extend the duration of coverage at anytime, with no new underwriting.

Male 52, Quadruple Bypass Age 45

This gentleman contacted us after he hard time getting approval for life insurance.

He had no heart attack, but he had some tightness in chest and some light headedness at age 45. It was determined he had significant coronary artery disease, so he had quadruple bypass.

We had him apply to the two most probable best insurance companies for him and quoted him Table 4 to 6 rates as a range of the cost prior to him applying.

The first insurance company declined him due to the fact that his cardiac medical records showed he had diffuse CAD throughout his coronary arteries, including vessels that were not bypassed but may require intervention in the future.

The second company approved him at a Table 5 rate due to his extensive CAD and atrial fibrillation mentioned in his medical records.

We reviewed his medical records and saw almost no evidence that he had atrial fibrillation other than a few incidents of irregular heart beats right after his open heart bypass surgery.

Based on our past experience, many people may have some irregular heart beats after open heart surgery (I did).

We pushed back to underwriter and emphasized how there were no mentions of a-fib in past several years in medical records, as well as the fact that his cholesterol, BP, blood sugar, and everything else was pretty good and asked her to improve on the offer.

The underwriter changed the offer to a Table 4, and the case was placed!

Male 75, Triple Bypass Age 61

This gentleman contacted us after he retired and the insurance cost to convert his group life insurance was unaffordable!

He had no heart attack, but he had triple bypass 14 years ago, he's had good regular cardiac follow ups since, he took both cholesterol and blood pressure medication, he was 5' 10"- 180 pounds and was in good health otherwise.

We had him apply for regular or standard rates to the two most probable best insurance companies for him...but quoted him Table 2 to 3 rates as a range of the cost prior to him applying.

The first approval was at the lower standard rate class...which we were all happy about.

The second company approved him at a Table 4 rate due to his triple bypass history.

This Table 4 rate was $1,103 more per year than the Standard rate offer and this gentleman will save $11,028 over the 10 year term.

Conclusion- Getting Life Insurance After Stent Surgery or Bypass

As you can see from above, getting approval for life insurance with stent surgery or after bypass surgery can be complicated.

But getting affordable life insurance after stent surgery or a bypass is possible.

Apply to the wrong life insurance company and you could end up being declined or charged much more than you should for any type of life insurance.

Use your better judgement when determining if any independent agent or agency you decide to apply through seems to be familiar with stent or bypass cases and ask them what happens if you don't end up qualifying for the rate you were quoted.

We've shopped thousands of heart disease cases including stent and bypass cases, but even we don't pick the best companies on our first try every single time.

Our Re-Shopping System Can't Be Beat Either

But we do have the perfect system to "re-shop" any case, and we obtain all medical records so we can easily "flip you" to any other insurance company later.

We'd recommend avoiding those smooth-talking call center insurance agents, as their only goal is to get you to apply and then move on to the next case.

If you'd like to save money and get a term life or traditional permanent life insurance quote with no obligation on your part to do or to pay anything, or if you don't want to be called 15 times by the call center insurance agents trying to get you to apply through them (we've heard the horror stories), simply click on this accurate quote link, answer the health questions, and we'll email you quotes and information.

We're too busy shopping tough heart disease cases to hassle you to apply through us, but we'll do our absolute best to get you the best offer possible if you'd like to give us the opportunity.

Check out our other articles about getting life insurance if you have heart disease.

- Life Insurance after a Heart Attack or Heart Disease

- Cardiac Arrhythmia Life Insurance

- Getting Life Insurance After Heart Valve Surgery

- Problems In Life Insurance Underwriting For Heart Conditions

- 2 Stents & Heart Attack Saves $103,500 On Life Insurance

- Can I Get Life Insurance If My Parent Died of A Heart Attack?

- Heart Attack Survivor Saves $35,107 On Life Insurance

- I Was Dead For 163 Minutes!

- Getting Life Insurance With Bicuspid Aortic Valve